Private equity (PE) and venture capital (VC) investors continue to bet big on India Auto Inc, particularly drawn by the huge potential of the electric vehicle (EV) industry.

As per data sourced from Venture Intelligence, in the first 10 months of CY2022 (January-October), PEs and VCs have invested around $1.087 billion (Rs 8,968 crore) across 27 deals in the Indian automotive sector. Of this, around $982 million or 90% is in EV-specific industry (pureplay EV OEMs like Ola Electric, Ather Energy) while around $184 million (Rs 1,518 crore) has gone to the auto component industry, which includes EV parts makers (see table at the bottom of this feature).

Arun Natarajan, founder, Venture Intelligence says as a result of proactive, EV-friendly Central and state government policies, PEs and VCs are bullish on investments related to the EV sector.

While big-ticket investors in the form of Sovereign Wealth Funds (SWFs) like GIC, ADQ, Mubadala and India’s NIIF and DFIs (BII and ADB among others) are betting big on the OEM segment, there are plenty of downstream opportunities emerging for VC- and SME-focused investors in segments like battery charging stations and swapping network, battery technology innovation, related software and also specialised financing.

According to Natarajan, new funds being raised with climate technologies and ESG as key focus areas are likely to bring more capital to the sector.

Strong numbers tell the growth story

At 277,910 units, sales of electric two-wheelers during April-September 2022 are a 404% increase over H1 FY2022’s 55,147 units. While the electric passenger vehicle (ePV) sector’s numbers are nowhere near that volume given their substantially higher pricing, the fact is that demand is on the rise. Cumulative ePV retails in the first six months of FY2023 have crossed 18,000 units. At 18,142 units, this sub-segment of the EV industry has registered a 268% year-on-year growth (H1 FY2022: 4,932 units). During the second quarter of FY2023’s (July-September 2022) 10,015 units are a 23% increase on Q1’s (April-June) 8,127 units.

Retail data for three-wheeler sales reflects the same strong growth trajectory. In Q1 FY2023 (April-June 2022), a total of 72,405 electric three-wheelers were sold, constituting 416% YoY growth (April-June 2021: 4,016 units). Return on investment in e-three-wheelers is faster given the longer running when ferrying passengers or for last-mile deliveries while catering to the e-commerce boom.

India EV Inc to attract $20 billion investment by 2030

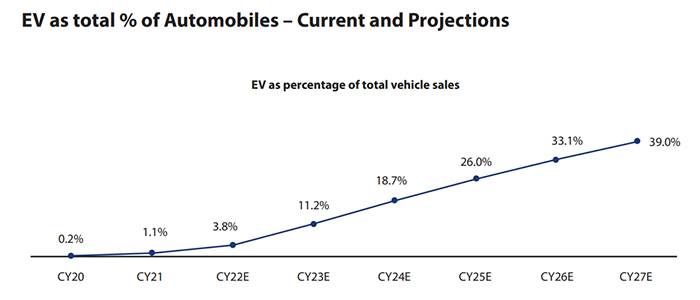

In July this year, the Indian Private Equity & Venture Capital Association (IVCA) released a report titled ‘Electrifying Indian Mobility’. A collaborative effort between IVCA, EY and IndusLaw, it states that the EV industry has attracted around $6 billion (overall) in 2021 and is expected to gain $20 billion by 2030. The report also adds that EV sales in India are slated to cross 9 million units by 2027. In CY2021, EVs accounted for 1.1% of total vehicle sales in India. They are expected to account for 39% of total automotive sales by CY2027 growing at a ~68% CAGR over the next five years. The bulk of the growth in EVs is expected to come from the travel segment, especially two- and three-wheelers – the low-hanging fruit of the Indian EV industry – due to their fixed duty cycle and companies (e-commerce, groceries, shops) committing to going completely electric in their last-mile deliveries.

In CY2021, EVs accounted for 1.1% of total vehicle sales in India. They are expected to account for 39% of total automotive sales by CY2027 growing at a ~68% CAGR over the next five years. The bulk of the growth in EVs is expected to come from the travel segment, especially two- and three-wheelers – the low-hanging fruit of the Indian EV industry – due to their fixed duty cycle and companies (e-commerce, groceries, shops) committing to going completely electric in their last-mile deliveries.

Yes, the sector has challenges in the form of high initial vehicle cost and lack of charging infrastructure but industry and the government are working on solutions. While OEMs and their suppliers are looking to optimise costs and in turn reduce EV sticker prices, the government as well as the private sector are upping the ante on the EV charging infrastructure front. At present, there are an estimated 1,800 charging stations in the country. By 2027, this number is expected to increase to over 100,000 stations to cater to demand from around 1.4 million EVs that are expected to ply on Indian roads at the time.

Yes, the sector has challenges in the form of high initial vehicle cost and lack of charging infrastructure but industry and the government are working on solutions. While OEMs and their suppliers are looking to optimise costs and in turn reduce EV sticker prices, the government as well as the private sector are upping the ante on the EV charging infrastructure front. At present, there are an estimated 1,800 charging stations in the country. By 2027, this number is expected to increase to over 100,000 stations to cater to demand from around 1.4 million EVs that are expected to ply on Indian roads at the time.

There are a number of tailwinds charging the India EV growth story: high petrol, diesel and CNG prices, greater awareness among consumers of the benefits of e-mobility, expected economies of scale to drive down vehicle costs, simplification of the fundraising process for industry and the sheer size and potential of the domestic market. What’s not to like for PE and VC investors?

All illustrations courtesy: IVCA report on ‘Electrifying Indian Mobility’