The market managed to grow 12.7% in September, but compared to the same month in 2019 it fell 17.7%

Registrations of light commercial vehicles fell by 3.6% compared to the same month of the previous year, with 9,571 units

Sales of industrial vehicles, buses, coaches and microbuses increased by 18.6% in September with 2,351 units

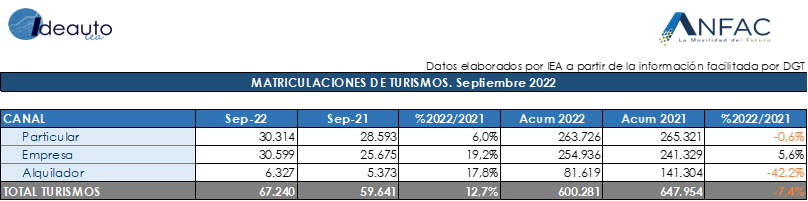

Madrid, October 3, 2022. The market achieved sales growth for the second consecutive month, with a rebound of 12.7% compared to the same month of September of the previous year, with a total of 67,240 units. Despite this increase, the month is below pre-pandemic records (September 2019), with a drop of 17.7%. The strong inflation, the greater economic uncertainty in the users and the microchip crisis are affecting both the demand and the volume of deliveries, being determining factors to reflect that the accumulated figure for the year remains negative, with a drop of 7.4 % up to the ninth month, with 600,281 units in total.

The average CO2 emissions of passenger cars sold in the month of September remain at 118.2 grams of CO2 per kilometer traveled, 1% less than the average emissions of new passenger cars sold in September 2021. Until the month of September emissions have been reduced by 3.6% compared to the same accumulated period of the previous year.

Added to the positive data for September is the fact that all channels closed higher. Both the accumulated sales in the channel for individuals and companies are especially significant. During the past month, sales to individuals achieved a growth of 6%, with a total of 30,314 units. With a similar sales volume, the business channel reached 30,599 registrations, an increase of 19.2%. To a lesser extent, but also positively, rental companies grew by 17.8% in September, to 6,327 units.

LIGHT COMMERCIAL VEHICLES

In September, registrations of light commercial vehicles accumulated a total of 9,571 units, which represents a decrease of 3.6%. For the accumulated of the year, 86,756 registrations were reached, which registers a fall of 27.7% compared to the same period of the previous year. Regarding sales by channel, only registrations aimed at companies managed to grow, with an increase of 23.6%, while the self-employed channel and that of renters registered a fall of 17.7% and 55.6%, respectively.

INDUSTRIAL AND BUSES

Registrations of industrial vehicles, buses, coaches and microbuses in September maintained their positive records, with growth of 18.6% and a total of 2,351 units sold. In the accumulated of the year, 18,170 units are added, which marks an increase of 12% in the first nine months. By type of vehicle, it is worth highlighting the strong growth of industrial vehicles, which totaled 1,942 sales, with an increase of 22.8%.

DECLARATIONS

Félix García, director of communication and marketing at ANFAC, explained that “the car and SUV market grew by more than 10% in the month of September. It is the second consecutive month in which sales have risen in a declining market context and with a very unfavorable socioeconomic situation. The sector continues with the serious semiconductor crisis that has become a bottleneck for production. Although there is an existing demand from users, the scarcity of components is determining that it can be fully satisfied. Added to this is the fact that economic uncertainty and geopolitical tensions, whether due to the war in Ukraine or the situation in Taiwan, one of the main manufacturers of these components, have not ceased and will continue to be factors that determine the evolution of the market in the coming months

Raúl Morales, communication director of FACONAUTO, indicated that “despite having ended positively, the registration data for September abounds in the trend of recent months and leaves us with a very bad year in sales. Brands and dealers continue to try to solve existing stock problems by always having immediate delivery vehicles, but it is undeniable that, in addition to this supply problem, there is already a clear weakening of demand due to the unfavorable economic and consumer situation. In this last quarter, we are concerned, in addition to the general lack of buyer confidence, that the rise in interest rates could become another additional factor that demobilizes sales. The result of all this context is that the new vehicle is moving away from the possibilities of the average Spanish family”.

According to the communication director of GANVAM, Tania Puche, she highlighted “the data recorded in September show a slowdown in the market decline. Vehicle production has experienced moderate growth as a result of a slight improvement in the supply of materials, which has allowed the distribution networks to fulfill the delivery of pending orders. However, we cannot lose sight of the fact that we are still far from the pre-pandemic figures and the supply of components is still volatile, so we are facing an uncertain autumn that does not yet allow us to speak of a recovery. In fact, the 2022 financial year will again close well below 900,000 units, that is, it will be as if we had been three years in a row with a quarter less activity.