The Bank Nifty is trading near lifetime highs, reflecting the fortunes of lenders that extricated themselves from the quagmire of bad assets spawned by the last round of bankrolled capacity expansion. Yet, bank profitability, now at its highest in a decade, faces the risk of starting a downward journey yet again as the hunt for deposits compels lenders to pay more to savers, narrowing net interest margins (NIM).

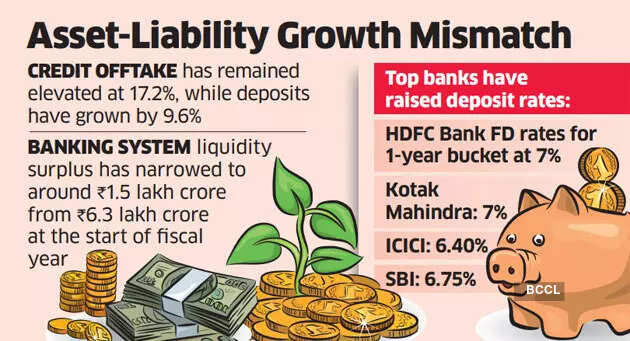

Over the past few weeks, lenders such as HDFC Bank, ICICI Bank and State Bank of India (SBI) have raised their deposit rates by up to a percentage point to garner more deposits so that they can lend to borrowers across segments — institutional, retail or small-business owners.

“With deposit growth running well below loan growth and deposit rates inching up rapidly, margins will peak out by the December quarter and will start heading down from March quarter onward,” said Suresh Ganapathy, associate director at Macquarie Capital. “A deposit rate war is clearly brewing up. The gap between deposit growth and loan growth is very high and it’s just a matter of time before deposit rates start inching up rapidly.”

Macquarie research showed HDFC Bank’s deposit rates have climbed 210 basis points to 7% in the past two years in the critical 1-3 year bucket, which accounts for the bulk of the deposits. Deposit rates for the bank are at a 3-year high.

One basis point is 0.01%.

SBI also raised deposit rates by 15-100 bps, the maximum increase being for bulk deposits. The increase in the critical 1–3-year bucket was 50-65 bps. For SBI, deposit rates in the one-to-two-year bucket are at 6.75%, while for ICICI it is at 6.40%. Kotak Mahindra Bank is offering an interest rate of 7% in the 390-day bucket.

Credit offtake has remained elevated at 17.2% on-year in the period that ended November 18. Growth is driven by NBFCs, retail credit, inflation-led working capital demand, and a lower base. At the same time, deposits saw a slower growth at 9.6% during the same period.

Liquidity has generally been trending down with the central bank draining the surplus from the system to manage inflation. Liquidity surplus in the banking system has narrowed to around Rs 1.5 lakh crore from Rs 6.3 lakh crore at the start of the fiscal year. The central bank has already increased the repo rate by 225 bps to 6.25% in FY23, and the odds are rather short on further increases in the upcoming policy-review meetings.

“The gap between credit and deposit is likely to reduce in FY24, driven by a moderation in credit demand and likely improvement in the balance of payment account,” said Ankit Jain, Senior Analyst, India Ratings and Research.

Go to Source