/

The company, which was founded by ex-Tesla CTO JB Straubel, is planning on hiring 1,500 workers over the next 10 years.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24290959/south_carolina_site_render_3.png)

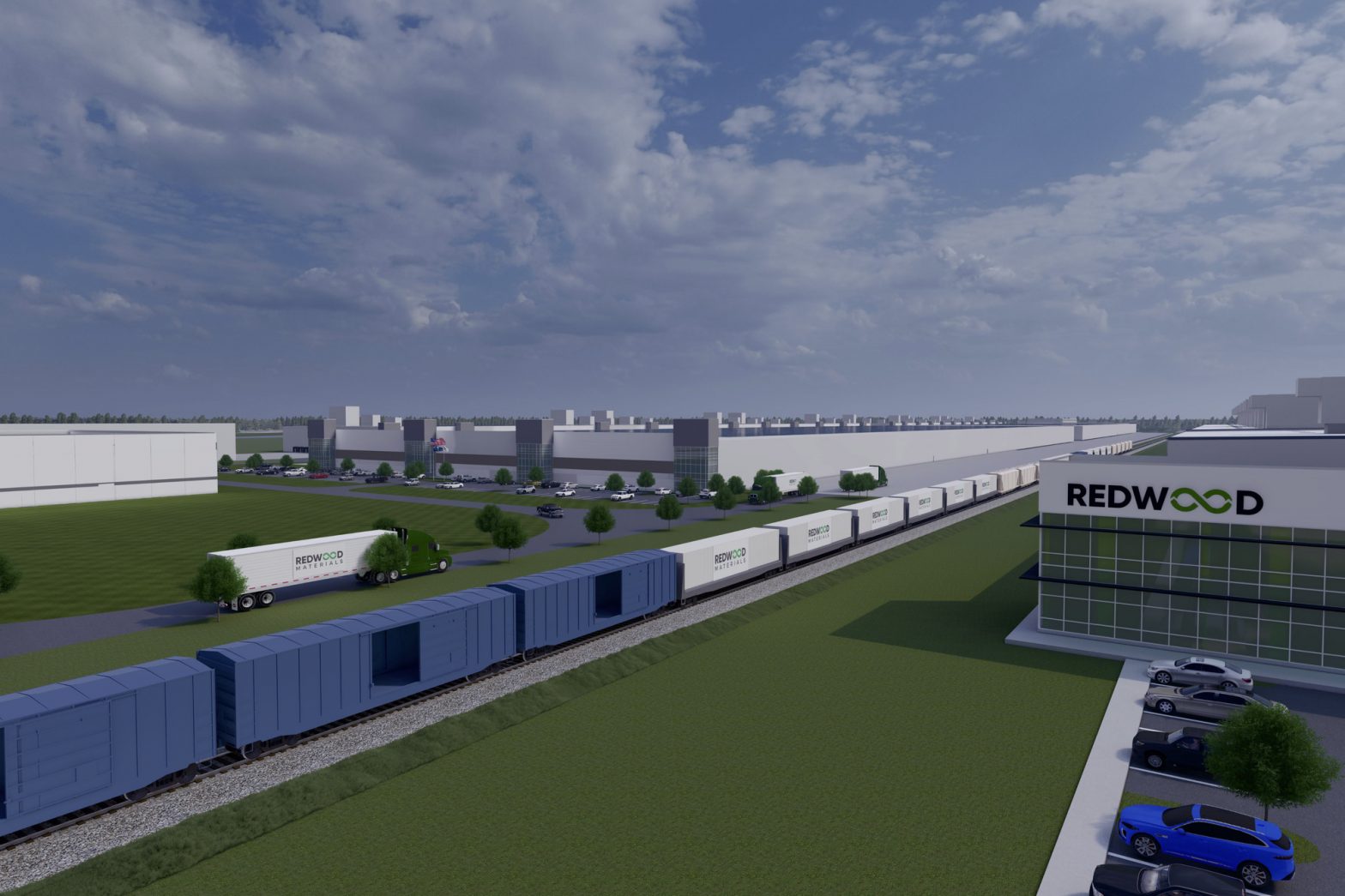

Redwood Materials, the battery recycling company founded by a former Tesla executive, announced today that it will build a massive $3.5 billion facility in South Carolina.

The 600-acre plant, which will be located just outside Charleston “in the heart of the ‘Battery Belt,’” will employ approximately 1,500 people over 10 years and will produce 100 GWh of cathode and anode components annually, Redwood said. Ground will be broken on the new factory in the first quarter of 2023, with an eye toward initiating the first recycling process by the end of the year.

Those components are not currently manufactured in North America, forcing automakers to source most of the materials needed for electric vehicle batteries from overseas. That has had the effect of creating a 50,000-mile supply chain at a cost of $150 billion by 2030, the company notes.

Redwood claims that by recycling EV batteries domestically, it can help drive down emissions and reduce global insecurity, with an eye toward reuse and recovery. The company says its operations will be “100% electric and we won’t use any fossil fuel in our processes (we will not even pull a gas line to the site).”

Redwood also claims it can reduce CO2 emissions of EV battery materials by “about 80% compared to the current Asia-based supply chain that we are dependent on for these crucial materials.”

Redwood selected South Carolina after the state approved at least $225 million in taxpayer-funded debt for the company in what’s likely the largest economic development deal in the state’s history.

Redwood Materials was founded in 2017 by Jeffrey “JB” Straubel, a former chief technology officer of Tesla. In addition to breaking down scrap from Tesla’s battery-making process with Panasonic, Redwood also recycles EV batteries from Ford, Toyota, Nissan, Specialized, Amazon, Lyft, and others.

Many of the batteries from those first-wave electric vehicles, like the Nissan Leaf, are just now reaching their end of lifespan and are in need of recycling. After receiving batteries from its various partners, Redwood begins a chemical recycling process, in which it strips out and refines the relevant elements like nickel, cobalt, and copper. A certain percentage of that refined material can then be reintegrated into the battery-making process.

Redwood’s new factory is the latest in a string of new facilities, many of which are located in the Midwest and South. Localizing battery production in the US is important for automakers that want to qualify for the $7,500-per-vehicle tax credit, which requires EVs to be assembled in the US. Foreign automakers have expressed concerns that the new tax credits could discriminate against companies without US-based manufacturing facilities — but they’ve also begun to make moves to localize production in the US.

Ford has said its three new battery plants will enable 129GWh a year of production capacity. General Motors is planning four new battery factories in the US with LG Chem for a total annual capacity of 140GWh, while Volkswagen is aiming to have six battery cell production plants operating in Europe by 2030 for a total of 240GWh a year. Stellantis is planning a new factory in Indiana, which will have an initial annual production capacity of 23GWh. BMW, Hyundai and Honda have also announced US-based factory plans.

Globally, battery production is expected to grow from 95.3GWh in 2020 to 410.5GWh in 2024, according to GlobalData, a data and analytics company. But raw material prices are also increasing, which could complicate the transition to electric vehicles.