New Delhi: Moody’s has changed its outlook for the global automotive industry to negative from stable because of the weakening macroeconomic environment and diminishing consumer demand. Higher cost of living (including for energy) not offset by salary increases, higher vehicle prices because of costlier production along the entire auto supply chain, and higher interest rates that make loans and leases less attractive for buyers all contribute to the shift in the outlook. Higher rates also increase refinancing costs for automotive companies, Moody’s said in a report.

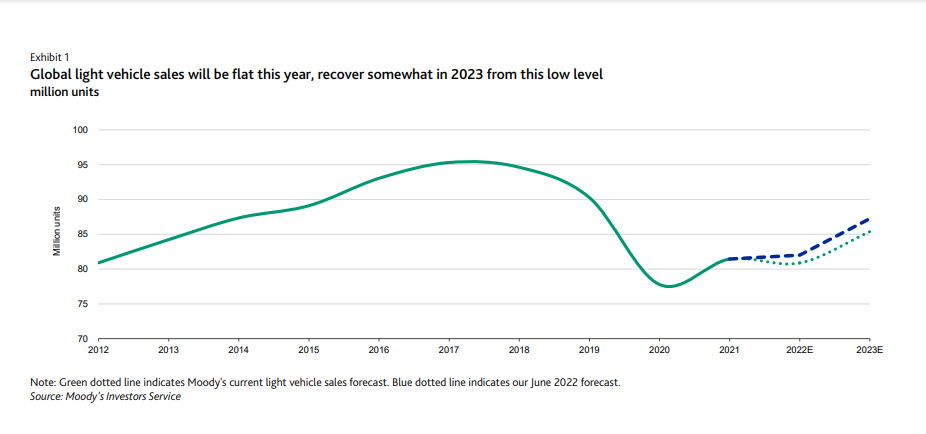

Moody’s expects 2022 global light vehicle sales to be about flat (-0.7%) versus 2021, and climb 5.7% in 2023. This will bring sales to about 85.5 million units, well below the pre-pandemic peak of 95 million. “This is in keeping with our macroeconomic board’s reduced forecast for 2.5% global GDP growth this year and 2.1% in 2023 (Global Macroeconomic Outlook 2022-23, August update), on the back of substantial inflation and higher interest rates meant to tame it — both of which eat into consumers’ purchasing power.”

Europe will be weakest of the major regions, and Asia-Pacific the strongest. Supply disruptions tied to the Ukraine invasion cleared, but concern over Russian energy supplies weigh on European consumers. An aggressive EU policy to quickly transition to Battery Electric Vehicles (BEVs) means even greater need for semiconductors that are still in short supply. In China, the world’s biggest auto market, previous downward revisions to sales expectations reflected negative effects of coronavirus-related supply chain disruptions during the first half and our expectation of slower economic growth, the report said.

An improvement in demand this year resulting from a vehicle purchase tax cut put in effect from June to December, and our expectation of higher economic growth in 2023 versus this year, should help sales. The US light vehicle sales through August are down 15% from a year ago, despite strong demand, because production is constrained. We believe increasing production volumes will lift sales for the rest of 2022 and into next year.

Supply chain to improve

Supply chain stress is easing, but the energy situation is fragile. Stress on global supply chains would improve, but stay elevated. Shortages of parts, particularly microchips, eased but are not resolved, so vehicle production is stifled. That leads to low inventory and keeps auto prices high. We expect semiconductor supplies to the auto sector to improve in 2023 as the global macroeconomic environment weakens. Still, energy price escalation, or even physical shortages, should Russia cut off natural gas to Europe, add risk to auto production.

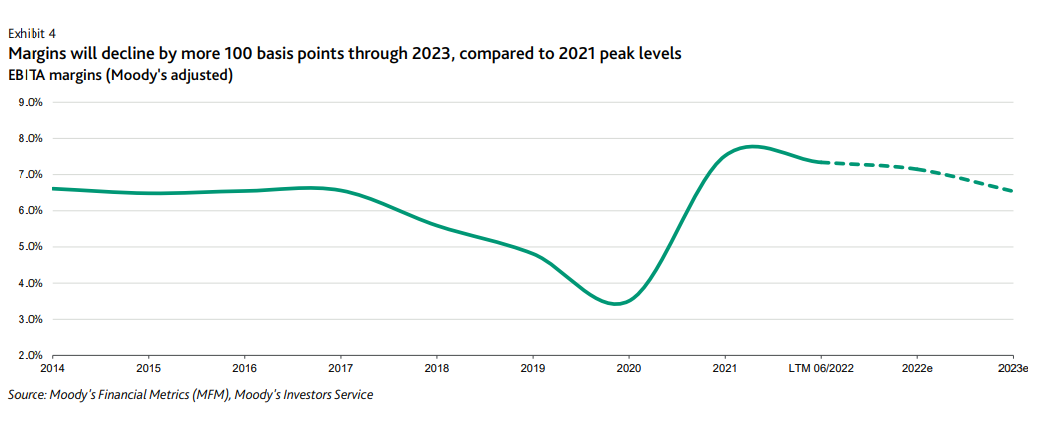

Automakers’ margins will diminish over the next 12-18 months as high prices and financing costs cut into demand. While production will improve, this interplay will slow volume recovery. We expect buyers to seek cheaper vehicles (with smaller engines and/or fewer features), especially when renewing leases. Despite some sales volume recovery in 2023, we expect automakers to reap lower margins on vehicles they deliver, and face pricing pressure on weakening consumer demand. We also expect free cash flow to be affected by built-up inventories, which fell to a minimum during the pandemic and the subsequent supply chain disruptions.

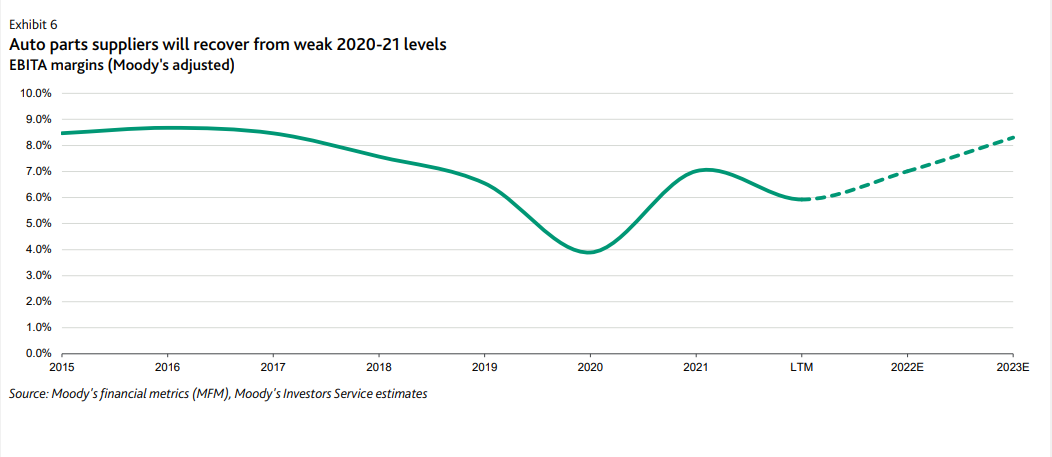

Parts makers’ challenges remain, with volume still lower than 2019, but cost-sharing with automakers should help. For these companies, other than those supplying sought after EV batteries and microchips, challenges remain from lower vehicle production and costs to remain flexible when automaker customers change volume requests. High raw material costs are another issue, especially when supply contracts do not include pass-through provisions or currency exchange rates are unfavorable. Efforts are underway to get compensation from automakers. Volume recovery and higher prices will support margins over the next 12-18 months, but a trend to smaller, less-equipped vehicles could hurt certain suppliers.

» What could change the outlook. We would consider reverting to a stable outlook if we expect a robust recovery (high single- digit percentage) in global light vehicle sales, with healthy momentum toward 90 million vehicles in 2024. A stable outlook would also require stable profitability, stabilization of supply chains and continued strong consumer demand that enables automakers and parts suppliers to pass on increased production costs to buyers. Finally, a stable outlook would require solid positive free cash flow generation, even at times of increasing inventory levels.

Sector and rating outlooks

The negative sector outlook reflects our view of credit fundamentals in the global automotive sector over the next 12 to 18 months. Sector outlooks are distinct from rating outlooks, which, in addition to sector dynamics, also reflect issuer’s specific characteristics and actions. A sector outlook does not represent a sum of upgrades, downgrades or ratings under review, or an average of rating outlooks.

Recovery of global light vehicle sales to peak levels will take more time. We expect the global light vehicle sales recovery to remain protracted. For H2 2022, we see constraints in production tied to limited semiconductor supplies, especially in North America and Europe. Also, order backlogs are strong — especially in markets where consumers order vehicles in advance (like Europe). Weakening sentiment when consumers feel price inflation (especially on winter energy bills) will, however, lead to some slowdown in global light vehicle demand in 2023 versus our previous estimates.

Our 2023 volume expectation of around 85 million units remains 10 million units below pre-pandemic peak sales (see Exhibit 1) and takes into consideration: affordability and higher interest rates; pent-up demand persistent since the beginning of the pandemic; an aging vehicle fleet and the stabilizing effect of expiring vehicle leases that must be renewed. The weakening environment risks shift the recovery to pre-pandemic peak sales to the early second half of the decade.

Europe weakest, Asia-Pacific strongest

Moody’s has cut its global light vehicle estimates to 80.9 million for 2022 (-0.7% vs. 2021), compared to the June estimate of 82.0 million. For next year, it has lowered its estimates to 85.5 million (+5.7% vs. 2022), compared to the previous estimate of 87.2 million. Its light vehicle sales forecast for EMEA is a 5.2% decline to 19.1 million vehicles for this year, rebounding to 20.6 million in 2023.

Most countries will see a decline, after a 11.9% fall in car registrations in the EU in the first eight months of 2022. This is despite a second half recovery, when supply chain disruption will ease. Germany and the UK will be the bright spots this year, while 2022 sales will drop substantially in East European countries closer to the Ukraine conflict.

Russian vehicle sales will plummet, with a 2023 recovery off a very low base. We expect a broad bounce back across Europe next year, but at a slower pace than previously expected. This will be driven by the aging European vehicle fleet, which we believe averages more than 12 years, versus 11.2 years in 2018. Overall, 2023 volumes in EMEA will remain 15% below the 2018 peak.

APAC will be the strongest of the major regions in 2022, growing by 3.5% driven by growth in China and India. We forecast 2022 auto sales will rise 4% in China, the world’s largest auto market, and gain a further 3.5% in 2023. By 2023, we expect automotive sales in China and India will return to 2018 levels, while the recovery in Japan remains protracted.

The previous downward revisions on sales expectations in China reflected the negative effects of the Coronavirus-related disruptions to the supply chain, as well as our expectation of slower economic growth. A vehicle purchase tax cut, put in effect from June to December, should offset those challenges.

In Korea, sales will be about flat this year at 1.7 million units, and up 2% in 2023. In Japan, sales will decline 5% this year to 4.2 million units, but we expect a rebound in 2023 with supply chain improvement (especially on semiconductors).

India the bright spot

India remains the bright spot for car sales this year. So far in 2022 sales are steady and we expect a stronger Q4 with the onset of the festive season which has just started. That will support volumes climbing by 12.5% this year and another 4% in 2023. A relatively stronger macroeconomic environment, the easing of semiconductor shortages as well as restocking by dealers will aid India’s outperformance relative to its regional and global peers.

LV sales

Light vehicle sales in the US, the vast majority of the North American market, declined 15% through August this year, as limited vehicle supply continues to lag demand. A dearth of inventory and vehicle production persistently constrained by microchip and other part supplies held vehicle sales back to an annualized rate of around 13 million units in May through August. Still, we believe prospects for easing supply chain issues will increase production volumes and lift retail vehicle sales during the remainder of the year to around 13.9 million for the full year, a 6.7% drop from 2021.

Light vehicle sales in the US are expected to grow to 15.1 million units in 2023. While this represents a growth rate of 8.6%, it remains more than 10% below retail unit sales of around 17 million units in each of the five years before the pandemic. Vehicle affordability and weak consumer sentiment pose a risk to our forecast.

Regulatory pressure

The EU and California are preparing bans on the sale of new internal combustion engines (including hybrids) by 2035 in an effort to hasten the shift to BEVs. Sales incentives for low- and zero-emission vehicles will decline or even be discontinued in some regions over the next 12-18 months, such as in Germany.

On the other hand, the recently revised tax credits for BEVs in the US could help spur adoption, although the incentives are subject to stiff eligibility rules with respect to vehicle assembly, sourcing of critical battery minerals and manufacturing of the battery. In developing regions like Latin America and India, a lack of charging infrastructure means a shift to BEVs will not be possible for many years.

Automakers’ margins to fall

Automakers represent about two-thirds of the consolidated revenue and EBITA of the sector, which also includes parts suppliers (about one-quarter) and truck makers (about 5%; all 2021 numbers).

For automakers, we expect a contraction of margins over the next 12-18 months tied to weakening consumer sentiment, increasing production costs (including cost pass-through from suppliers and despite recent price declines for certain raw materials like steel), and a potential trend to cheaper vehicles with smaller engines and fewer features. Low vehicle affordability along with a gradual increase of vehicle supply could also cause automakers to increase purchase incentives again, or to lower vehicle prices.

Truck market

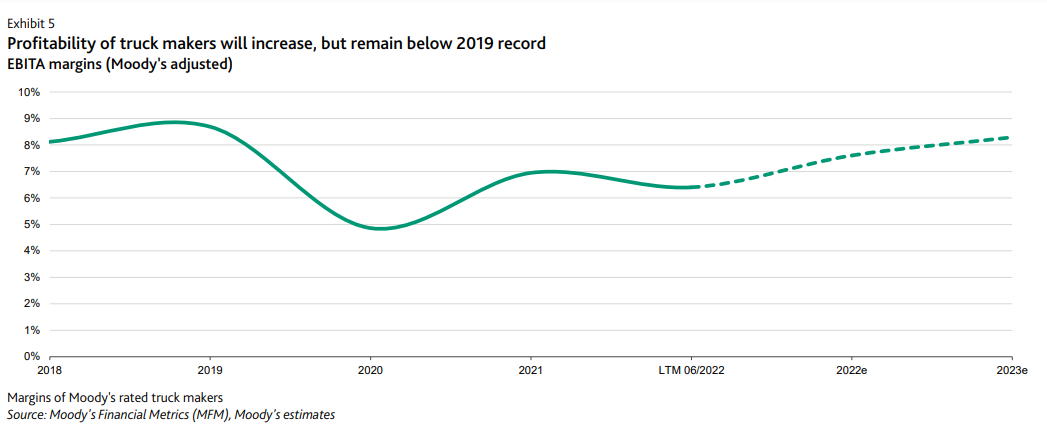

Truck sales volumes should be strong through 2023. Moody’s expects volumes in the truck market to outperform passenger car sales in Europe and North America over the next 12-18 months. For 2022, we expect mid-single digit percentage growth rates globally, excluding China. Including China, where we expect truck sales to drop meaningfully this year, we expect a decline in the low teens in percentage terms. For 2023, we expect low to mid-single digit percentage growth rates for the truck markets globally. Our expectation reflects strong order books, but also pre-buy effects ahead of stricter emission standards in Europe and North America from 2025.

The truck markets may grow slightly more than global GDP in 2023. Macroeconomic downside risks are significant, and the on-going cost inflation combined with a weaker business sentiment could prompt diminished demand for trucks in H2 2023, after the stabilizing effect of the current high order-backlog runs out.

Truck prices will increase materially, but consumer demand will remain strong, benefiting by the outcome of total cost of ownership (TCO) calculations. High fuel prices incentivize the replacement of older vehicles with newer, more fuel efficient ones. Increased cost of maintaining an aging fleet (now averaging more than 14 years in Europe, compared to less than 13 years in 2018) also makes new vehicles attractive. We also see more muted risks for truck makers’ margins, as the truck market has not followed the car market trend to the larger, better-equipped vehicles.

We expect margins of truck makers to improve over the next 12-18 months, driven by the continued volume recovery, and still strong demand, that allows the pass-on of cost inflation. Efficiency improvements within the manufacturing process also contribute to margin improvements.

Challenges remain for parts makers

Vehicle production remains well below pre-pandemic levels, keeping parts suppliers’ sales low while they bear the brunt of supply chain disruptions and have to cover higher raw materials and energy costs. Many of these cannot easily be passed on under the companies’ fixed-price contracts with automakers. We believe the balance will shift over the next 12-18 months, with improved cost-sharing measures helping recover credit metrics of many parts suppliers. Still, these will only partly compensate for the extra costs from supply chain disruptions and order volatility over the past 2 years.

Contracts between automakers and parts suppliers generally contain pass-through mechanisms for common raw materials like steel, copper, aluminium, and nickel. Because the adjustments come quarterly or annually, the “pass-through” always lags and so the steady rise in costs over the last quarters was not well reflected. As a result, these higher costs were a massive burden on the finances of parts suppliers.

Moody’s expects this to change as more suppliers’ contracts now include “pain-sharing” terms — with the carmakers willing to carry part of the burden (and get benefits should prices drop). Meanwhile, some material prices are dropping. For instance, European steel prices almost halved since their March peak, dropping to within our medium-term forecast range of EUR 500-EUR700 per tonne for the first time since early 2021.

While lower raw material prices could provide some relief, gradually rising salary costs that typically cannot be easily passed on, could increasingly constrain margins in 2023.