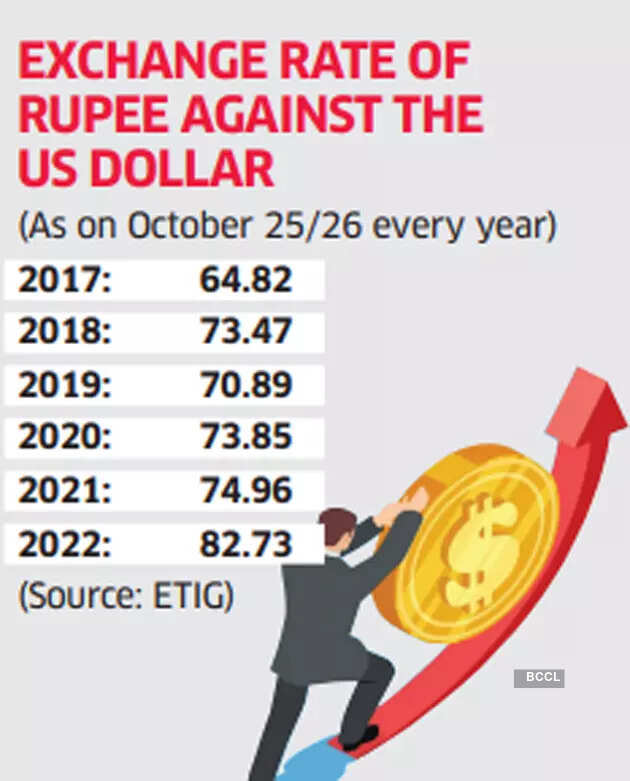

The Indian rupee has been hitting new lows, week after week. From holding on to 74 against the US dollar in January to dropping to 83 last week — a double-digit fall in percentage terms in just 10 months — the rupee’s depreciation has not augured well for the economy.

Economists caution that the currency could plunge further in the coming months before settling down. Some forecasters argue that the rupee could rebound and gain strength in the next fiscal year.

The fall of the rupee has been precipitated by global factors and an unusual strengthening of the dollar against almost all major currencies of the world. While the rupee has performed way better against the greenback than biggies such as the pound and the euro, the runaway dollar can’t be taken lightly since it has a massive fallout on India’s import bills and inflation.

Rumki Majumdar, chief economist, Deloitte India, says, “The rupee will remain depreciated for some more time before gaining some lost ground by the end of this fiscal year.” She adds that more clarity is required over the next few months on variables such as the energy crisis in Europe and the slowdown in China and the US. “We expect the rupee to gain back strength in the range of 77-79 per dollar in FY2023-24,” she forecasts.

Mahindra Group’s chief economist Sachchidanand Shukla makes a similar projection. According to him, “the rupee might be prone to sudden and sharp bouts of depreciation now”, as over $100 billion of foreign exchange reserves have been exhausted to keep the rupee resilient.

“I don’t rule out 85 rupees a dollar between November and March,” he says. Shukla gives three reasons to justify his forecast. One, the dollar will be prone to sudden spikes owing to inflation data accidents or Fedspeak. Two, oil prices may rise once the US midterm polls in November get over (then the US may not release oil liberally from its reserves or exert pressure on other oil-producing countries to keep up supplies). Three, RBI can at best play around with another $40-50 billion worth of forex reserves intervention to prevent a falling rupee.

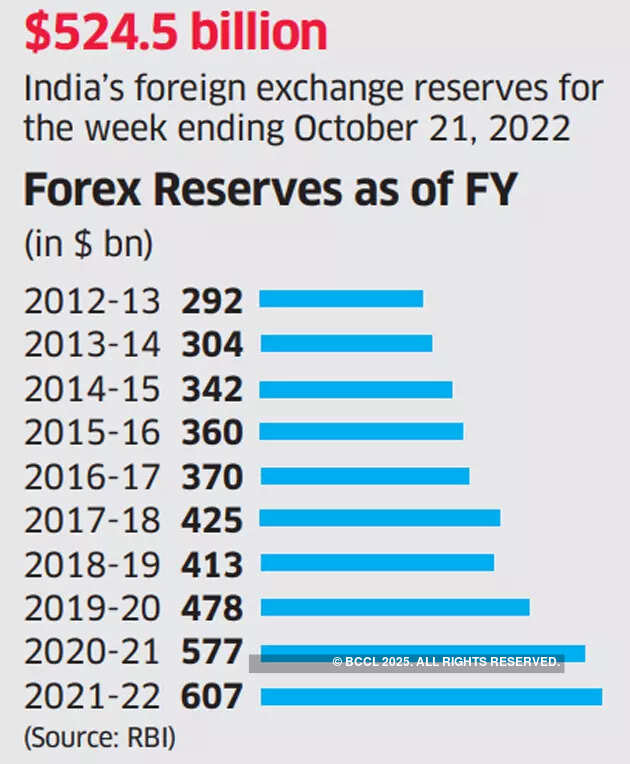

According to RBI’s bulletin for October, India’s foreign exchange reserves, at $533 billion (as on October 7), were equivalent to 8.7 months of imports projected for 2022-23.

Experts say reserves of at least seven months of imports are considered necessary. “So far, in 2022-23, the reserves have been depleted by US$74.4 billion; however, most of the depletion was on account of valuation loss due to the appreciation of the US dollar against major currencies,” says the bulletin, citing examples of dwindling foreign currency reserves across the globe as central banks have been selling dollars to support their respective currencies.

In fact, global reserves worth $884 billion evaporated in the first half of calendar year 2022, according to the International Monetary Fund’s database. The number is still not very large, considering the cumulative holdings of $4 trillion reserves.

IT’S ALL ABOUT THE ECONOMY

Economist and former chief statistician of India, Pronab Sen, says the rupee movement will hinge on the health of the Indian economy and the growth of its gross domestic product (GDP). “If the Indian economy does fairly well and the American economy weakens, then the rupee will start appreciating a little bit against the dollar. In that case, the rupee may return to 80 or 81 against the US dollar,” he says. “But if the Indian economy deteriorates, I won’t be surprised if the rupee breaches the level of 85 or 86.”

Another economist has similar projections.

EY India’s chief policy advisor DK Srivastava says, “In the short run, the exchange may go up to Rs 85/USD.” But he projects another scenario of the US currency nose-diving against many currencies, including the rupee, if some nations succeed in de-dollarising their international payments and reducing the extent to which they are using dollar as a reserve currency. “Once this movement gathers momentum there may be a sudden and sharp deterioration of the USD against various currencies, including the INR,” he says.

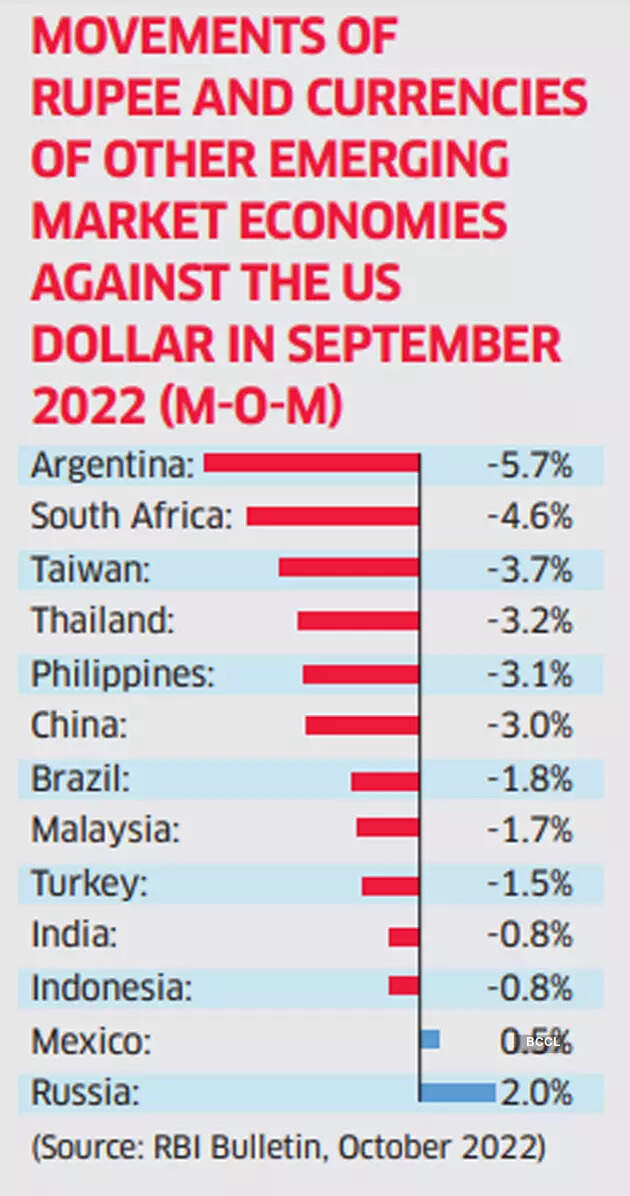

The depreciation of the rupee against the US dollar, as seen in the last few months, has been modest compared with the currencies of other emerging market economies. For instance, the rupee depreciated only by 0.8% vis-à-vis the US dollar in September over August 2022, whereas the currencies of Argentina, South Africa, Taiwan and Thailand weakened by 5.7%, 4.6%, 3.7% and 3.2%, respectively, in the same month, according to data compiled by multiple sources, including Thomson Reuters and the RBI.

Even the Chinese yuan depreciated against the dollar by 3% during that month. The only major currency that bucked the trend was Russia’s ruble, which appreciated by 2% against the US dollar last month.

The Union finance ministry’s monthly report for September says “local reasons such as the sensitivity of capital flows to c h a n g e s i n (US) Fed rates and dependence on fuel and food imports ” contributed a lot to the depreciation of currencies against the US dollar. The document adds, “Rupee has performed relatively well in H1:2022-23 compared to other major economies, reflecting the strong fundamentals of the Indian economy. A large build-up of forex reserves has been beneficial for India as it has helped in withstanding exogenous shocks.”

India’s robust forex reserves, part of which is being used to weather the current storm, have been the result of many years of efforts and sustained GDP growth. According to RBI’s data, India’s forex reserves grew from $294 billion in September 2012 to $537 billion in September 2022. At the end of 2021-22, the reserves were far healthier at $607 billion but the central bank had no option but to deploy a part of it to cushion the impact of the currency turmoil.

“The RBI had to intervene to contain volatility and ensure an orderly movement of the rupee,” says Majumdar, adding that the import cover from reserves has reduced to nine months from a high of 19 months at the start of 2021. The annual import bill of India’s merchandise trade has been increasing phenomenally over the last few years — from $393 billion in 2016-17 to $619 billion in 2021-22, according to RBI data, something that has put pressure on available dollars.

So what’s the ideal level of the rupee vis-avis the dollar that New Delhi could aspire for?

“The RBI does not have any fixed exchange rate in mind,” writes RBI Governor Shaktikanta Das in the central bank’s October bulletin, emphasising that the rupee is a freely floating currency and its exchange rate is market-determined. “It (RBI) intervenes in the market to curb excessive volatility and anchor expectations. The overarching focus is on maintaining macroeconomic stability and market confidence,” he adds. He then says the RBI’s actions have helped in “engendering investor confidence” as reflected in the return of capital inflows since July.

As economist Sen argues, the effort must be in improving the overall economic health of the nation rather than in chasing a comfort level for the rupee. “The RBI should manage volatility and nothing more. Let the rupee find its own level,” says Sen.