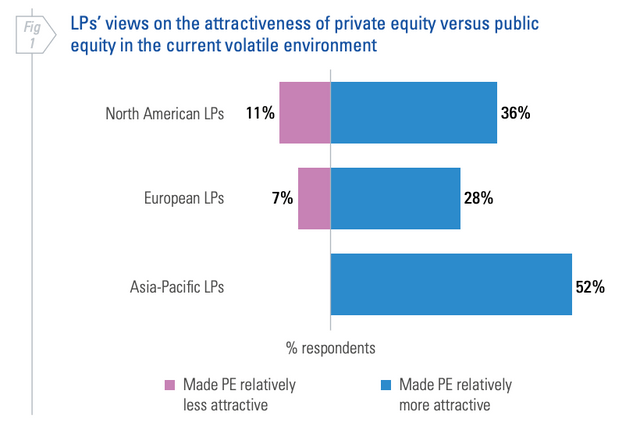

Limited partners (LPs) in the Asia-Pacific are finding private equity (PE) more attractive under the current market conditions, according to London-based Coller Capital’s 2022-23 Global Private Equity Barometer.

The report surveyed 112 investors in private equity funds globally, of which 21% of the respondents were from APAC. “Asia-Pacific LPs are positive on the outlook for private equity, with more than half saying private equity has become more attractive than public equity,” Peter Kim, head of Asia at Coller Capital, said in the company’s statement. Their interest in PE was higher than LPs in North America and Europe.

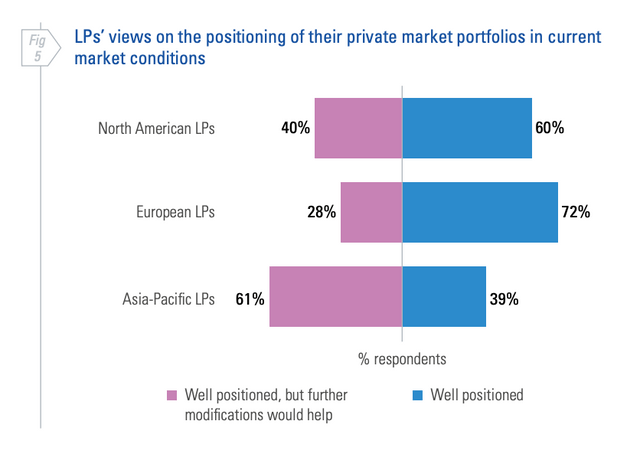

However, North American and European LPs were more positive about their portfolios compared with their counterparts in Asia-Pacific. More APAC LPs believed that their portfolios were well positioned but that further modifications could help, while a higher percentage of other global LPs felt their portfolios were well positioned.

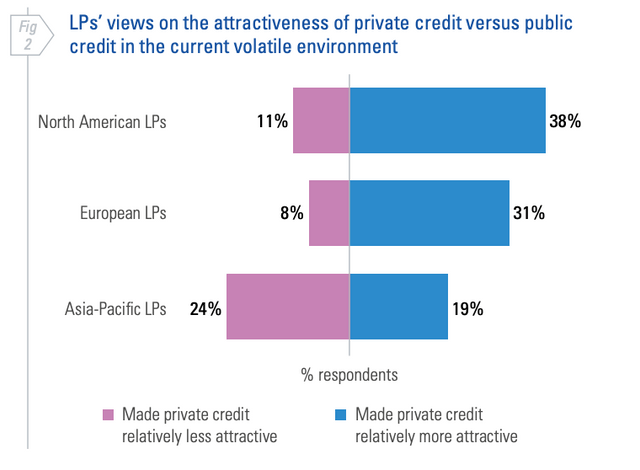

Twenty-four per cent of APAC LPs found private credit to be less attractive and only 19% of APAC LPs found private credit to be more attractive in current markets. Other global LPs found private credit to be relatively more attractive under current times.

Almost all LPs cited the current micro environment and high inflation factors as significant risks to their private equity returns over the next couple of years. Some of the other concerns on investors’ minds included high asset prices, trade wars, and regulatory changes.

But despite these concerns, LPs are still optimistic on the outlook for returns from private equity, with a third of them forecasting net annual returns of over 16% from their PE portfolios, the highest level since Coller Capital’s report from over a decade ago.

The report also noted the increase in interest among LPs to invest in PE energy assets, including renewables and hydrocarbons, since four years ago. The number of LPs who said they would either start, maintain, or increase their investments in renewable energy jumped from 55% in 2018 to almost 70% this year.

Interest in technology investments, on the other hand, has slumped in both PE and venture capital (VC) due to volatility within tech markets — 45% of LPs believed that the volatility in the current environment reduced attractiveness for VC investments in tech, while 28% believed the same for PE tech investments.

Compared with Asia-Pacific LPs, North American and European LPs believe that their institutions are broadly fit to assess ESG measurement systems of general partners (GPs). Fifty-seven per cent LPs in APAC deemed their institutions unfit for it.