Matt McKinney was a data science manager at Uber, helping launch Uber Freight, along with software engineer Shaosu Liu.

One of the main problems the pair saw there was that while they were able to grow the top line, they found it difficult to grow the bottom line because they were “losing a bunch of money” to bad debt and late payments.

When digging in to understand why, the duo realized that “there’s so much complexity in a single freight bill.”

For example, they found out that 20% of all freight invoices have an error. They also discovered it takes 50 days on average to process and pay a single invoice.

“A lot of people in this business aren’t like Uber — they don’t have 250 engineers working on problems to figure this out,” McKinney explains. “So Joe’s Trucking in Cincinnati, Ohio, for example, probably has very similar billing and payment problems as Uber Freight.”

In speaking to about three dozen shippers, carriers and brokers in the industry, McKinney and Liu kept hearing the same thing: “It’s hard for us to get paid and it’s hard for us to pay.”

“So as an entrepreneur, when you hear that pain described so vividly verbatim 35 different times, you kind of, you know that the pain is your opportunity to build a product that doesn’t exist in the market,” he told TechCrunch in an interview.

So the pair spent nights and weekends building a prototype for Loop, a startup that sits at the intersection of logistics and payments, before leaving Uber in May of 2021 to focus full time on the business. Soon after, they raised a $6 million seed round co-led by Susa Ventures and 8VC. And then earlier this year, they raised a $24 million Series A round led by Founders Fund. Both financings were not previously publicly announced.

During their exploratory phase, three of the 35 companies — unnamed large enterprises — they talked to told them if they built a tool to help solve the problem that they would help test out the prototype and be its first customers. Since then, the company has developed open APIs that it says “ingest data and streamline shipment document capture.”

More specifically, the company said it uses natural language processing (NLP) and computer vision to digitize workflows and reconcile payments and that its technology “accommodates the lack of standardization and is able to extract data from a variety of document types and data sources to validate invoice accuracy, so that invoices and payments can be cleared in close to real-time,” or even to real time, depending on when the user wants to release their funds.

Loop goes as far as to claim that its tech can reduce the lag time between the time an invoice is received and paid from 50 days to 3 days, as well as reduce invoice errors to “near 0%.”

The startup’s target customers are shippers that manufacture or distribute goods (think Walmart, Pepsi, Coca-Cola and Nike). They also can work with brokers, or 3PLs, who broker a transaction between a truck driver and shipper.

Loop launched its product offering in March and in its first month, did $25 million in booked total payment volume. Today, it’s doing over $1 billion in total payment volume.

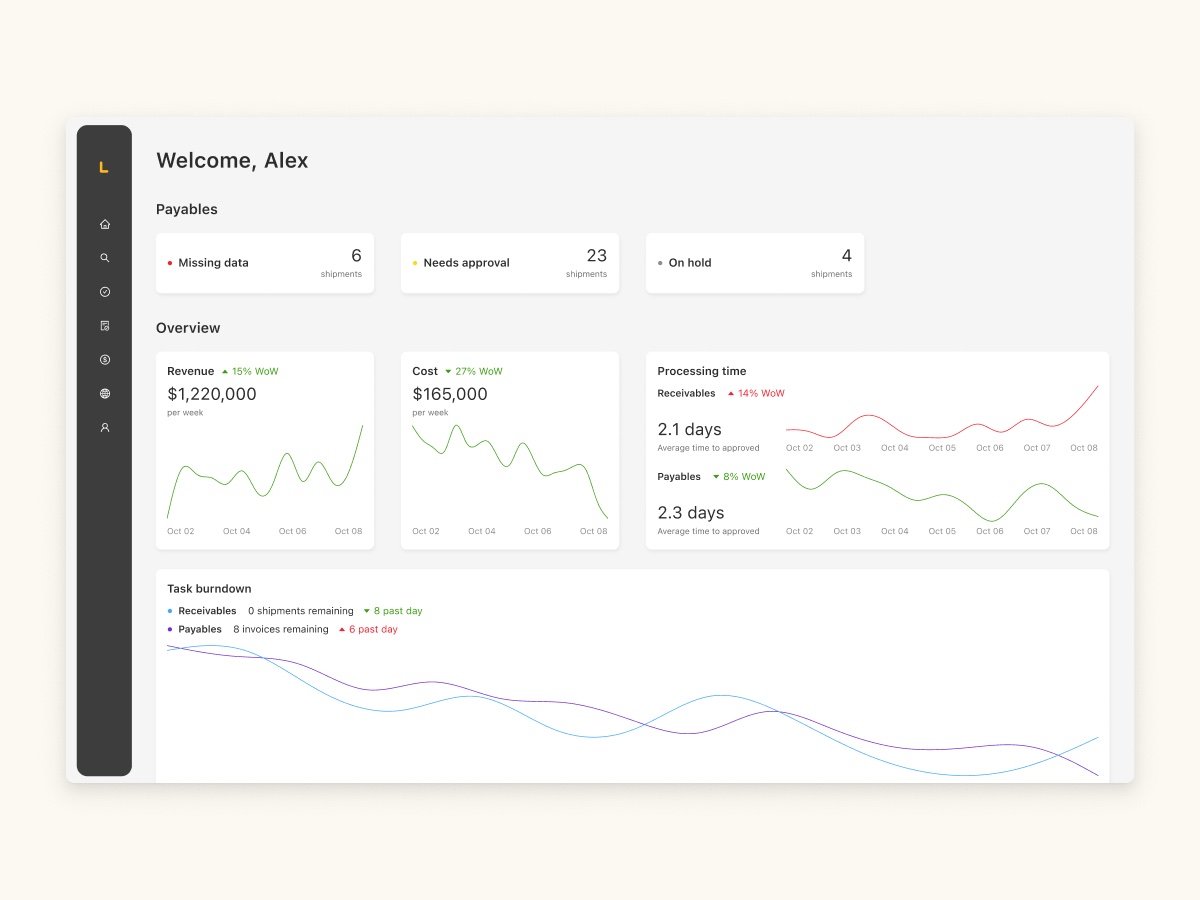

Image Credits: Loop

One of the tailwinds that helped Loop, believes McKinney, is the COVID pandemic-driven secular shift of paper to electronic methods of payments. Also, geopolitical issues and the pandemic exposing vulnerabilities in the global supply chain have led to a surge in freight costs, which means that shippers “are looking for every way to cut costs,” he said. Loop’s aim is to help these companies minimize cost and be more efficient. And, McKinney claims, it can bring payments down

Loop makes money by taking a percentage of total payments volume. It’s a fixed percentage based on tier, and as a company advances tiers, the percentage they pay goes down. A consumption-based revenue model was important to the pair, McKinney told TechCrunch.

“We want to align incentives so that if you’re getting value out of the product, you’re going to be using it more,” he said. “And that’s how we should get paid.”

The company today has 35 employees, with engineers hailing from Uber, Google, Meta and Flexport. In fact, one senior software engineer from Flexport cold emailed Loop about a job. When he told Flexport founder and then-CEO Ryan Peterson that he was leaving for Loop, Peterson reached out.

“He said, ‘You just stole one of our No. 1 engineers,’” McKinney said. “I want to know what you’re doing and I want to invest.” And so he did.

Also showing no hard feelings in backing the company are Uber co-founders Garrett Camp, through his venture firm, Expa, and Ryan Graves, through his family office, Saltwater Capital. And more than 10 of Loop’s 35 employees came from Uber. Other investors include FourMore Capital, Lineage Ventures, Nichole Wischoff, 9Yards Capital, McVest Co, Mark Pincus and OEL Ventures.

“We’re simplifying logistics payments but we’re also generating data and that data, and the quality of the data, is what differentiates us from a lot of the competition as well,” McKinney said.

Founders Fund principal John Luttig, who led the Loop investment, told TechCrunch via email that his firm was drawn to the startup because it is using a tech-first approach to eliminate friction for all parties in the supply chain “while competitors are simply throwing more people at the problem.”

“As the domestic logistics renaissance continues and more companies look to reshore U.S. manufacturing, Loop’s technology will only become more valuable,” he added.