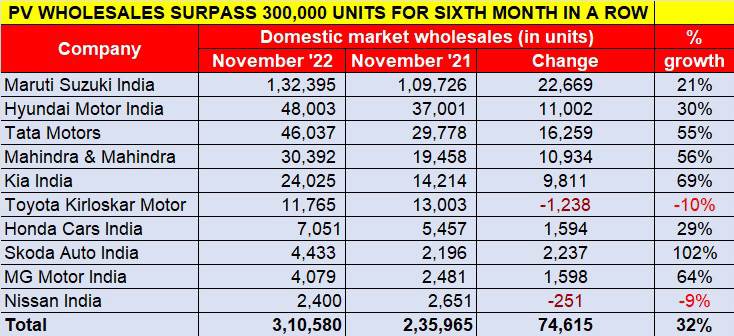

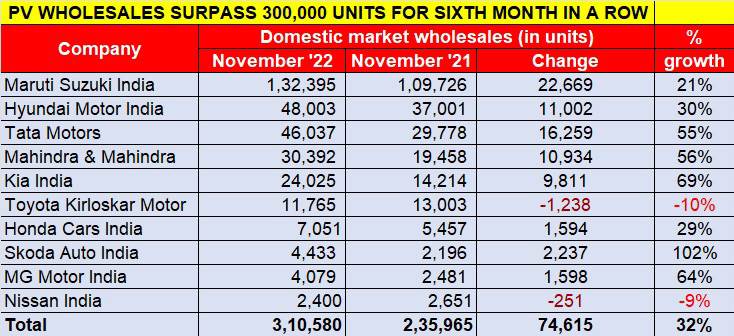

There’s no stopping the Indian passenger vehicle juggernaut. With 10 out of 16 OEMs announcing their November wholesales, which add up to 310,580 units (up 32%), this is the sixth month in a row that numbers have driven past the 300,000-unit count. Once SIAM officially releases the PV industry data later this month, it is expected the total would be around the 325,000-unit mark.

What has helped fuel as well as sustain the high growth rate is improved factory production at the leading OEMs as a result of better supplies of semiconductors. What’s more, the combined backlog of just three leading players – Maruti Suzuki, Mahindra & Mahindra and Tata Motors – adds up to 750,000 units, all of them for popular models.

SALES IN FIRST 8 MONTHS OF FY2023

April 2022: 293,168

May 2022: 294,393

June 2022: 320,985

July 2022: 341,370

Aug 2022: 328,376

Sep 2022: 355,043

Oct 2022: 336,330

Nov 2022: 325,000*

Total: 2,594,665 units

*Estimated

The top six players – Maruti Suzuki, Hyundai, Tata Motors, Mahindra & Mahindra, Kia India and Toyota Kirloskar Motor – together account for 292,617 units or 94% of total sales in November, of which PV market leader has a 42% share (see OEM sales data table at the end of this analysis).

Let’s take a closer look at how the carmakers fared last month.

Maruti Suzuki India – 132,395 units / 21% YoY

With India’s PV market firing on all cylinders, it’s not surprising that the market leader is also making the most of the positive market sentiment. It reported wholesales of 132,395 units in November 2022, a 21% YoY increase. For the April-November 2022 period, cumulative sales have crossed a million units – at 1,067,282 units, they are up 31% over year-ago sales (April-November 2021: 811,809 units).

What augurs well for Maruti Suzuki is that sales across all sub-segments are in positive territory, other than for the Eeco van last month albeit on the cumulative sales front, it is in the black.

The entry level cars – the Alto and S-Presso – saw marginal 4% growth in November at 18,251 units but see 16% growth in April-November 2022 at 164,243 units. With demand returning to the entry-level hatchback market, Maruti Suzuki launched the CNG variant of the third-generation Alto K10, priced at Rs 595,000, on November 19.

Maruti Suzuki’s six-pack comprising the Baleno, Celerio, Dzire (and Tour S), Ignis, Swift and Wagon R have posted 28% growth last month with 72,844 units (November 2021: 57,019).

The UVs – new Brezza, Ertiga, XL6 and the new Grand Vitara – contributed 32,563 units, up 33% on year-ago 24,574 units. Maruti Suzuki is currently seeing strong demand for the recently launched Grand Vitara and the new Brezza.

The premium Ciaz sedan saw demand rev up 43% to 1,554 units in November, contributing to the cumulative April-November 2022 total of 10,364 units, up 12% YoY.

The company, which has an estimated order backlog of a little over 400,000 units, is currently operating at 90% manufacturing capacity. It is also driving home the CNG market advantage, having recently expanded its CNG portfolio to the premium Nexa channel with the Baleno – the best-selling Nexa model – and the XL6 getting the S-CNG factory-fitted treatment too. Maruti Suzuki now has all of 12 models with a CNG option.

Hyundai Motor India – 48,003 units / 30% YoY

Hyundai Motor India’s 48,003 units constitute year-on-year growth of 30% (November 2021: 37,001 units). Cumulative sales for the first eight months of FY2023 at 381,009 units are a 20.37% growth over year-ago numbers (April-November 2021: 316,516). Seen from a calendar-year perspective, cumulative numbers – 513,681 units – for the first 11 months of 2022 point to single-digit growth (January-November 2021: 472,721 units).

This company has crossed the half-a-million-units sales milestone and with December numbers yet to be counted in, it is headed for its best-ever annual sales yet in India.

Commenting on November 2022 sales, Tarun Garg, Director (Sales, Marketing & Service), Hyundai Motor India said, “This year we have seen a sustained recovery and growth in demand for our cars. On the back of a strong festive season, we have achieved high double-digit growth in domestic sales in the last couple of months when compared to the same period last year. With the launch of three new SUVs in 2022 and strong demand for models like the Creta, Venue, Grand i10 Nios and Aura, we are well poised to achieve the highest ever domestic sales in 2022 since our inception in India.”

Tata Motors – 46,037 units / 30% YoY

Tata Motors, which continues to record strong double-digit growth in its domestic market passenger vehicle operations, has reported sale of 46,037 units in November 2022, just 1,966 units behind No. 2 player Hyundai. This constitutes 55% year-on-year growth and is 16,259 units more than 29,778 units the carmaker had sold in November 2021.

Viewed from the April-November 2022 cumulative sales perspective, Tata Motors has sold a total of 363,704 units – a 71% YoY increase (April-November 2021: 212,022 units) – which translates into average monthly sales of 45,463 units. What’s more, this total in the first eight months of the ongoing fiscal is already 97% of the company’s best-ever sales of 373,138 units in FY2022. At present, it is just 9,434 units shy of that total, which will be crossed in the first week of December.

The EV advantage

Where Tata Motors has a strong advantage over its PV rivals is with its EV portfolio. At present, it has three models – the Nexon EV, Tigor EV and the fleet-only XPres-T EV. The Tiago EV, which takes the electric vehicle mantra to the mass-market, will enter the market in January 2023.

The company, which has targeted production and sale of over 500,000 PVs, including 50,000 EVs in FY2023, is well on track towards achieving its goal. With four months left in the ongoing fiscal, Tata Motors is 136,296 units away from that target. The estimated model split for the cumulative sales is 334,765 IC engine cars and 28,939 EVs.

Tata Motors’ strong and sustained performance also means it is hard on the heels of No. 2 PV player, Hyundai Motor India. At this stage in the fiscal, Tata is 17,305 units behind Hyundai’s cumulative April-November 2022 sales of 381,009 units.

Mahindra & Mahindra – 30,392 units / 56% YoY

Mahindra & Mahindra, which is among the OEMs making a speedy ride on the surging wave of demand for SUVs in India, sold 30,238 SUVs in November 2022, up 56% (November 2021: 19,384). The company also sold 154 e-Veritos, which augments the November total to 30,392 units, also up 56% year on year.

For the April-November 2022 period, cumulative SUV sales are 229,516 units, up 75% over the 131,434 units sold in the year-ago period. With this, M&M has driven past FY2022’s SUV sales of 223,682 units, with four months still to go in the fiscal. Its previous best was 235,362 SUVs in FY2019, which will be surpassed this December.

The company, on November 1, had an order bank of 260,000 units, essentially comprising five models led by the recently-launched Scorpio N and Scorpio Classic (130,000 units), XUV700 (80,000 units), Thar (20,000 units), Bolero and Bolero Neo (13,000 units) and the XUV300 (13,000 units).

Given this scenario, M&M has announced an aggressive manufacturing capacity expansion programme, designed to increase production by 68% to over 600,000 units per annum over the next 12-15 months. This will see the monthly output grow from 29,000 units in Q4 FY2022 to 49,000 units by January-March 2024 (Q4 FY2024).

Commenting on November 2022’s sales, Veejay Nakra, President, Automotive Division, M&M, “Our sales volume continued to grow in November powered by robust demand across our portfolio. We sold 30,238 SUVs in November, registering a growth of 56%. The supply chain situation continues to be dynamic due to continuing international disruptions. We are keeping a close watch and are taking appropriate steps.”

Kia India – 24,025 units / 69% YoY

Kia India clocked wholesales of 24,025 units, a YoY growth of 69% (November 3032: 14,214). Its mainstay – the Seltos – led the sales chart with 9,284 units, followed by the Sonet compact SUV (7,834), and the Carens (6,360) and Carnival (419) MPVs. The company also delivered 128 units of the premium EV6 electric car, taking total EV6 deliveries to 296 units

Hardeep Singh Brar, Vice-President and Head of Sales & Marketing, Kia India said, “We are glad to post healthy sales figures throughout this year due to improved customer sentiment and pent-up demand. The commencement of the third shift at our state-of-the-art Anantapur plant earlier this year and gradually improving supply chain has also helped us streamline the delivery period and meet our customers’ expectations. However, we will remain observant of dynamic market conditions.”

Toyota Kirloskar Motor – 11,765 units / -10% YoY

Toyota Kirloskar Motor has reported wholesales of 11,765 units in November 2022, which is a 10% decline on November 2021’s 13,003 units.

In the first eight months of the fiscal year, the Bengaluru-based automaker has clocked cumulative sales of 116,262 units, which constitutes 46% year-on-year growth (April-November 2021: 79,725 units). For the first 11 months of CY2022, Toyota Kirloskar Motor has cumulative sales of 149,422 units, up 25% YoY (January-November 2021: 119,917 units).

Atul Sood, Associate Vice-President, Sales and Strategic Marketing, TKM said, “We began last month with demand soaring and positive sentiments building towards the unveil of the all- new Innova HyCross. The Urban Cruiser Hyryder too has been receiving good traction from the market.”

Honda, MG and Skoda make solid gains too

Of the remaining OEMs, nearly all have benefited from the much-improved market sentiment as well as the festive season. Honda Cars India sold 7,051 units, up 29%, with the Amaze sedan maintaining its status as the best-seller. MG Motor India reported retail sales of 4,079units, a growth of 64%.

Skoda Auto India continues to reap market dividends from its new products – the Kushaq SUV and Slavia sedan. At 4,433 units, November 2022 numbers are a 102% YoY growth (November 2021: 2,196 units).

This strong performance, ensures that the Czech carmaker’s sales in the year to date have risen by 137% YoY. In the first 11 months of 2022, Skoda has sold a total of 48,933 units (January-November 2021: 20,624), which is over and above the total calendar year 2021 sales of 23,858 units. Given the sales momentum, the company should easily cross its 50,000-units sales target for CY2022. India is now Skoda’s third largest market globally and the company is driving new initiatives to further its growth. These include expanding its retail network by 26% from 175 in December 2021 to over 220 as on date.

Growth outlook: Driving at record 3.8 million sales in FY2023

The sustained level of OEM despatches in November 2022 to feed dealer and in turn customer demand is good news for Indian carmakers as also the overall industry as the benefits percolate to several ancillary sectors. Despite inflationary trends and rising interest costs, the PV market has set the pace for India Auto Inc.

The growth outlook for the PV industry is very promising. With much-improved supplies of semiconductors, a good number of new models particularly in the booming SUV market, the stock market scaling a new high and strong customer sentiment mean demand should sustain in strong double-digits.

The surging demand for SUVs, which now account for nearly one out of every two cars sold in India, is reflected in the new charge in the PV market. All OEMs, with a strong and fresh SUV product portfolio are firing on all cylinders. While the compact SUV segment remains high on the consumer radar, the growing demand for midsize SUVs is apparent. Meanwhile, there is also a smart uptick for executive sedans.

The electric vehicle segment will also be adding to the growth curve, particularly from January 2023 when the Mahindra XUV400, the first real rival to the EV leader Tata Nexon, will be released. The month will also see the rollout of the Tata Tiago EV as well as the premium Byd Atto 3 SUV.

With cumulative sales of 2,594,665 units in the first eight months of the ongoing fiscal, India PV Inc is cruising towards record sales of around 3.8 million units. India PV Inc’s best-ever sales in a fiscal were in FY2019 when it clocked 3.37 million units – 33,77,436 units. This big number is now around 750,000 units away which looks achievable with four months left to go till end-March 2023. And given the surging demand for SUVs, which now account for every second car sold in India, half of that or nearly two million units could comprise utility vehicles.

Clearly, it’s an exciting time out there in India’s booming passenger vehicle market. Keep watching this space