Singapore-based buy now, pay later (BNPL) startup Pace received $6 million this week in Series A funding from Vertex Ventures Southeast Asia & India, UOB Venture Management, Mindful Wealth and Taufiq Fuad.

The latest capital injection comes about a year after the company announced its $40 million Series A round. The firm has garnered $31.5 million in equity funding so far this year.

Pace, which was founded in January last year, previously announced that the company would utilise the Series A financing to expand into Taiwan, South Korea, and Japan. Its BNPL services are currently available in Singapore, Malaysia, Hong Kong, and Thailand.

Earlier in March, the Singapore-based firm declared that it had reached an agreement to acquire Rely, an older rival, for an unknown sum.

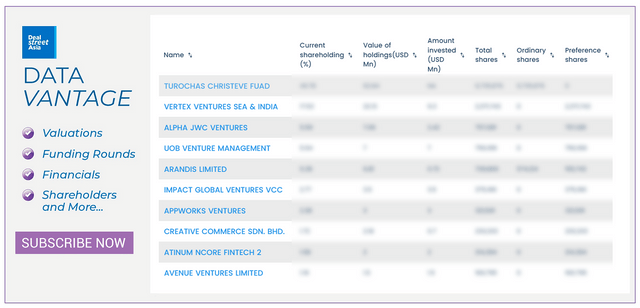

Top shareholders in Pace

Singapore-based shopping and rewards platform ShopBack received $30 million from Australia’s Westpac Banking Corporation this week in Series F funding.

The company’s shares were priced at $8.45 apiece in the latest transaction, down 7.1% from July this year, when it received $79 million from Asia Partners and January Capital. ShopBack had announced securing an $80 million investment from Temasek’s 65 Equity Partners in October, but its regulatory filings show it is yet to receive the equity funding.

Other updates from DATA VANTAGE

TipTip, a monetisation platform for content creators, received $13.1 million in the first week of December. It had announced the East Ventures-led Series A round in November.

East Ventures contributed $6.5 million to the round, while Vertex Ventures and SMDV invested $3 million each.

Delivery Hero injected another $1.2 million into Singapore-based restaurant tech startup TabSquare this week, bringing its total investment in the latter this year to $9.6 million.

Indian grocery delivery startup Zepto received $1.35 million from Razor Ventures last week as part of a $200 million round announced in May this year. The company has so far received $170 million in equity funding as part of the round.

Fintech company FinAccel, the parent of BNPL firm Kredivo, received $700,000 this week from FPL Holdings as part of its Series D funding round. The stakeholders in FPL Holdings include Anderson Point Consulting, Kalpesh Patel, Akshay Garg and Tuan Thet An Nguyen.

TAU Express, a Singapore-based AI-enabled data analytics firm, received $3 million in new funding last week. Founded in 2018 after a spinoff from Nanyang Technological University, the firm specialises in using AI to provide assistance for research and analysis of emerging threats in the cyber landscape.

Singapore-based venture capital firm Jungle Ventures invested $1.5 million in India-based edtech firm Dynamind.

OhMyHome, a startup providing proptech solutions for the Singapore market, saw a 35.5% year-on-year growth in revenue last year, allowing it to marginally reduce its net losses.

Edtech startup LittleLives registered a 26.1% growth in revenue in the year ended Dec 31, 2021.

StanPlus, a tech-enabled emergency response system company, posted a 73% growth in revenue last year.