Internal combustion engines still rule the roost when it comes to powering automobiles, but there are signs that they’re trundling into oblivion, at least in some markets. The likes of Sweden, Denmark, and the U.K. are planning to ban sales of diesel and petrol cars by the end of the decade, while markets such as Australia and California are also making moves in that direction albeit at a slower pace.

Part of this process will have to involve making it easier for consumers and businesses alike to transition to electrification, for example through extending access to electric vehicle (EV) charging stations as the U.S. recently announced as part of its $1 trillion infrastructure bill. But companies will also need help acquiring and operating their EV fleets — and this is where a new startup called Papaya is setting out to play its part.

Soft-launched back in February, Papaya’s software is designed to help fleet operators source and manage electric or light-electric vehicles (LEVs), solving something that cofounder and CEO Santi Ureta says is usually “highly fragmented and opaque.” And to help take things to the next level, the London-based company today announced that it has raised $3.5 million from a slew of institutional and angel investors.

For context, there are no shortage of vehicle management systems out there already, from Automile and Fleetcheck to Webfleet, but Papaya is hoping to set itself apart with its specific industry focus on smaller EVs that are likely to be used by last-mile delivery companies and such like. It’s about solving very specific pain points, reducing fragmentation, and serving as a single platform for everyone to connect and communicate.

“No one is really connecting all sides of the market as we are doing, and also building the tools they need to manage the relationship better,” Ureta told TechCrunch.

Ureta and Papaya’s CTO cofounder Renato Serra both have experience working at companies where transport and logistics are pivotal to their bottom line, including European food delivery juggernaut Deliveroo and quick-commerce unicorn Gopuff. And this experience was what proved the genesis for Papaya.

“We realised first-hand that sourcing an electric fleet is hard, and managing one efficiently is even harder,” Ureta said. “Managing a hybrid electric fleet with current software tools is impossible to do in one place.”

Moving parts

Among the problems that Papaya is looking to solve is the complexity of multimodality — electric fleets require different kinds of vehicles for different use-cases. For example an e-van may be more suitable for larger scale grocery deliveries, while a cargo bike or e-bike might suffice for food delivery. And for each kind of vehicle, there is a whole host of different suppliers, maintenance firms, and other service providers to keep everything functioning and in order.

Papaya essentially joins the dots between the fleet operators (e.g. Gopuff or Deliveroo) and service providers which may include vehicle suppliers (e.g. Hop or Otto), maintenance providers (e.g. Fettle or Cycledelik), insurance providers (e.g. Laka or Zego), or even storage spaces designed for housing and charging EVs (such as Reef or Infinium Logistics)

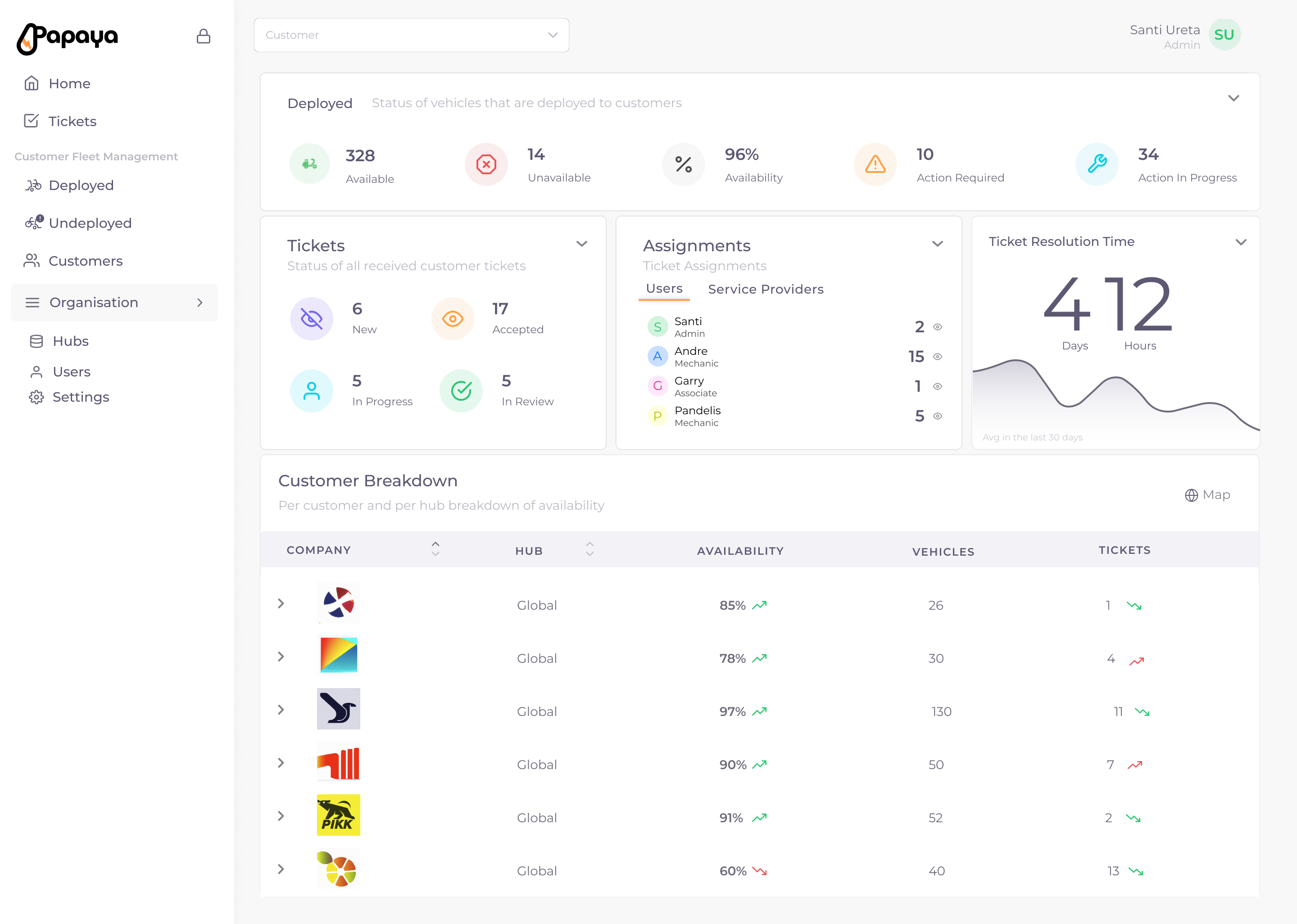

“Every single provider has their outdated systems — Google Forms, spreadsheets, emails or clunky fleet management tools — and the fleet needs to interact with all these tools to report incidents and maintain their availability, which makes it really difficult and inefficient,” Ureta said. “Papaya is centralising all these different processes and tools into one single operating system, allowing the fleet to have full visibility, accountability and transparency about the status of their vehicles, and manage all their relationships in the same place.”

Papaya dashboard

In its original guise, Papaya was mostly about enabling the management of existing EV and LEVs, but its overarching objective is to help companies transition from traditional fossil-fuel burning vehicles to emission-free alternatives. And that is why the company is gearing up to launch its vehicle marketplace, serving as a single conduit for fleet operators to procure EVs and LEVs and all the related services.

“One could see it [the marketplace] as a way for vehicle suppliers and service providers to showcase their products and services to fleets, in the geographies they operate within,” Ureta explained, adding that he expects the marketplace to launch by the end of the year. “Papaya will make it far easier for companies to source EVs, and manage them — this will accelerate the transition from combustion engine fleets to EV fleets.”

Papaya is already live in five markets, including the U.K. Spain, France, Germany and Estonia. And in its short lifespan so far, the company has already amassed an impressive roster of customers that include the aforementioned Gopuff (currently valued at $15 billion) and parcel delivery giant Evri.

Gopuff, according to Ureta, uses Papaya to interact with all the vehicles in their fleet, track availability and cost, and manage incidents as they come up.

“Gopuff uses Papaya as its main vehicle management system — they have all their vehicles on the platform and their main service providers onboarded on the other side,” Ureta said. “The platform is used by multiple actors, from riders to hub operators, fleet managers and heads of operations.”

On top of sourcing and managing EVs, much like other vehicle management systems, Papaya is also substantively about generating data and garnering insights into everything that’s happening in a fleet at any given point in time.

Bringing down emissions

A quick look at the data reveals that Papaya is onto something. The European Commission (EC) has targeted a 90% reduction in transport emissions by 2050, while last-mile logistics are currently responsible for around 5% of a company’s supply chain emissions — but with ecommerce only going on an upwards trajectory, this figure is likely to increase. Indeed, the World Economic Forum suggests that the number of delivery vehicles in the top 100 cities will increase 36% by 2030, with emissions from the traffic growing in tandem.

In short, if the world has any hope of meeting lofty climate goals, it needs to address the emissions problem. And this is what lies at the heart of Papaya’s growth plans — the company’s new $3.5 million investment ushered in a host of backers including Giant Ventures, Seedcamp, 20VC, FJ Labs, Flexport, Cocoa, Sir Richard Branson’s family (specifically: Freddie Andrewes and Holly Branson, who manage the family fund), Glovo cofounder Oscar Pierre, and former TechCrunch journalist Steve O’Hear.

The company said that it plans to use its cash injection to “build Europe’s largest electric vehicle ecosystem and decarbonise European fleets.”