Tata Motors, India’s largest automobile company by revenues, is set to break a series of new records in passenger vehicle (PV) sales in India for calendar year 2022. For the first time ever, the company’s annual PV sales are set to cross the half-a-million-units milestone, making it the highest ever sales by the brand in a year since its inception in 1998.

Thanks to the widest product portfolio of SUVs – from the Rs 600,000 Punch to the top-end Safari – which has helped Tata address a broader customer base, the company is also set to march ahead of Hyundai Motor India as the largest SUV maker in India in 2022.

Given the massive demand for SUVs in India, Tata is also narrowing the gap for the No. 2 position with the South Korean carmaker in the overall passenger vehicle market, with just 30,000 to 40,000 units currently separating the two carmakers. Tata Motors has already sold over 325,000 SUVs in the first 11 months of this calendar year, while Hyundai Motor India’s SUV sales are a shade below 300,000 units.

Over two-thirds of its Tata Motors’ PV sales now come from SUVs, even as new electric and CNG powertrains for its hatchbacks and sedan have offered incremental volumes in the non-SUV space. Interestingly, the Tata Nexon – India’s best-selling SUV – the Punch are amongst the very few non-Maruti brands that have consistently figured in the top 10 car brands sold in India this year.

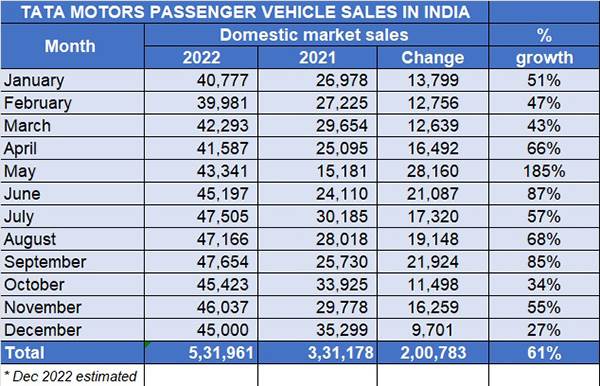

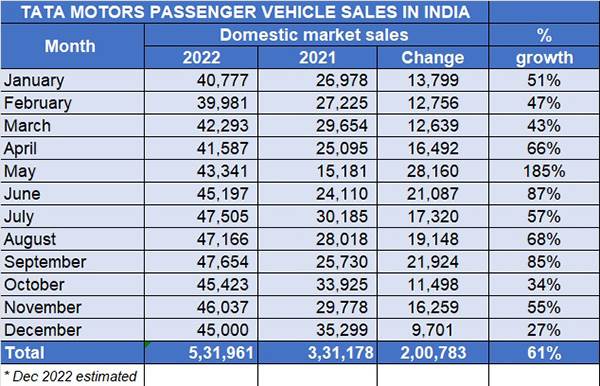

Tata Motors has already crossed half-a-million sales in the first fortnight of December and is likely to close CY2022 with sales of around 525,000 to 530,000 PVs. This will constitute year-on-year growth of 61% over the 331,178 units the company sold in 2021. With its best-ever annual sales, Tata Motors will account for a 14% share of the overall Indian PV market, which is set to grow over 20-25% to about 3.75 to 3.8 million units in 2022. A reply to an email sent to Tata Motors is still awaited.

Over the past two years, Tata Motors has seen its PV market share double to 14 percent. In comparison, Hyundai Motor India’s PV market share has shed about a couple of hundred basis points to about 14.5-15% at present.

What has also helped Tata Motors’ accelerated growth is its first-mover advantage in the electric vehicle arena. At present, the company has an around 84% share of the overall ePV market and at an estimated 39,000-odd units sold this year, EVs will account for 7% of Tata’s half-a-million-plus sales in 2022.

From Hyundai Motor India’s perspective, while the new-generation Verna and new entry SUV based on the Grand i10 platform will help the Korean carmaker expand its volumes in 2023, Tata Motors will be relying on the mid-cycle enhancement of its existing models and introduction on EV and CNG powertrains on existing models like the Punch and Altroz in the future to bring in the incremental volumes.

In the overall analysis, while Tata Motors has managed to win a critical battle of SUVs in 2022, 2023 will throw up an intense neck-to-neck race between the India’s largest automobile company by revenues and the South Korean Chaebol.

Tata set to enter Top 20 global light vehicle manufacturers list

Meanwhile, Autocar Professional learns Tata Motors is also on track to break into the top 20 light vehicle producers in the world with an output of a million units. The light vehicle market includes all passenger vehicles and small commercial vehicles and vans up to 5 tonnes. The one-million cumulative light vehicle production is between Tata Motors standalone and Jaguar Land Rover for the first time since 2018.

ALSO READ:

India’s Top 5 UVs in April-November 2022 amass total sales of over 3 million units