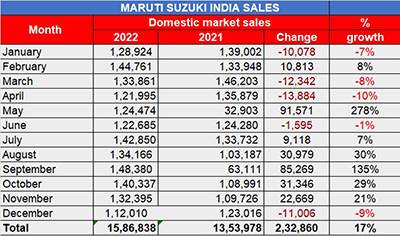

Chip-impacted Maruti Suzuki’s December sales down 9% to 112,010 units, lowest in 2022

Nearly 18-odd months after the phenomenon first impacted the automotive industry adversely, the semiconductor supply chain issue still continues to have a detrimental effect on vehicle manufacturers and their production ecosystem. Case in point is passenger vehicle market leader Maruti Suzuki India’s December 2022 wholesales performance.

The carmaker has posted its lowest monthly numbers in all of CY2022 in December: 112,010 units. This is 9% down on December 2021’s 123,016 units.

In its statement, Maruti Suzuki said: “The shortage of electronic components had some impact on the production of vehicles, mainly in domestic models.”

After five months of consistent growth, December 2022 numbers are a dampener albeit that’s more due to production constraints rather than lack of consumer demand. The impact can be clearly seen in the fact that of the five product categories, only two (UVs and the Eeco van) are in positive territory.

The company’s entry level cars – the Alto and S-Presso – saw a sharp 40% year-on-year decline at 9,765 units. On November 19, Maruti Suzuki had launched the CNG variant of the third-generation Alto K10, priced at Rs 595,000. Tepid deliveries to showrooms across the country could hamper potential demand in this segment, which is gradually seeing demand return.

Maruti Suzuki’s six-pack comprising the Baleno, Celerio, Dzire (and Tour S), Ignis, Swift and Wagon R is also down – 57,502 units are a 17% YoY decline (December 2021: 69,345) whilke the premium Ciaz sedan’s sales fell by 4% YoY to 1,154 units.

The UVs – new Brezza, Ertiga, XL6 and the new Grand Vitara – contributed 33,008 units, up 22% on year-ago 26,982 units. Maruti Suzuki is currently seeing strong demand for the recently launched Grand Vitara and the new Brezza. The Eeco van was the second vehicle category to show growth: 10,581 units, up 15% on year-ago wholesales of 9,165 units.

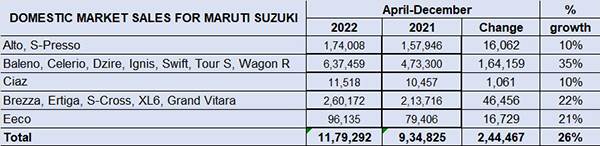

April-December 2022 sales up 26%

On the cumulative 9-month (April-December 2022) front, things look better for the company as seen in the data chart below. All five model segments are showing double-digit growth .

Given that Maruti Suzuki, which is seeing strong demand for its new Grand Vitara and Brezza SUVs, it is imperative that the company has to sort out its production issues if it is to capitalise on the market demand.