A majority of family offices in the Asia Pacific (APAC) are looking at increasing their exposure to private assets such as private equity and venture capital, according to The Asia Pacific Family Office Report 2022 by Hong Kong-based Raffles Family Office and Campden Wealth.

As these investors seek new investment opportunities to offset the impact of a volatile market, 57% and 50% of them intend to up their private equity and venture capital investments, respectively, the survey report shows.

With 83% of APAC family offices investing in private equity, which improved from 80% last year, private equity has become the second largest asset class comprising 23% of their AUM on average.

Public equities still represent the largest bucket of investment or 32% of APAC family offices’ AUM.

In terms of venture capital and technology, the report indicates that green tech, digital transformation, artificial intelligence, biotech, and healthcare are the most promising segments for future investment.

“Starting from a low base, private equity is becoming a more popular asset class for Indian family offices. A few years ago, it was only 1 or 2% of the portfolio. For our family office, it’s now up to 10%. There is more going on in private equity now and cash is being returned from older investments,” the report cited a head of a single-family office and family member in India.

When it comes to returns, however, APAC family offices reaped less than their European and North American counterparts in 2021. The estimated average investment return for APAC family offices for the year was 10% compared to 15% a year earlier, while family offices in Europe and North America achieved 13% and 15%, respectively. The Western markets benefited from surging US stock market valuations and buoyant exit activity during the period, the report said.

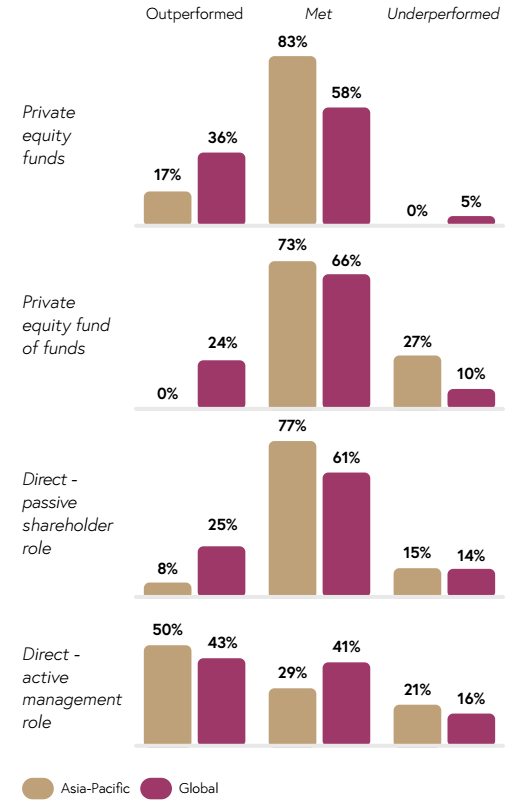

The number of APAC family offices reporting outperformance across private equity strategies was also much lower than in other regions, except for direct active investment where APAC family offices take an active role in advising and mentoring management and giving them access to the family network.

At the same time, the report suggests that several family offices in the region are not so keen on private equity.

“There are two factors that count against private equity as far as families are concerned. First, it’s still possible to make good money in public markets – at least until quite recently. Second, private equity is something of a black hole. You never know when you will get your money back. It could be an eight- or nine-year wait, and that could impact a family’s lifestyle,” another head of a single-family office and family member in India was quoted as saying.

A CEO of an Australian multi-family office said in the report that private equity funds will typically only work with extremely low-interest rates “so that excessive gearing enables them to earn sufficient returns.”

Family offices in APAC collectively hold $94 billion in wealth, which accounts for around 13.4% of the estimated global family offices’ total wealth. In terms of assets under management, the figure for family offices across APAC stands at $45 billion, compared to $390 billion worldwide.

Cautious outlook

Driven by fear of continued inflation risks, 69% of senior APAC family office executives surveyed by the report have a negative economic outlook for next year. Specifically, 88% of the family offices in this region have identified inflation as the biggest threat.

APAC family offices are still holding a more conservative approach to investment than their peers. Twenty-eight per cent of them see wealth preservation as their primary objective, compared to 22% in Europe and just 10% in North America. The percentage of APAC family offices operating a growth strategy (30%) is also lower than elsewhere, the report shows.

However, 46% of APAC family offices believe that in 10 years, they will be operating a growth strategy, while the percentage with wealth preservation as their objective will be down to 10%.