The new surge in Covid cases in China is making Indian companies, from electronics and apparel manufacturers to gold and diamond exporters, worried about another bout of supply chain disruptions as well as exports to the Chinese market getting hurt.

According to consumer electronics companies, their component suppliers have warned them about slowing production at Chinese factories where many workers are down with the infection. Similar concerns are raised by apparel manufacturers, who are heavily dependent on China for raw materials. With the Chinese New Year holidays too around the corner, which could cause shipment delays, many Indian companies are placing orders in bulk to ensure that they have enough stock of components and raw material, said industry insiders.

“Situation is very bad in China with component suppliers saying their factory production is hit which will have a cascading effect on our supplies,” said the chief of one of the largest electronics contract manufacturers.

‘Information Sketchy’

“Problem is information coming in is very sketchy, so we are yet to gauge the exact impact this Covid wave will have,” he said.

Satish NS, the India chief at Chinese electronic company Haier, said his company is advancing the purchase of components to ensure India production is not impacted.

The Covid surge in China is driven by a complete reversal of its zero-Covid policy. While infections have touched all-time high, epidemiologists have warned at this rate almost 60% of the Chinese population will get Covid in the next 90 days and there could be multiple such waves. These could slow down production in China and break down supply chains globally.

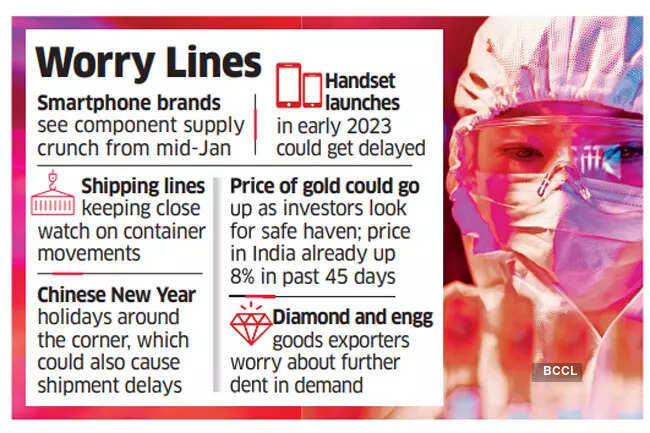

Smartphone brands are expected to face a supply crunch for components from the middle of next month if the current Covid surge continues in China, according to market trackers. But they could still be able to serve the immediate local demand since the market is muted and they are already stocked up on components to meet shorter-term requirements.

“If the situation plays out for another three weeks, we may see disruptions in component supplies for the smartphone brands that rely heavily on components from Chinese factories,” said Faisal Kawoosa, chief analyst, TechArc. But there could be an impact on the launches slated for early next year.

Exporters of diamond and engineering goods are concerned about extended holidays during the Chinese New Year further hurting demand that has weakened already since October compared with a year earlier.

India’s exports of cut and polished diamonds to China in November declined by 4% over last year at about $1.25 billion. China is the second largest buyer of diamonds from India accounting for 30% of total exports. Engineering goods exports fell year-on-year by 58% in November and 64% in October, as per data by Engineering Export Promotion Council of India.

Garment manufacturers and exporters in India source accessories from China which are required for manufacturing. “If the evolving Covid situation impacts the supply of accessories, the brands that we supply to may have to look for alternative sources,” said Raja M Shanmugam, former president at Tirupur Export Association.

Shipping lines are keeping a close watch on container movements, which were affected during previous Covid waves.

Sunil Vaswani, executive director at the Container Shipping Line Association (India), said while there has been no official communication yet about any impact on port operations in China, if the situation worsens it could impact operations and productivity at ports. “This, in turn, will impact container movement and disturb the supply chains,” he said.

Commodity trade executives said the Covid condition in China could affect the sentiment of the global food commodity trade. “China is the biggest importer of many commodities like rice, cotton, wheat, corn, soyabean, sugar, cooking oils like palm and soya bean oils. We may see some restrictions in export and imports coming from the central government (to keep domestic prices under control),” said commodity analyst Rahul Chauhan.

Worries about the impact of the pandemic on the world’s second largest economy could also cause the price of gold to go up, as was the case during the first wave of Covid in 2020, as the yellow metal is a safer investment during times of uncertainty.