- UK new light commercial vehicle (LCV) registrations end the year down -20.6% following significant post-pandemic fleet renewal in 2021 and supply chain challenges.

- 16,744 battery electric vans (BEV) registered in 2022, representing 5.9% of all vans joining UK roads last year.

- Action needed to deliver van-suitable charging infrastructure and a fiscal framework to encourage more van drivers to make the switch in 2023.

SEE LCV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

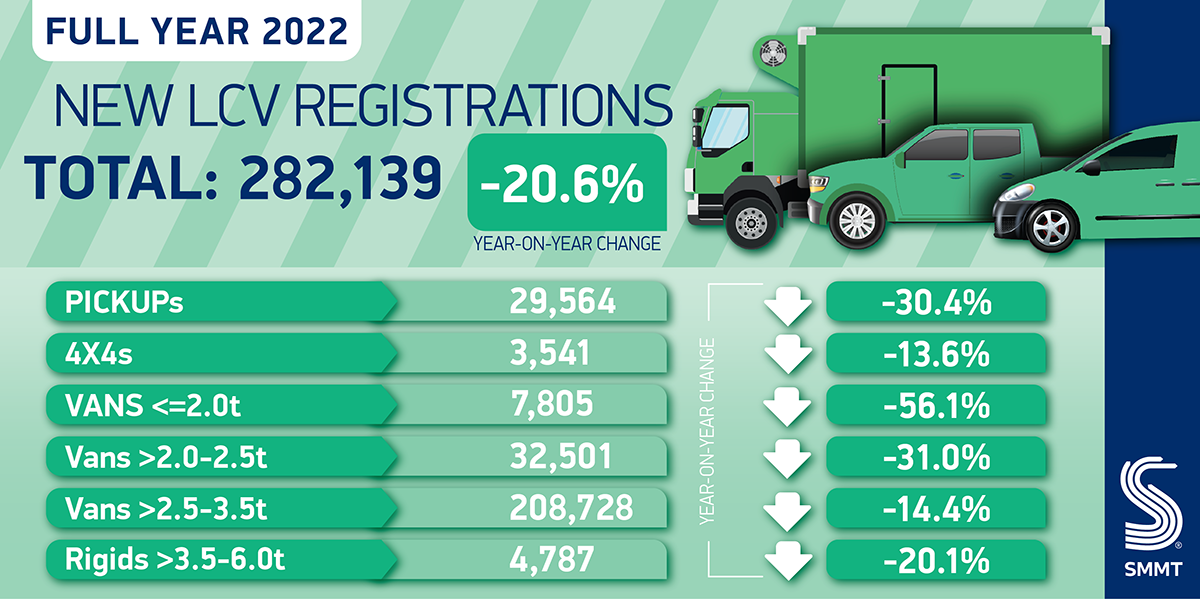

UK new light commercial vehicle (LCV) registrations reached 282,139 units in 2022, a decline of -20.6% on the previous year of strong post-pandemic bounceback, according to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT). Despite strong order books throughout 2022, performance continued to be held back by persistent supply chain issues, which have restricted production globally, resulting in limited model availability. As a result, the market was -22.9% down on pre-pandemic 2019,1 marking the fewest LCV registrations since 2013.2

Despite the significant economic and supply challenges faced by the sector, demand for battery electric vans (BEVs) grew, with deliveries up 31.2% to 16,744 units. There is an ever-increasing number of electric van models available for a broad range of use cases, however, uptake remains some way off the new car market, where BEVs comprised 16.6% of new registrations. Four in 10 of all the BEVs ever registered in the UK were delivered last year,3 but action from all stakeholders is needed to ensure the UK can achieve its ambitious green goals.

Registrations of the most popular vans weighing greater than 2.5 to 3.5 tonnes fell by -14.4% in 2022, while vans weighing greater than 2.0 to 2.5 tonnes fell by -31.0%. Meanwhile, deliveries of pickups fell by -30.4% and 4x4s by -13.6%, with these two segments remaining a fraction of the market. While overall average new van CO2 emissions rose by 3.9% to 195.7g/km, reflecting a market shift to larger vehicles which offer payload efficiencies, many segments of the van market saw their average CO2 emissions fall.

The LCV market is set to deliver an additional £1.6 billion for the British economy this year, and a further £2.4 billion in 2024 as the latest market outlook forecasts around 330,000 new van registrations in 2023.4 With the second largest van market of all European nations, the UK should be at the forefront of LCV decarbonisation, with BEV van deliveries expected to rise by 60.7% in 2023.

Public charging infrastructure, however, is already insufficient for the number of plug-in vehicles already on the road and is generally geared towards cars rather than vans. With the Zero Emission Vehicle Mandate due to come into force in 2024 – which includes cars and vans – and the end of sale of conventional petrol and diesel vans in 2030, a national van infrastructure plan is essential if environmental goals are to be met. This means delivering the necessary levels of LCV-suitable charging points across every region of the UK. At the same time, a fair fiscal plan and the continuation of incentives will be essential if van buyers are to be encouraged to switch to zero emission and the UK’s ambitious targets for zero emission mobility are to be met.

Mike Hawes, SMMT Chief Executive, said,

While demand for new vans remained robust throughout 2022, replicating last year’s high levels of fleet renewal was always going to be a challenge with relentless supply chain disruptions and wider economic malaise. A return to growth is expected in 2023, but if this crucial sector is to deliver for the economy, society and the environment, action is needed from all stakeholders, particularly in the areas of charging infrastructure and fiscal frameworks, enabling more van buyers to make the switch.

Notes to editors

1 UK LCV registrations, 2019: 365,778 units.

2 UK LCV registrations, 2013: 271,073 units.

3 43,933 BEV vans have been registered in the UK since 1997.

4 SMMT UK new car and van forecast, October 2022.