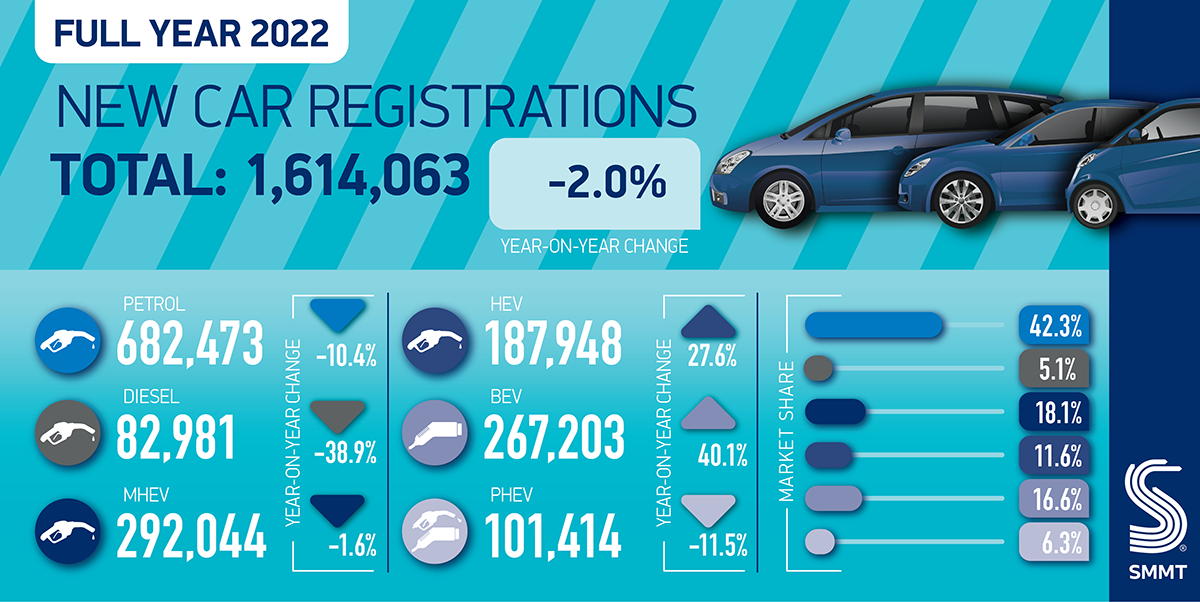

- Supply chain shortages subdue new car market to 1.61m units in 2022 – a -2.0% fall on pandemic-afflicted 2021 – but UK reclaims position as Europe’s second biggest market.

- Battery electric vehicles secure best ever monthly market share and become Britain’s second most popular powertrain for the year.

- Rising registrations see market improvement in last five months with sector poised to deliver growth worth £8.4bn during 2023.

SEE CAR REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

The UK new car market recorded its fifth consecutive month of growth in December, with an 18.3% increase to reach 128,462 new registrations, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). This second half year performance was not enough, however, to offset the declines recorded during the first half of 2022. Despite underlying demand, pandemic-related global parts shortages saw overall registrations for the year fall -2.0% to 1.61 million, around 700,000 units below pre-Covid levels.1

Constrained supply saw many manufacturers prioritise deliveries of the latest zero emission-capable models. December saw battery electric vehicles (BEVs) claim their largest ever monthly market share, of 32.9%, while for 2022 as a whole they comprised 16.6% of registrations, surpassing diesel for the first time to become the second most popular powertrain after petrol. Meanwhile, plug-in hybrids (PHEVs) saw their annual share decline to 6.3%, meaning that combined, all plug-in vehicles accounted for 22.9% of new registrations in 2022 – a record high, although a smaller increase in overall market share than recorded in previous years.2 Hybrid electric vehicles (HEVs) also enjoyed growth, rising to an 11.6% market share for the year. As a result, average new car CO2 fell -6.9% to 111.4g/km, yet again the lowest in history.

While private buyers accounted for more than half of all registrations, fleets and business buyers were responsible for the lion’s share of battery electric vehicles, accounting for two thirds (66.7%) of all BEV registrations and 74.7% of the volume gain in 2022. Delivering the scale and speed of market transition required to meet climate change targets will require action to enthuse more private buyers to go electric.

Ensuring drivers in every part of the country can benefit depends on broader policies to encourage uptake of zero emission-capable vehicles during 2023. For instance, while the industry recognises the need for fair vehicle taxation, plans to introduce VED on BEVs from 2025 with the same ‘premium’ threshold as internal combustion-engine cars will disproportionately penalise those moving to electric. Higher production costs mean more than half of all BEV registrations this year would have incurred the ‘premium’ VED if it had been in place, a move which risks discouraging wider adoption.3

Chargepoint provision also remains a barrier to EV uptake. The government’s EV Infrastructure Strategy forecast that the UK would require between 300,000 and 720,000 chargepoints by 2030. Meeting just the lower number would still require more than 100 new chargers to be installed every single day. The current rate is around 23 per day.4

Manufacturers face a Zero Emission Vehicle Mandate from 2024 (the details of which have still not been published). As a result, accelerated investment in charging infrastructure is needed if consumers are to be confident they can make the switch and brands are to have a chance of securing sufficient supply to support UK market growth and not lose out to other markets which are investing more rapidly. Last year, Britain reclaimed its position as Europe’s second largest new car market by volume, both overall and, specifically for plug-in cars.5 However, as of the end of Q3 2022, it was 13th overall by plug-in market share, behind markets including Norway (78.3%), the Netherlands (28.7%) and Germany (23.5%). 6

Mike Hawes, SMMT Chief Executive, said,

The automotive market remains adrift of its pre-pandemic performance but could well buck wider economic trends by delivering significant growth in 2023. To secure that growth – which is increasingly zero emission growth – government must help all drivers go electric and compel others to invest more rapidly in nationwide charging infrastructure. Manufacturers’ innovation and commitment have helped EVs become the second most popular car type. However, for a nation aiming for electric mobility leadership, that must be matched with policies and investment that remove consumer uncertainty over switching, not least over where drivers can charge their vehicles.

Looking ahead, supply chains are beginning to stabilise and although the shortage of semiconductors is expected to ease, erratic supply will likely impact manufacturing throughout 2023. The most recent market outlook, published in October 2022, anticipates around 1.8 million new car registrations in 2023, worth around £8.4 billion in additional turnover.7

Notes to editors

1 2019 new car registrations: 2,311,140

2 2020 market share: 10.7%; 2021 market share: 18.6%;

3 SMMT research comparing registrations with retail prices recorded by Auto Express

4 Based on 263,000 chargers to be installed 1 Jan 2023 to 31 Dec 2029 inclusive; based on 6,262 chargers installed 1 Jan 2022 to 31 September 2022 inclusive

5 ACEA: New passenger car registrations November 2022

6 ACEA: Fuel types of new cars. Plug-ins defined as Battery Electric Vehicles + Plug-in Hybrid Electric Vehicles

7 UK Automotive calls for urgent action plan to safeguard £14bn recovery as investment deadlines loom