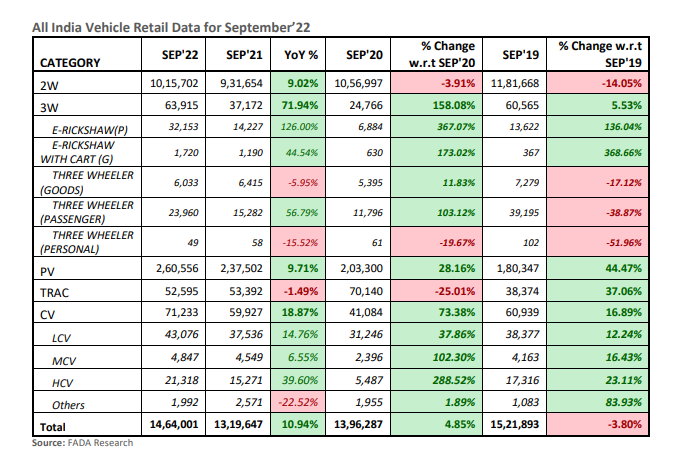

New Delhi: Passenger vehicle registrations saw year-on-year growth of 10% to 2,60,556 units in September 2022 owing to better availability owing to the easing of semiconductor supply, new launches and feature rich products, the data shared by the Federation of Automobile Dealers Association (FADA) based on VAHAN confirmed.

According to the dealers’ body report, total vehicle registrations at regional transport offices (RTOs), which are proxies for sales, rose by 11% to 14,64,001 units in September 2022.

Manish Raj Singhania, President, FADA, said, “Auto retail in September 2022 saw an overall growth of 11%. September witnessed both, the inauspicious period of Shradh (a.k.a Pitru Paksha) from 10th to 25th and the festive period which began with Navratri on September 26. Due to this, the full potential for the month was not realized as it should have been.”

“When compared with September 2019, a pre-Covid month, total vehicle retails continued to fall by -4% but narrowed the gap from the previous months. The PV segment continues to show extremely healthy figures by growing 44%. Three-wheeler, Tractor and CV segments also closed in green with an increase of 6%, 37% and 17% respectively. The 2W segment is yet to show signs of any revival as it remains a drag by falling as much as -14%. The 2W segment showed a growth of 9% YoY but fell by -14% from September 2019,” he said.

Singhania added, “Due to increased input costs, 2W companies raised prices by 5 times in the past one year. Apart from this, RBIs fight with inflation saw rate hikes which continued to make vehicle loans expensive. While India is showing revival signs, Bharat is yet to perform. 2W especially the entry level vehicles are finding extremely less number of buyers thus dragging the entire segment.”

The 3W segment continues to see a structural shift from ICE to EV. This is also reflected in the extremely healthy growth rate of e-rickshaws. Apart from better availability of vehicles with full range products including alternative fuels, customers have started using public transport and rickshaw service thus fuelling demand in this segment, the FADA President said..

While the CV segment grew by 19%, it is the HCV segment which showed a healthy growth of 40% YoY. Reasons like better availability of vehicles, festivities, bulk fleet purchase and Government’s continued push for infrastructure development made this segment shine. The PV segment continued its ‘Bolt’ run by showing a growth of 10% YoY and 44% when compared to September 2019.

Better availability due to easing semiconductor supply, new launches and feature rich products kept customers glued to dealerships for getting their favourite vehicles during the auspicious period. The waiting period continues to range between 3 months and 24 months especially for SUVs and compact SUVs which have become the absolute choice for today’s customers, he said.

Retail sales for the commercial vehicle segment witnessed a growth of 19% to 71,233 units as against 59,927 units in September 2021.

On the outlook, Singhania said that October will see Auto Retail on high grounds with 24 days of festive season in the month. Dealers anticipate this to be the best festive seasom in a decade for the PV segment as we anticipate even higher sales during the month.

While semiconductor supply continues to ease, FADA requested OEMs to match supply as per the demand so that PV sales can further receive a nitro-boost. The enquiry level in the 2W segment is showing positive movement. If this segment, especially entry level 2Ws, also performs well improving their growth to low double digits, the overall auto retail will see higher growth than in the past 2 festival seasons, though below the October 2019 numbers.

FADA continues to remain optimistic about October the festive month.

Read More: