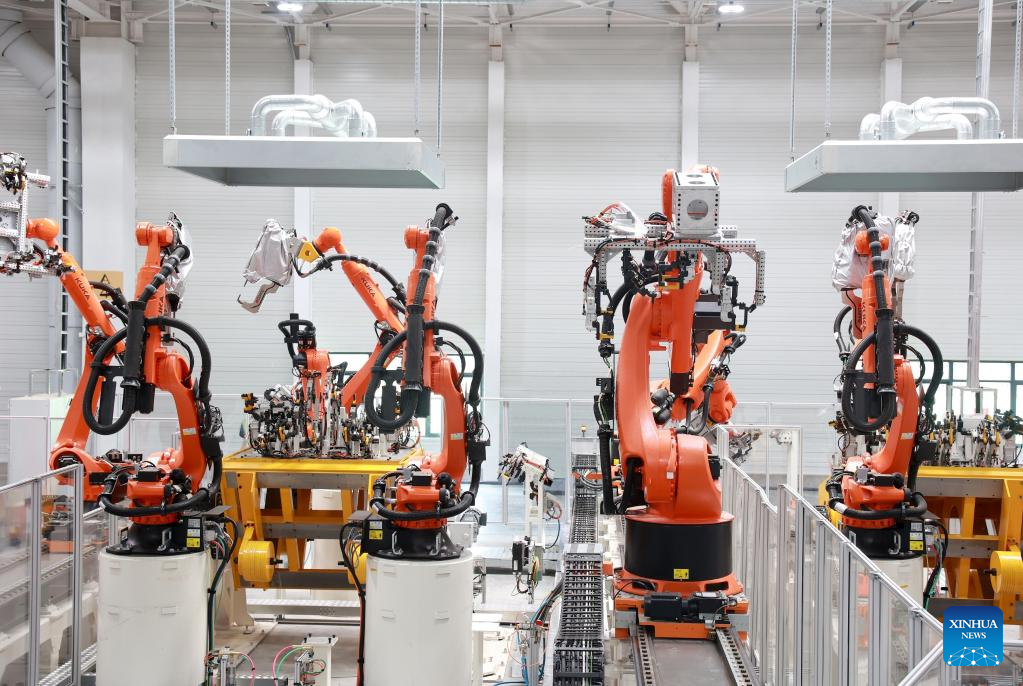

This photo taken on July 4, 2022 shows a workshop of the Volkswagen Anhui MEB (Modular Electric Drive Matrix) plant under construction in East China’s Anhui province. [Photo/Xinhua]

HEFEI – China’s new energy vehicle sector remains a strong magnet for foreign investment despite the world grappling with the effects of the pandemic, thanks to the country’s super-large market, high-level opening-up, and improved business environment.

“China is the world’s largest NEV market that cannot be neglected by international carmakers,” said Erwin Gabardi, CEO of Volkswagen Anhui, a joint venture in which the German automaker has a 75 percent stake, in East China.

Covering an area of about 16 football fields, the body shop of Volkswagen Anhui’s MEB plant in the provincial capital of Hefei is equipped with over 800 robots and will be able to produce six types of NEVs at the same time upon completion.

Gabardi said the mass production of electric vehicles at Volkswagen Anhui is scheduled to start at the end of next year.

Adjacent to Volkswagen Anhui MEB plant, an industrial park for batteries and components is under construction, and 17 of Volkswagen Anhui partners have already moved in.

“We have strong cooperation with the Hefei-based press shop supplier,” said Gabardi, adding that Volkswagen Group has invested in a Hefei-based battery manufacturer and integrated Anhui-based suppliers into the global supplier network of the German automaker.

China’s NEV market is in the spotlight of the global automobile industry. Official data shows that the country’s NEV output and sales have ranked first globally for seven consecutive years since 2015. Dividends including the super-large market and high-level opening-up have attracted foreign automakers to double down on investment in the country.

In 2018, China removed restrictions on foreign investment in NEVs. Shortly afterward, Tesla established China’s first wholly foreign-owned car manufacturing enterprise in Shanghai. It started construction in early 2019 and delivered its first batch of made-in-China vehicles within a year.

Since the beginning of this year, global auto companies including Audi, BMW and Volkswagen have accelerated their expansion in China, launching a number of large NEV and other projects.

The Audi FAW NEV project, with an investment of over 30 billion yuan ($4.25 billion), broke ground on June 28 in Changchun, Jilin province. This is Audi’s first production base for purely electric vehicles in China and is expected to start operation at the end of 2024, with a planned annual production capacity of 150,000 vehicles.

BMW Group’s joint venture in China, BMW Brilliance Automotive Ltd. (BBA), will invest 10 billion yuan into a new battery production project in Northeast China’s Liaoning province. The signing ceremony of the project was held last week in Shenyang, capital of Liaoning.

China’s NEV market saw a remarkable expansion in October. The output of NEVs in the country reached 762,000 units last month, up 87.6 percent year-on-year, while the sales of NEVs rose 81.7 percent from a year earlier to 714,000 units.

Industry insiders believe that favorable market policies will continue to boost the NEV market. China announced that the purchase tax exemption for NEVs will be extended to the end of 2023. This marks the third extension since the country first implemented the policy in 2014.

“We are continuing to develop our R&D team, adjust our R&D strategy and innovate products exclusively for Chinese customers to suit the consumption preferences of the Chinese market,” Gabardi said.

China’s unlocked market potential, wider opening up and deepening cooperation under the new development paradigm will offer more development opportunities to the world, said Zhang Bingli, professor at the School of Automotive and Transportation Engineering, Hefei University of Technology.