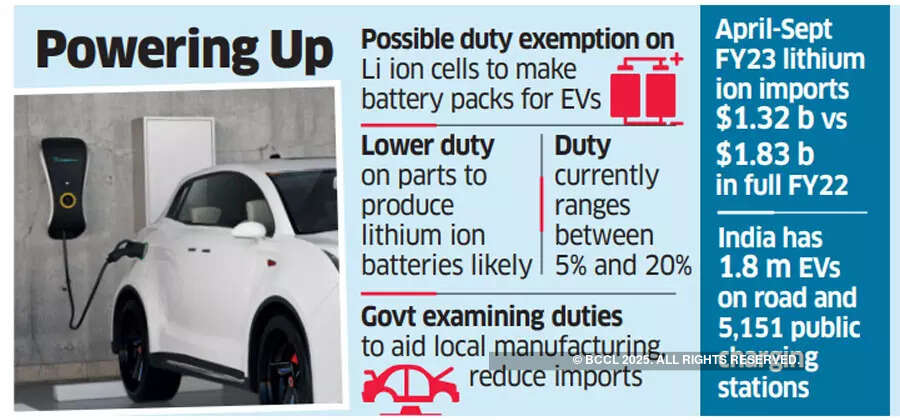

India’s electric mobility ambitions could get a boost in the upcoming budget, with the government examining incentives to encourage local manufacture of electric vehicles (EVs) and energy storage systems (ESS). Customs duty exemptions available on lithium ion cells for making mobile phone battery packs could be extended to EV batteries and ESS as well.

Additionally, the government may lower import duty on components that go into producing lithium ion batteries, currently at 5-20%. “Discussions are on to further promote manufacturing of the entire ecosystem related to electric transportation, and some proposals on reviewing the duties are being examined,” said a government official.

Duties on anodes, cathodes and synthetic separators, among other components of lithium ion batteries, could be lowered to promote indigenous manufacturing. India imported $1.32 billion of lithium ion batteries in April-September FY23.

Reducing China Dependence

This is against $1.83 billion of lithium ion battery imports in FY22. Most of these shipments came from China. The government has rolled out a Rs 25,938-crore production-linked incentive (PLI) scheme for automobiles and auto components that covers electric vehicles. There is a separate Rs 18,100 crore PLI for advanced chemistry cells to encourage domestic battery production and bring down prices.

States have been advised to waive road tax on EVs to help lower purchase costs, a deterrent even though operating costs are low.

The Rs 10,000-crore Faster Adoption of Manufacturing of Electric Vehicles (FAME) scheme rounds up the incentives India has instituted to leapfrog to environmentally cleaner, sustainable, advanced and more efficient EV-based systems.

Between 2014 and 2020, lithium ion cell imports rose to over $1.2 billion from $180 million, said a Niti Aayog study. “The reduction in customs duties on components of lithium ion batteries will boost the local manufacturing of these products in India and supplement the PLI already introduced for this sector,” said Bipin Sapra, partner at EY India.

The government has lowered the goods and services tax on EVs to 5%, from 12%, and on chargers and charging stations to 5% from 18%. The Bureau of Indian Standards has published test specifications for lithium ion traction battery packs and systems for electrically propelled road vehicles.