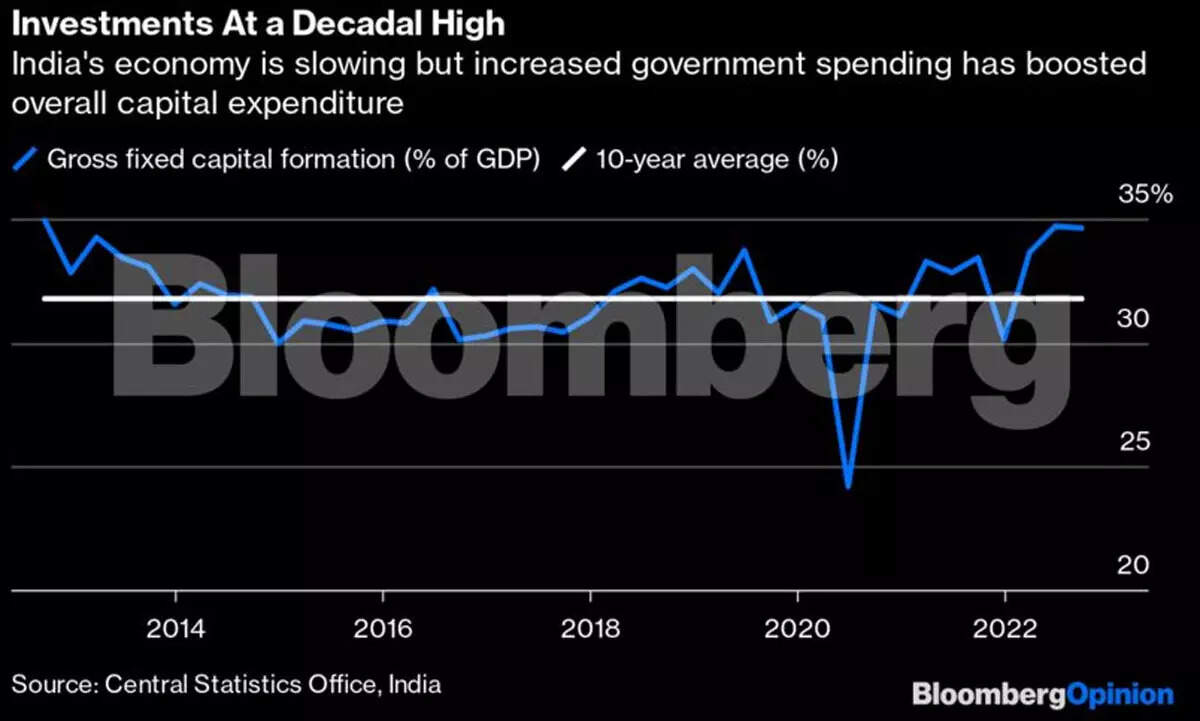

It’s not immediately obvious that the global slowdown has also arrived in India: Investments in factories, roads, and other fixed assets are just shy of 35% of domestic output; they haven’t been this high in 10 years. Loan demand is growing so fast that deposits can’t keep up.

What’s driving India’s animal spirits amid a worldwide malaise? Some of it is a result of the economy reopening fully. Contact-based services like travel and hospitality came back sharply from their pandemic funk in the first half of the year, fueling optimism. The other oft-cited reason is what multinational corporations refer to as their “China+1” strategy.

Global manufacturers have taken note of the violent protests by locked-down workers at Apple Inc.’s most important iPhone assembly plant in China. Their search for risk mitigation is bringing them to the second-most-populous nation, which is offering generous subsidies for making everything from semiconductors and solar panels to electric-vehicle batteries and textiles. It’s a compelling combination of push and pull.

But China+1 is not going to be of much help in averting a near-term economic slowdown. For one thing, the ramp-up in capital expenditure has been driven by the federal government. Persistent above-target inflation gave it extra tax resources, and it pumped them into infrastructure. The private sector followed suit, even though it faced a margin squeeze from not being able to fully pass on higher costs to consumers. India’s banks, eager to bulk up their post-pandemic asset books, have been more than willing to help firms tide over their cash-flow crunch. As a result, the combined capital expenditure by the federal and state governments as well as large publicly traded companies this fiscal year may exceed 21 trillion rupees ($258 billion), double the annual investment rate between 2016 and 2018, according to ICICI Securities.

There’s a flipside to this happy story, though. Now that the pent-up consumption from the pandemic is exhausted, the double whammy of high inflation and indirect taxes — the source of buoyant government revenues — is starting to pinch average- and low-income households.

Nomura’s consumption tracker fell from 11 percentage points above its pre-pandemic reading in the June quarter to below that level in October. It’s hard to see 2023 as a great year for the urban middle-class as global tech-industry layoffs affect jobs and capital availability for startups. Rural demand is anyway sluggish, according to consumer-goods companies.

“We believe India’s growth rate cycle has peaked and a broad-based slowdown is under way,” Nomura analysts wrote last week after gross domestic product expanded 6.3% in the September quarter, less than half the rate of growth in the previous three months. In their estimate, the full-year rate at the eve of India’s general election in the summer of 2024 may be 5.2%.

Leaving out the pandemic years, that will be the nation’s second-worst rate of economic growth in more than a decade. It will put question marks around Prime Minister Narendra Modi’s expensive industrial policy push. The country needs more public spending to narrow the severe learning deficits in students caused by Covid-19, fill large gaps in public health care, and tackle climate change.

Those challenges are immediate, whereas the supply chains India is hoping to set up from scratch by throwing subsidies at investors — and offering them the protection of high tariff barriers — are a long-term gamble. Only 15% of the $33 billion in private investment approved by the government under its production-linked incentive program has fructified so far; fewer than 200,000 jobs were created as of September, compared with expectations of around 6 million, according to official data cited in an article on Quint, a news website.

Even if the West’s estrangement with China deepens, or if the much-anticipated end to President Xi Jinping’s Covid-19 policies gets postponed, there’s nothing to suggest that private investment will do much heavy lifting for India next year.

That’s also because exports are starting to slow down for most Asian suppliers: Shipments out of India hit a 20-month low in October. The recent GDP data shows clear signs of the country’s industrial sector losing momentum. The unemployment rate has risen to 8%.

The policy playbook for New Delhi appears rather thin. Yes, local interest rates will top out in early 2023, but not before taking the total tightening in the current cycle to over 2 percentage points. Financial conditions could become harsher still. If the war in Ukraine escalates — or if China suddenly drops its stringent virus controls — a shortage of commodities relative to demand could again flare up. That will crimp cash flows for Indian firms, sending more of them to seek external financing to meet their stretched working-capital needs. Banks, under pressure to raise deposit rates to shore up their liquidity position, may not be as accommodating of credit risk as they have been this year. If they are, they’ll only be storing up trouble for later.

The growth outlook for India next year is subdued. Just how tough it could get depends on how badly the global economy sputters. There will be long-term benefits from positioning India as an attractive second destination for producers trying to curb their China exposure.

But the wisdom of staking $24 billion of public funds over five years to accelerate a shift in global supply chains is bound to get questioned, especially if India in 2024 finds itself in the same low-growth rut that had propelled Modi to national power in 2014.