NEW DELHI: With global uncertainty still thriving, growth is slowing down in both advanced and emerging economies, while inflation is trending much higher. However, Indian markets are getting slowly decoupled from the global uncertainties, and a large part of such scenarios has been made possible by the Reserve Bank of India frontloading forward guidance in rates, in inflation projections and even in liquidity adjustment, said SBI in a report.

In a “reverse-Goldilocks” economy – where the global economy and policymakers are confronted with a stagflationary supply shock that is negative for growth and will tend to push up inflation further- SBI thinks India has emerged as an outlier.

“The Fed has now picked up the gauntlet of frontloading rate hikes… clearly emerging economies central banks have outperformed their advanced economies in this round,” said Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

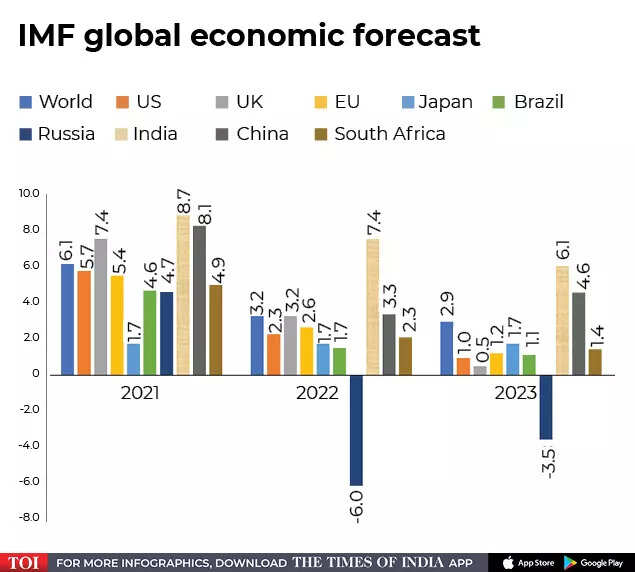

Despite, lowered GDP forecasts, India will remain one of the fastest growing key economies globally in 2022-23 as well as 2023-24, shows data from IMF

The IMF’s GDP projection for India stands at 7.4 percent for FY 2022–23, which is significantly higher than most developing economies. China, for example, had a rate of only 3.3 percent. The IMF’s estimate is even marginally higher than the Reserve Bank of India’s latest estimate of 7.2% for the same period.

Even when compared with developed economies like the US and UK, India is projected to grow at a faster pace.

Global brokerage firm Morgan Stanley has also said India is likely to be the fastest-growing Asian economy in the Asian region in 2022–23. It anticipates India’s GDP growth to average 7 percent in 2022–23 and saod the Indian economy is set for its best run in over a decade as pent-up demand is being unleashed.

If we compare India’s inflation data with the rest of the world, the country’s price rise is one of the lowest in the world.

The US CPI inflation (y-o-y) may have moderated to 8.3% in August 2022 from 8.5% in July but core CPI accelerated to 6.3% in August.

Europe’s annual inflation shot up to a record high of 9.1% in August, primarily driven by high energy prices followed by those of food, alcohol and tobacco.

CPI inflation in the UK touched 9.9% in Aug 2022 from its double-digit peak in July due to moderation in motor fuel prices

Among the BRICS economies, inflation in Brazil eased to 8.7% in August from 10.1% in July, while in China it eased to 2.5%. In Russia, inflation softened further to 14.3% in August from 15.1% in July. And, at 7% India’s inflation is one of the lowest in the world.

Even investment announcements touched an all time high this year in India.

“New investment announcements reported in FY22 is all time high of around Rs 20 trillion as compared to around Rs 10 trillion each in last two years. You will surprise to know that the same is led by

private sectors, where around Rs 13.75 trillion of investment announcement were made in FY22,” noted SBI.

Private participation in the investment announcements has increased to around 70% from less than 50% in earlier years, indicating revival of the capex in the economy.

The banking and financial sector has fared remarkably well amidst a pickup in credit growth, lower provisioning costs and improvement in asset quality

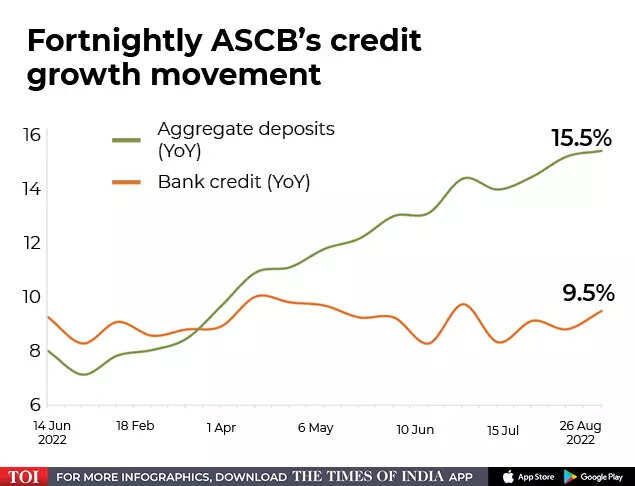

In India, credit growth continues to remain strong and has been consistently rising since February 2022, with latest number at 15.5% y-o-y as on 26 Aug 2022 (6.7% a year ago).

The incremental growth (YTD) in credit is Rs 5.66 lakh crore till date against a degrowth f Rs 0.5 lakh crore last year, said SBI. The demand for credit is continuing and is likely to grow at 15% (YoY) in FY23.

Moreover, aggregate deposits grew by Rs 5.2 lakh crore or 3.2% year to date compared to last year YTD growth of Rs 4.03 lakh crore/2.7%.

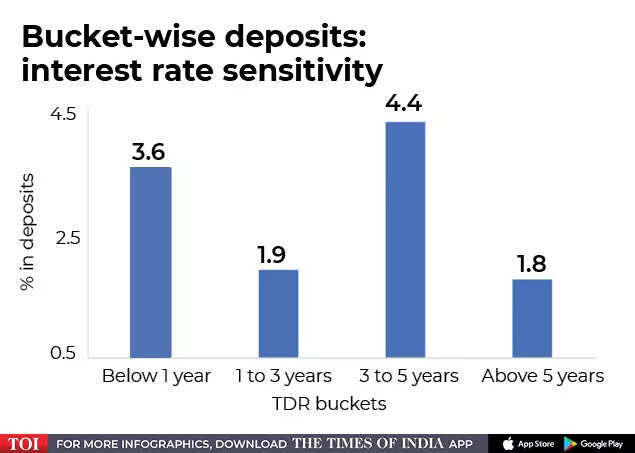

Also this ,SBI modelled bucketwise time deposits on bucket-wise interest rate on yearly data for 32 years starting from 1991 to 2022. The results showed that the deposits in buckets 3-5 Years (constitute 7.1% of TDR) is most sensitive to interest rate, followed by short term deposits (below 1 years), which constitutes 20.23% of total TDR. The 1-3 Year bucket, which constitute around 50% of total TDR is found to be most stable deposits and less sensitive to interest rate among all buckets.

“Interest sensitivity analysis reveals a strong sensitivity of interest rate to deposit rate changes in 3–5-year bucket and clearly supports that household inflation expectations is largely anchored, which is good for banks,” said Ghosh.

India’c current accound deficit may reduce, which means G-sec yields will be capped at near 7%.

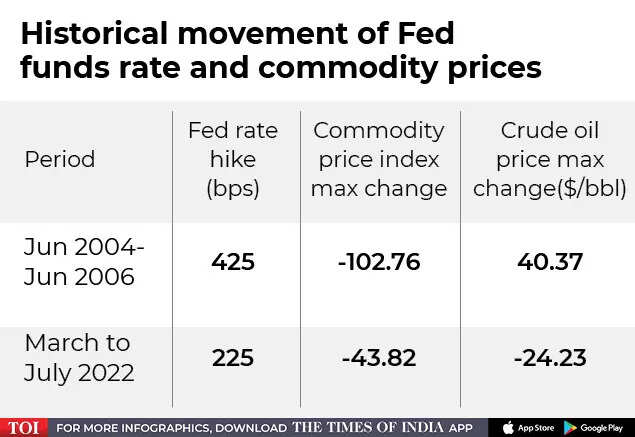

More than expected US inflation data implies aggressive rate hikes by the US Fed will continue and can go up even up to 5%. This in turn will put pressure on the commodity prices, which have significantly declined since March 22. The crude prices have declined by more than 12% so far since March 22.

Historical rate hike cycle by the US Fed has been accompanied by significant decline in crude oil prices.

“A comparison with the previous US rate hike cycle indicate that the commodity and crude price change mapped to a 425 bps rate hike (a likely scenario now) is much higher than the current commodity and crude price changes from peak to bottom. This clearly indicates crude and commodity prices will correct further.. a good harbinger for India’s current account deficit. Our analysis shows that every $10 decline in crude prices will lower our current account deficit by 35 bps. Thus, if average crude prices fall to $90/bbl then current account deficit is likely to be $112 billion (3.2% of GDP) compared to $126 billion (3.6% of GDP). Even, inflation will be lower by 20-25 bps if oil price declines by $10/bbl,” noted SBI.

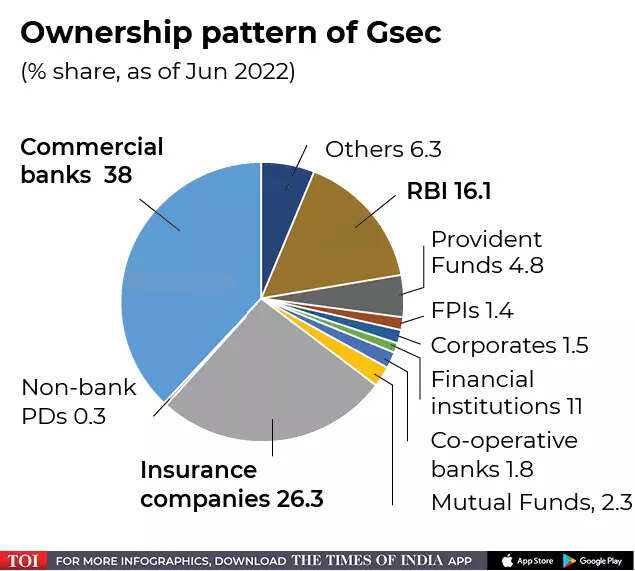

Given redemption of Rs 1.3 lakh crore in September-December 22 quarter, SBI believe 10-year G-sec Yield is likely to remain anchored up to 7.25% with an outside chance of a sub 7%.

The currency

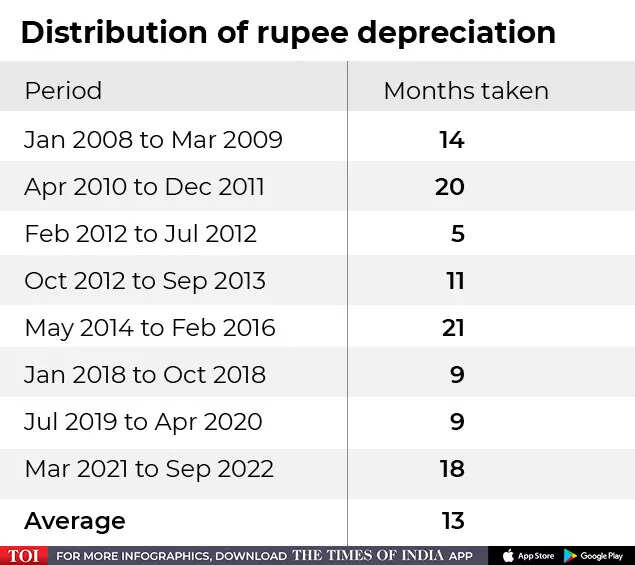

Much of the weakness in the Indian rupee is on account of a strong dollar and not because of India’s domestic economic fundamentals. The Indian rupee (INR) depreciated by a modest 7% vis-à-vis the US dollar since the Ukraine-Russia war broke out. The US $ Index has appreciated by 15% during the same period. There have been instances in the past which shows that rupee depreciation has been much more than the appreciation of the Dollar (like Jan-08 to Feb-12 and Oct-12 to May-14), which had happened because of India’s weak domestic macro-economic fundamentals.

“No central bank can prevent currency depreciation currently and RBI may allow the rupee to depreciate for a limited period. Foreign currency assets of RBI have declined by $75 billion since Ukraine War, in order to protect the rupee. This has led to reduced import cover of 9 months, which is at the lower end. This is also true that once the currency settles at a lower level, appreciation of currency picks up dramatic pace, that is a distinct possibility given India’s strong fundamentals,” said Ghosh.

Currency in circulation in control

While India’s liquidity has become deficit after 40 months, the liquidity situation is not going to worsen significantly because of Currency in Circulation / CIC remaining largely under control in FY2020 and FY2021 with a significant jump in UPI.

“With liquidity in a deficit mode, the RBI may carefully calibrate its statement given that Government cash balances still at record highs. The good thing is that with capital inflows picking up rapid pace in August and continuing in September, liquidity could get an unlikely buffer of rupee injection in lieu of dollar purchases / building up reserves,” said Ghosh.