December retail sales down 5%, CY2022 sees 15% growth as PVs, CVs, 3Ws and tractors shine

India Auto Inc’s real-world retail sales numbers for December 2022 as well as calendar year 2022 are out, courtesy the Federation of Automobile Dealers Associations (FADA). They point to a realistic growth story that can get better, albeit with some challenges along the way.

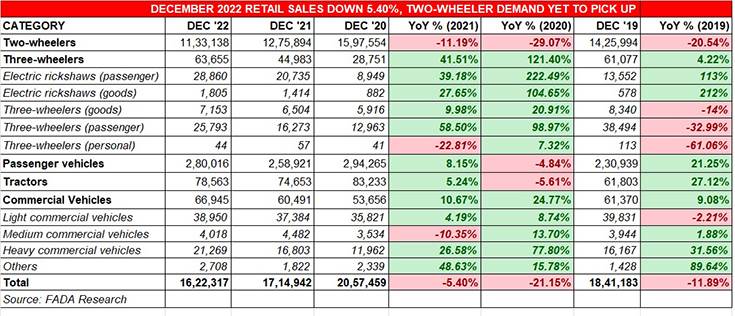

After the heady festive-season-driven sales of October 2022 (20,94,378 units / up 47.62% YoY) and November 2022 (23,80,465 units / up 25.71% YoY), December 2022’s 16,22,317 units, down 5.40% on December 2021’s 17,14,942 units and down 12% on the pre-Covid December 2019 (18,41,183 units) point to the fact that there is still some way to go before growth is fully secular across vehicle segments.

The December 2022 segment-wise splits reveal that of the five vehicle segments – two- and three-wheelers, passenger vehicles, tractors and commercial vehicles – two-wheelers, which is the largest of them all by volume, is still faltering when it comes to growth.

Two-wheeler retails of 11,33,138 units in December 2022 were down 11% on December 2021’s 12,75,894 units and 20.54% below the pre-Covid December 2019’s 14,25,994 units. Clearly, the dampened demand in the entry level commuter motorcycle and scooter market has taken a toll, so much so that this segment has proved to be a drag on overall industry growth in the last month of last year.

Commenting on the segment’s performance, FADA president Manish Raj Singhania said: “The two-wheeler segment once again failed to impress as retail sales during December 2022 continued to fall after two good months. Reasons like rise in inflation, increased cost of ownership, rural market yet to pick up fully, and increased EV sales means the IC-engined two-wheeler segment is yet to see any green shoots.”

Commenting on the segment’s performance, FADA president Manish Raj Singhania said: “The two-wheeler segment once again failed to impress as retail sales during December 2022 continued to fall after two good months. Reasons like rise in inflation, increased cost of ownership, rural market yet to pick up fully, and increased EV sales means the IC-engined two-wheeler segment is yet to see any green shoots.”

That’s not the case with the three-wheeler, passenger vehicle, tractor or commercial vehicle segments which have registered growth. Total three-wheeler sales of 63,655 units in December 2022 are a YoY growth of 41% – the shift to electrification is most apparent here because of this total, 48% or 30,665 units are electric three-wheelers.

Passenger vehicle retails at 280,016 units were are an 8.15% increase (December 2021: 258,921), dipping below the double-digit growth they have maintained for most of the year. And this is despite most carmakers offering sizeable year-end discounts. Pin the slower buying of PVs to December being the last month of the year and customers preferring a new car purchase in early in the new year.

The tractor market is seeing a pick up in demand as seen in the 8% growth in December 2022 to 78,563 units, which is importantly a 27% growth over December 2019 retails.

The over commercial vehicle segment saw December retails of 66,945 units, up 10.67% YoY and 9.8% over December 2019. For this industry which sees sales increase in four-year cycles, a new growth cycle has begun which can only get better

How India Auto Inc fared in CY2022

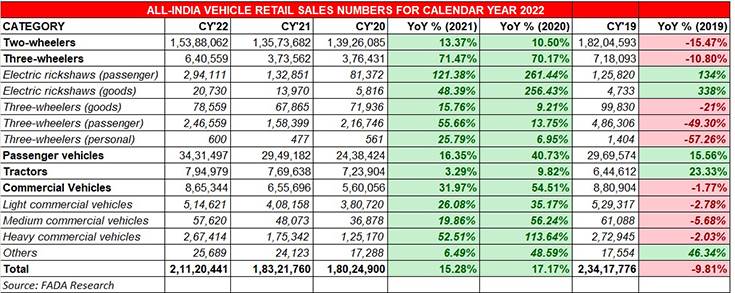

While the cumulative retails of 21.12 million vehicles, for all five segments, between January and December 2022 constitute 15.28% YoY growth over CY2021 (1,83,21,760 units), the fact of the matter is that the overall annual number is 50,96,016 units less than CY2019’s 2,34,17,776 units or down 9.81 percent. Clearly, there’s much catching up to do in CY2023.

Let’s take a closer look at each segment’s performance in CY2022.

Two-wheelers: If there is a concern for India Auto Inc and its eco-system then it is the two-wheeler segment which is yet to see sustained sales revival. At 1,53,88,062 units in CY2022, it did post a 13% increase over CY2021’s 1,35,73,682 units but remains considerably below CY2019’s 1,82,04,593 units. That’s a difference of 2,816,531 or 2.81 million units, or 234,710 units every month of the year. This sizeable gap can only be bridged if demand returns to the 100-110cc entry-level two-wheeler market, particularly from rural India which is the big buyer in this sub-segment.

Three-wheelers: The three-wheeler growth story is getting better with every month and year. At 640,559 units in CY2022, growth was a robust 71% (CY2021: 373,362) albeit 11% below CY2019’s 718,093 units. But given the speedy rate of growth, particularly for electrified three-wheelers, this segment should conquer that decline very soon.

Of total three-wheeler sales, passenger carriers at 541,270 units accounted for the bulk of the demand (84.49%) while goods carriers, with 99,289 units (15.50%) made up the rest. But the real story is the EV-olution of the three-wheeler market.

Of the total retail volume of 640,559 units, electric three-wheelers accounted for 314,841 units or 41.15% share. In CY2021, EVs accounted for 39% (146,821 units) out of total sales of 373,562 units and were just 18% (130,553 units) in CY2019’s 718,093 three-wheeler sales. In this segment, where TCO is a key buying factor given that most vehicles are single-owner, EVs are turning out to be truly VFM products.

Passenger Vehicles: The passenger vehicle segment has been the shining star of CY2022 with wholesales of 3.8 million units and retails of 3.43 million units. The 34,31,497 units retailed last year are a strong double-digit YoY growth of 16.35% and also an increase of 15.56% over CY2019.

FADA president Manish Raj Singhania said: “The 34.31 lakh retails during the full year are, by far, the highest retails which PVs have done till date. The PV segment has continued to show remarkable consistency in growth during the entire year. While supply woes have decreased, better product spread and ever highest consumer offers have kept consumer interest on.”

Commercial Vehicles: What has brought smiles to India Auto Inc is the return of good times to the barometer of the economy – the commercial vehicle sector. At 865,344 units, retail growth in CY2022 was 32% above CY2021’s 655,696 and just 1.77% below CY2019’s 880,904 units. Importantly, the growth is democratised across all three sub-segments.

LCVs, which with 514,621 units, have the largest share – 59.47% – and recorded 26% growth, benefiting from the humungous demand for last-mile services across the country.

Heavy commercial vehicles (HCVs) with 267,414 units account for a 31% share of the CV market in 2022, posting 20% growth while medium CVs (MCVs) with 57,620 units make up the balance with a 6.65% share.

According to Singhania, “The CV segment has continued to grow during all of CY2022 and is now almost at part with CY2019 retails. With uptick in demand in LCVs, HCVs, buses and construction equipment, the government’s continued push for infrastructure development has kept this segment going.”

Tractors: The tractor segment is farming growth and how. Along with PVs, it is the only other segment to have gone well above the past three years’ sales and in CY2022, it notched all-time high retails of 794,979 units, which are 3.29% above 2021 and a sizeable 23% above 2019.

Commenting on the tractor market’s sterling performance, Singhania said: “This feat was possible due to a consistently good monsoon, improved cashflow with farmers, better MSP of crops and the government’s focus on better procurement. Apart from this, timely sowing of rabi crop also helped to continue this momentum. Festive season sales, which were normal after three years, also played its part in this strong momentum.”

Growth Outlook for FY2023 and beyond

Amid the uncertain global geopolitical scenario, India remains a positive growth story. What has helped India Auto Inc, which has seen a challenging export market scenario, is the strong domestic market growth despite the RBI raising repo rate by 225 basis points since May 2022. India is projected to be one of the world’s fastest growing economies, which augurs well for 2023.

FADA has retained its cautiously optimistic outlook for retail sales in the last quarter of FY2023 (January-March 2023) due to inflation-driven pressures and upcoming changes in vehicle norms resulting in price hikes.

Also, according to the FADA president, the first fortnight of January usually see low sales prior to Lohri/ Sakranti. Most OEMs have already announced routine price hikes in December at the beginning of this year. Moreover, with BS-VI Phase 2 and RDE norms coming in April, vehicle buyers should brace themselves for another round of price hikes across all categories. To counter this, Singhania said. “OEMs should announce special schemes so that the retail sales momentum continues.”

All in all, India Auto Inc has driven into 2023 on a sound footing albeit it will have to tackle some challenges along the way if it is to maintain the growth rate this year, which will see a number of new products being launched across segments.