Of India Passenger Vehicle Inc’s current cumulative order backlog of an estimated 800,000 units, Mahindra & Mahindra with 260,000 units is the second largeAst after Maruti Suzuki’s 400,000-odd units and Tata Motors’ 100,000 units.

While announcing its Q2 FY2023 results today, Mahindra & Mahindra revealed that it has cumulative ‘open’ bookings of 260,000 units as of November 1, 2022. Given that on July 1, the company’s order backlog was 143,000 units, the surging demand for its utility vehicles means that the company’s order book has further increased by 117,000 units over four months.

Massive demand for Scorpio N and Scorpio Classic

The 260,000-units’ order bank is essentially made up of five models led by the recently-launched Scorpio N and Scorpio Classic (130,000 units), XUV700 (80,000 units), Thar (20,000 units), Bolero and Bolero Neo (13,000 units) and the XUV300 (13,000 units).

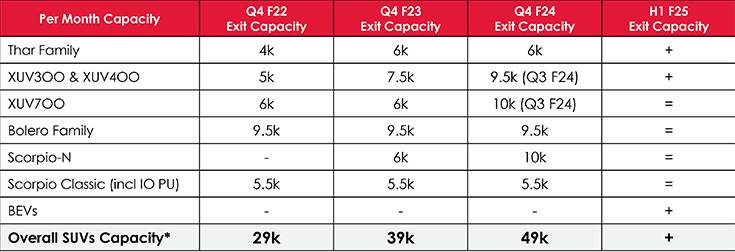

Given this scenario, M&M has announced an aggressive manufacturing capacity expansion programme, designed to increase production by 68% to over 600,000 units per annum over the next 12-15 months. This will see the monthly output grow from 29,000 units in Q4 FY2022 to 49,000 units by January-March 2024 (Q4 FY2024).

Aggressive capacity expansion plan

Aggressive capacity expansion plan

M&M, which is among the carmakers which have been impacted by the semiconductor supply chain issues, is clearly putting its shoulder to the wheel to reduce the substantial waiting periods for these popular models. The aggressive capacity expansion is with a view to cater to continued robust demand for new products, clear the sizeable number of existing bookings, reduce the waiting period for new launches and also get future-ready for EV manufacturing.

As the detailed production ramp-up data chart (below) reveals, all the five models which currently are witnessing long waiting periods will see a marked rise in their total number of units rolling out from Mahindra plants.

Launched on July 30, new Scorpio N set a new record for customer bookings: within 30 minutes of online bookings opening, the all-new SUV received 100,000 bookings within just 30 minutes – that’s 3,333 bookings in every minute! And the first 25,000 bookings, at the introductory pricing of Rs 11.99 lakh for the entry-level petrol MT Z2 variant through to the top-end Z8L diesel Automatic at Rs 21. 45 lakh, came within the first minute. M&M said this translates into an ex-showroom value of around Rs 18,000 crore or US$ 2.3 billion.

This huge customer interest and demand has meant that the Scorpio N (along with the Classic), is the No. 1 model on the pending-order chart with 130,000 units.

While M&M is not increasing the monthly output for the Scorpio Classic from the existing 5,500 units a month, the huge demand for the Scorpio N means that the company plans to roll out 6,000 units a month from Q4 FY2023 and by 67% to 10,000 units by fourth quarter of FY2024.

While the Thar’s production will increase from the existing 4,000 units a month to 6,000 units by Q4 FY2023, the XUV300 and the all-electric XUV400 (whose deliveries are to be begin in January 2023) will see their combined production rise from 5,000 units at present to 7,500 units in Q4 FY2023 and further to 9,500 units in October-December 2023 (Q3 FY2024).

Flagship XUV700’s existing 6,000-units-a-month capacity will remain unchanged until Q3 FY2024 when it will grow by 67% to 10,000 units per month.

What is giving a fillip to demand for Mahindra SUVs is their strong performance at Global NCAP crash tests. While the XUV700 and the XUV300 have aced the stringent Global NCAP test with 5-star ratings and have also won GNCAP’s ‘Safer Car’ award, the Thar has received a 4-star crash test rating.

Capitalising on the SUV boom

India, in line with global trends, is witnessing a surging wave of demand for SUVs, with one out of two passenger vehicles currently sold being a utility vehicle. The UV-portfolio-strong Mahindra is doing all to capitalise on that.

On the back of a strong performance in FY2022 when it sold 225,895 units, up 44% (FY2021: 157,215) and grew its PV market share to 7.36% and UV share to 15%, M&M continues to record strong growth in the ongoing fiscal.

In the April-October 2022, the company reported wholesales of 199,278 UVs, a 78% jump over the 112,080 units sold in the year-ago period. Sales in festive October were 32,226 units, up 61% YoY.

Thanks to the overall demand for SUVs, the passenger vehicle market is recording strong double-digit growth. As per the April-October 2022 wholesales numbers released by apex industry body SIAM today, over 1.12 million UVs have been sold, accounting for over 50% of the PV market and up from 47% a year ago. It is just this continued wave of demand for SUVs that Mahindra and some of its rivals aim to tap in the near future and beyond.