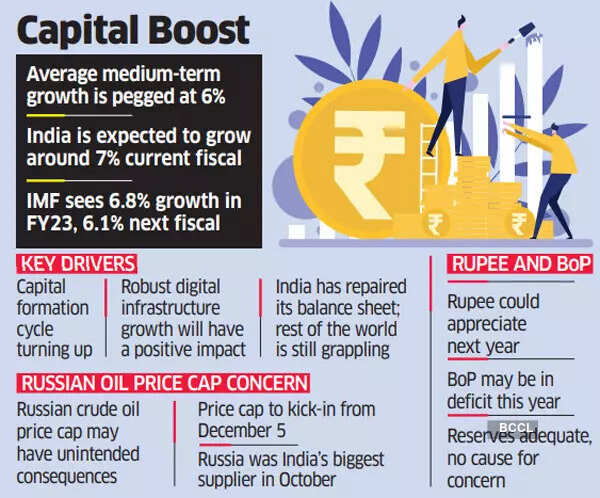

The Indian economy is likely to grow 6.5-7% in the medium term, buoyed by a revival in the capital formation cycle, chief economic adviser (CEA) V Anantha Nageswaran said, but warned that a proposed price limit by the West on Russian crude oil would be a matter of concern. The International Monetary Fund has forecast the economy to grow by 6.8% in the current fiscal year and 6.1% in the next.

“Taking a baseline scenario of oil…under $100 (per barrel), our medium-term (growth) outlook would be closer to 6.5-7%, rather than closer to 6%, because the capital formation cycle will turn up and there are already insipid signs that it is happening,” Nageswaran said. He was speaking at a mid-term review of the Indian economy by the National Council of Applied Economic Research (NCAER) on Saturday.

India’s balance of payments may be in deficit this year and the next, the CEA added, though it would be manageable, with the existing gold and foreign exchange reserves, as well as better remittances expected this year.

“It’s not the end of the world because we do have about $530 billion (in reserves), and currencies alone about $480 billion worth of reserves at end of October,” Nageswaran said. “We should be able to ride through this space because FDI flows are stable.” The country could also face a problem of rupee appreciation next year, Nageswaran said. India’s growth cannot be completely decoupled from global risks, he added.

NCAER’s review said the economy was showing growth and resilience in 2022 despite an unprecedented global environment.

The next year is slated to be tougher and subject to uncertainty, NCAER said in its review. ET reported earlier in the week that Russia had become India’s biggest crude supplier in October.

Led by the US, advanced economies have proposed a price cap for Russian crude for global buyers to create economic hardship for Moscow while ensuring that global energy supplies are not disrupted.

Countries that violate the cap will not have access to key maritime services such as insurance. The price cap, which has yet to be decided, will kick in from December 5. “In this situation, what is really important for us to worry about is the oil price cap…(which) basically means insurance and shipping services will not be available to those who buy Russian crude…,” Nageswaran said.

It could deny India cheaper Russian oil that has allowed New Delhi to keep import costs low. India imports 85% of its crude requirement. The chief economic adviser said given the way the limit had been structured, some contracts entered into before December 1 would not be subject to the ceiling, resulting in hoarding of crude by traders.

Go to Source