New Delhi: Banks have pitched for including loans towards electric vehicles and green hydrogen to be classified under the priority sector lending.

“Some lenders made these suggestions during various individual interactions with the Reserve Bank,” said an executive aware of the developments.

Banks are of the opinion that bringing such loans under priority lending list will help plug financing gaps in these sectors and help lenders meet their priority sector lending targets.

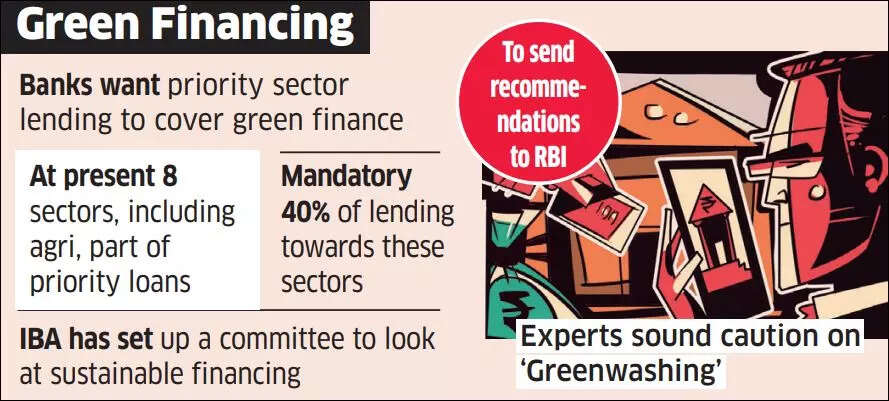

“Expanding the PSL category will also help lenders meet their requirements, which they are unable to do presently and are required to buy priority sector lending certificates,” said another executive aware of the matter. Banks are mandated to provide 40% of their adjusted net bank credit to priority sectors.

Last month, the Indian Banks’ Association (IBA) set up a committee to investigate various aspects of sustainable financing and lending with Environmental, Societal and Governance (ESG) issues in focus.

IBA chief executive Sunil Mehta told ET that the banking body will examine the committee’s recommendations and accordingly make a formal representation to the regulator.

“There are various suggestions on green financing and ESG related issues. A committee comprising of both Indian and foreign lenders has been set up to evaluate all the issues and best practices,” he said, adding that the banking regulator also expects IBA to play a role in capacity building.

At present, lending towards eight sectors, including agriculture, micro and small medium enterprises, export credit, housing, education, renewable energy and social infrastructure is considered eligible under priority sector loans.

“This will help firms operating in these sectors scale up operations,” said Sumit Dhanuka, founder of ElectriVa, which sets up independent EV charging stations in India.

Experts stress on the need to keep ‘green washing’ risks in view while defining sustainable finance.

“For example, investing in a business that claims to use recycled materials when it actually does not…. This could result in funds under sustainable finance getting channelised incorrectly,” said Vivek Iyer, national leader, financial services-risk, Grant Thornton Bharat.