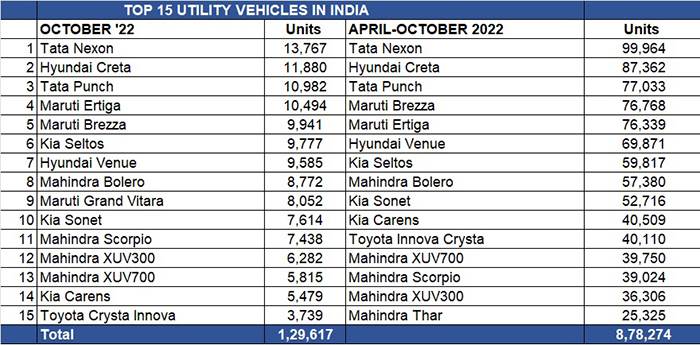

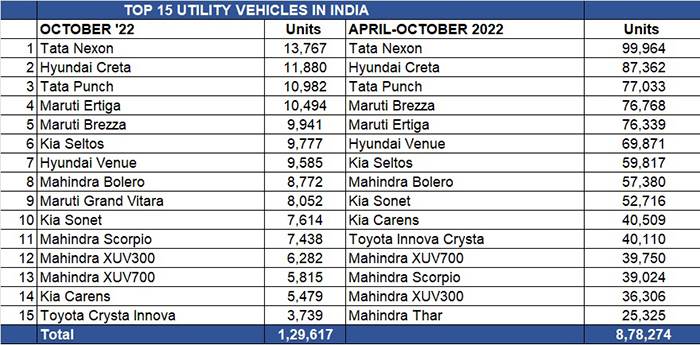

Top 15 UVs: Tata Nexon leads, five Mahindra models among best-sellers in April-October

The utility vehicle (UV) segment the world over is the prime mover of passenger vehicle growth and it is no different in India. Utility vehicles sales in India have raced past the one-million mark in the first seven months of FY2023 (April-October 2022) – the fastest ever, compared to 10 months in FY2022 and 12 months in FY2021. Of the 11,52,952 UVs sold (up 46% YoY), 15 models have contributed no less than 76%, which marks them as the movers and shaker of the segment whose sales show no signs of slowing down.

Mahindra muscles in

Mahindra muscles in

The surging demand for SUVs means that OEMs with UV-strong portfolios and popular models have seen robust growth as well as gained market share. UV market leader Tata Motors with an estimated 210,743 units has an 18.27% share while Mahindra with 199,278 units has a 17.28% share. While Tata Motors has its Nexon and Punch in the Top 15 list, M&M has no less than five models – Bolero, XUV700, Scorpio, XUV300 and the Thar – which are part of the company’s 260,000-units order backlog at the beginning of November.

While Kia India has three models (Seltos, Sonet, Carens), Hyundai India (Creta, Venue) and Maruti Suzuki (Brezza, Ertiga) have two each. Toyota Kirloskar Motor has the popular Innova Crysta MPV among the best-sellers.

Though Tata Motors leads the table by virtue of the Nexon’s performance, in terms of cumulative model-wise sales in the Top 15, Mahindra’s five-pack tops with 197,785 units, followed by the Tata duo (176,997 units), Hyundai (157,233 units), Maruti Suzuki (153,107 units), Kia (153,042 units) and Toyota (40,110 units.

OEM sales in Top 15 UVs

Mahindra: 197,785

Tata Motors: 176,997

Hyundai: 157,233

Maruti: 153,107’

Kia: 153,042

Toyota: 40,110

Total: 878,274

In terms of models, the Tata Nexon rules the roost – both at No. 1 position in October and also for the April-October 2022 period. It had lost the No. 1 position, albeit temporarily in September to the Maruti Brezza but has bounced back with 13,767 units last month, taking its seven-month total to just 36 units short of the 100,000 mark.

The Hyundai Creta maintains its No. 2 position both for October (11,880 units) as well as April-October 2022 (87,362 units). With Tata Motors eyeing its No. 2 position in the overall PV segment and well set to surpass sales of 500,000 units in FY2023, Hyundai Motor India has begun a manufacturing capacity expansion programme designed to take it to 850,000 units per annum. This is to be achieved through further automating of processes, removing existing bottlenecks and improving supply chain operations.

The Tata Punch is punching above its weight and has averaged monthly sales of 11,004 units in the April-October 2022 period. This strong performance takes it to No. 3 position, ahead of the Maruti Brezza and Maruti Ertiga.

Small is big in India’s SUV market

Within the overall UV market, the compact SUV sub-segment rules the roost. Of the Top 15 models, six are compact SUVs – Tata Nexon and Punch, Maruti Brezza, Hyundai Venue, Kia Sonet and Mahindra XUV300. There are also six midsize models – Hyundai Creta, Kia Seltos, Mahindra Bolero, XUV700, Scorpio and Thar. The Maruti Ertiga, Kia Carens and Toyota Innova Crysta are the three MPVs in the best-selling UVs chart. And interestingly, the recently-launched Kia Carens with 40,509 units has gone ahead of the Toyota Innova Crysta (40,110 units).

Number-crunching reveals that the six compact SUVs with cumulative 412,658 units have a 47% share of the Top 15 UV table (see data table below). The growing demand for midsize models is also seen in their 35% contribution – 308,658 units – while the three MPVs with 156,958 units make up the balance 18 percent.

Segment-wise split

Compact UVs: 412,658

Midsize UVs: 308,658

MPVs: 156,958

Total: 878,274

UV sales in India could hit 2 million units in FY2023

With much-improved semiconductor supplies, ramped up production and sustained consumer demand, UV sales can only go up. With five months left in FY2023, this sub-segment of the PV industry, which accounts for a 50% share, could be headed for 2 million sales this fiscal.

At 11,52,972 units, the first seven months of UV sales make up already 77% of FY2022’s 14,89,178 units. Each day of the past seven months (cumulatively, 214 days) has seen around 5,388 UVs being sold in India. With the current momentum amid the surging wave of demand and a flurry of new models in the market, the 2-million-units milestone could be in sight – at this stage, the UV industry is 847,028 units short of that big number.

New models are upping the ante for the segment. While Toyota India has launched the Urban Cruiser Hyryder in a CNG avatar earlier this month, BYD India has priced the all-electric Atto 3 at Rs 33.99 lakh . On November 25, Toyota will launch the much-awaited Innova Hycross, while the MG Hector facelift is also slated to roll out. The Mahindra XUV400, which will be open for test drives from December and get officially launched in January 2023, will be the first proper rival to the high-selling Tata Nexon EV.

* Estimated April-October wholesales for data table

ALSO READ

Tata Nexon sales in India surpass 400,000-unit milestone

India’s top five Global NCAP five-star-rated cars sell over 900,000 units

India auto retails soar 48% in festive October, all vehicle segments register double-digit growth