New Delhi: In this era of digitalization, over 73% vehicle shoppers in India know the exact model they want to purchase, and 88% research online. With this, product discovery at a showroom remains an important driver of customer experience, said the J.D. Power 2022 India Sales Satisfaction Index Study (SSI) released on Thursday.

The 2022 SSI is based on responses from 6,618 new vehicle owners who purchased their vehicle between December 2021 and August 2022. The study, done in association with NielsenIQ, was fielded from June through September 2022.

It measures new-vehicle owners’ satisfaction with sales process by examining their satisfaction on six factors (listed in order of importance); delivery process (20%), dealer facility (18%), paperwork completion (17%), working out the deal (15%), sales consultant (15%), and brand website (14%). The study examines the after-sale satisfaction only in the mass market segment.

The study finds that customers with a seamless product discovery engagement have an increase of 28 index points (on a 1,000-point scale) over those who do not (878). However, more than one-third (36%) of the customers in India mentioned that the product discovery engagement was not seamless.

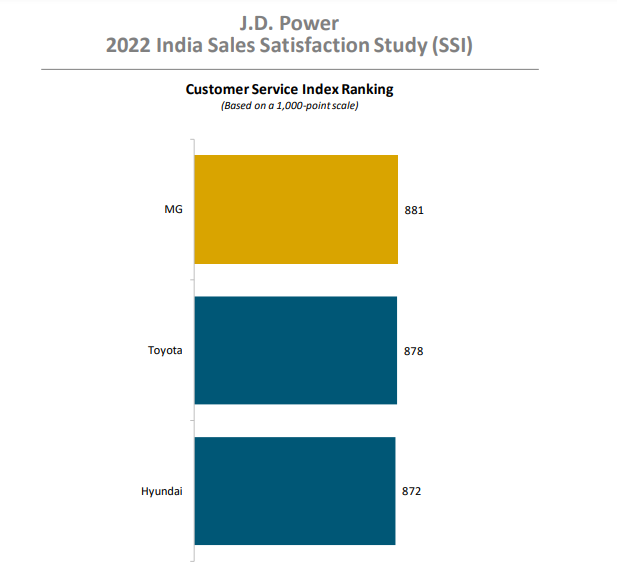

Based on its key finding, the study ranked MG Motor first, for a second consecutive year, with a score of 881. Toyota (878) is second and Hyundai (872) third.

Sandeep Pande, lead of the automotive practice India at NielsenIQ, said, “Even in an era of instant information availability, the importance of sales consultant-led product discovery continues to drive purchase experience.”

“With customers returning to the showrooms for their purchase, a seamless product discovery will aid satisfaction and will drive dealer referrals,” he said.

According to the study, nearly one-third (27%) of customers mentioned that they faced one or more issues during their commercial engagement with the dealers. Satisfaction of these customers dropped 26 points compared with those who did not experience any such issues.

Millennials and Gen Z customers remain the least satisfied, with an overall satisfaction of 852. That score, which is lower than the industry average, reflects lower satisfaction in product discovery engagement as 41% of this cohort cited issues vs. 33% among the older customers.

Customers remain sensitive towards key explanations on the day of delivery and a bit beyond. Customers who were provided all explanations at a special ceremony and a follow-up call had an average score of 871. If a dealer fails to complete any of these steps, satisfaction may decline to 835, it said.

From 2021, J.D. Power has re-launched the India Sales Satisfaction Index Study in partnership with NielsenIQ.

Also Read: