Executive Summary:

- How Akulaku managed to raise $200m despite the tech winter

- Murky outlook for capital markets in Indonesia

- Grab, GoTo cut costs and rein in promotions

How Akulaku managed to raise $200m despite the tech winter

In the midst of the funding winter facing tech companies, it was noteworthy that Akulaku raised $200m in fresh funds from Mitsubishi UFJ, Japan’s largest bank. The latest fundraising could value the Indonesian fintech at $1.5 billion, according to market sources.

Akulaku had raised $100 million in new funds in February 2022 in a funding round involving Siam Commercial Bank (SCB), which was, at the time, considered to be a pre-IPO round. Prior to this, it had raised funds from high-profile investors such as Silverhorn, Ant Financial, Sequoia Capital, and Qiming Venture Partners.

While seven-year-old Akulaku is among Indonesia’s oldest fintechs, it is still one of the most dynamic, morphing itself from a consumer finance company to a peer-to-peer (P2P) lender and more recently into one of the leaders in the Buy Now Pay Later (BNPL) space, taking on players like Kredivo (FinAccel), and Atome in its home market.

The company also operates in Thailand, the Philippines, and Malaysia. It provides a broad array of offerings from BNPL and consumer credit to digital banking, underpinning a more certain future given the more diversified offerings.

Akulaku was one of the early movers into Indonesia’s neo-banking sector through Bank Neo Commerce, which now has over 20 million users, compared with 7.8 million users in 2020. Bank Neo Commerce is currently one of the leaders in the digital banking space, alongside Bank Jago and SeaBank Indonesia.

Bank Neo-Commerce has the potential to become one of the winners in the space, given that it has rolled out services earlier than the competition. Akulaku and its sister company Rockcore currently own 31% of the bank and are the largest shareholders.

The bank broke even in Q3 2022 and will likely make a small profit in Q4 2022 but should break even for FY 2023, according to market consensus. This reflects a more measured approach given the bank’s rapid build up of customers.

Bank Neo Commerce offered very high rates of deposit (7-8%) to begin with, to attract depositors but it has since pulled back on this strategy with a focus on profitability. The best time deposit rates being offered currently are at 3.5% with regular savings at 0.5-1.5%.

The bank is optimistic that it will be more profitable in 2023. This is in line with the company’s plan to boost its credit performance, streamline operational costs, maintain the cost of funds and credit costs, and maintain interest margins.

Bank Neo Commerce’s Net Interest Margin (NIM) has continued to increase from 5.2% in end-2021 to 12.7% in Q3 2022. The management believes margins will remain stable despite the recent interest rate rise. Net interest income grew by 387.6% YoY to 989.3 billion rupiah in Q3 2022, while operating income shot up by 441% YoY to 312.3 billion.

Buy Now Pay Later has been the company’s main focus as it shifted away from the more risky P2P lending space.

BNPL is promoted to retailers to increase their sales, for which they are charged a transaction fee ranging from 0.5-1.5%. The company works with most of the major e-commerce players in Indonesia including Shopee, Lazada, JD.id, BliBli, DANA, Tiket.com, and Alfamart and claims to increase new customers by 30%, user repurchases by 20%, and average order value by 20%.

Akulaku also has an e-commerce app with 90,000 merchants and 33 million customers providing a natural fit with both its BNPL business and its digital banking business. Having a digital bank as part of its ecosystem also gives Akulaku access to low-cost funds, allowing it to make higher margins.

As part of MUFJ’s strategic investment, Akulaku has agreed to work with MUFJ companies in Southeast Asia on tech, product development, financing, and distribution. MUFJ has already made a foray into the consumer lending space through its acquisition of the Philippines and Indonesia units of Home Credit.

The fact that MUFJ has gone ahead with this recent funding round is a reflection of the quality and synergistic exposure that Akulaku can provide in Southeast Asia. Akulaku can be seen as one of the lucky few tech companies that have been able to raise funding during the tech winter.

Murky outlook for capital markets in Indonesia

The outlook for tapping Indonesia’s public markets in 2023 remains a murky one, especially for the tech sector, which is facing intense scrutiny on the path to profitability. This means that only companies that can demonstrate at least some form of profitable measure can succeed in meeting investor expectations and raising new funds.

A significant issue to consider is also the profile of the investors that are being targeted for fundraising options. Retail investors in Indonesia were badly burnt by the larger IPOs last year including Bukalapak and many had been drawn into investing in highly speculative instruments such as crypto, which has since collapsed. Having said this, the retail investor base has grown significantly to over 10 million by November 2022, a rise of 35% YoY.

Companies raising new capital will likely focus on securing the interest of longer-term investors – local mutual funds, pension funds, and insurance companies. These types of investors are more sensitive to valuations than retail investors in general. Foreign institutional investors are far more sensitive to global liquidity flows as well as valuations, which makes them less likely to participate in new issues.

The days of massive lock-ups are also likely to be over given the uncertainty and obvious overhangs these strategies present. The overhang of GoTo’s increase of its “free float” from under 4% to around 95% will remain for some time to come. Other recent listings such as Grab and Bukalapak also experienced some impact from this but none quite as extreme as GoTo.

The last major tech IPO we saw in 2022 was Blibli, which has fared better than its peers in that it has held up well above its IPO price but at the same time it remains relatively illiquid, with potential support coming from its major shareholder.

There are a number of candidates planning to list in the coming year but have not declared that intention officially, which include Traveloka and potentially Tiket.com in the online ticketing space. The companies may also look at a US listing instead if global market sentiment improves.

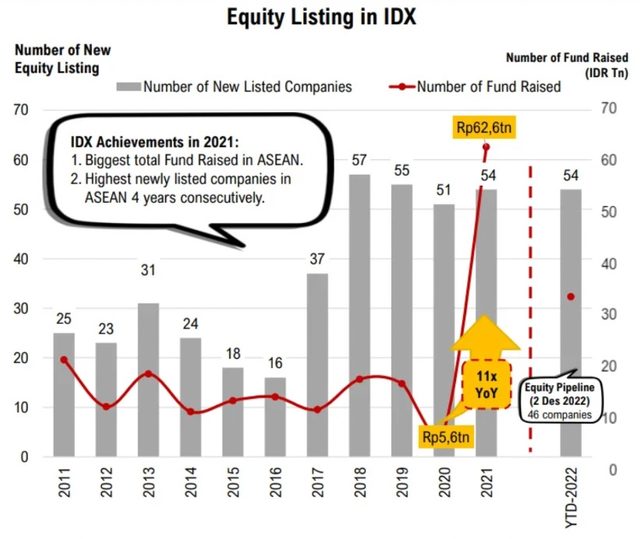

A total of 59 companies were listed in 2022, raising over $2.1 billion, against a total of 54 companies in 2021 and 51 in 2020. To date, 58 companies have stated their intention to IPO in 2023 on the IDX, with an estimated value of 54.1 trillion rupiah. Only six come from the tech space, with the remainder from the consumer, healthcare, and financial space.

Among the bigger planned listings in 2023 are two subsidiaries of state-owned energy firm Pertamina, namely Pertamina Geothermal Energy, and Pertamina Hulu Energi, with the latter expected to raise $2 billion alone. The state-owned palm oil company, Palm Co, a unit of PTPN III, is also looking at a potential listing in 2023.

The key point for prospective companies looking to launch an IPO will be the need for valuations that the market can digest. Listed market valuations have collapsed for the tech sector, which will make it more difficult for new listings in this sector.

There have been very few large private fundraisings given the funding winter. The only one of note is fintech Akulaku, which raised $200 million just before the New Year, led by MUFG.

The next round of fundraising in the private market could well include down rounds, given that some of these startups have a limited runway in terms of internal funding.

In order to attract new tech listings, the IDX has set up a new economy board, which already counts GoTo, Bukalapak, and Blibli, as members. The board was set up to allow startups from areas of the digital economy such as fintech, EVs, e-commerce, logistics, and 5G to list. There is a long list of unicorns including Traveloka to DANA, Xendit, LinkAja, and Kopi Kenangan, which would likely become members of the new economy board but the board will not help those companies achieve desired valuations.

In fact, only those with valuations in line with or below their peer group will likely succeed in attracting investor interest in this environment. The creation of the board is also to protect retail investors as membership denotes a higher risk versus main board listings. Being a member is not a guarantee of a successful listing. In fact, it may be quite the opposite.

Grab, GoTo cut costs and rein in promotions

The significant switch in focus from growth at all costs to the path to profitability has forced listed companies to make some tough decisions to hasten the pace towards breakeven, which has meant large layoffs at GoTo and a hiring freeze at Grab.

The key is to reduce long-term operational costs so that the benefit is not just a one-off but is extended into the future. The big cost items for tech players that can be reduced are typically related to human capital, IT, procurement and other fixed costs such as outsourcing of services and property rentals.

Reducing costs to the bone can be counterproductive if efficiency is sacrificed given that there are optimal levels of staffing and cloud capacity required for smooth operations.

Grab’s cost-cutting measures include a freeze on hiring, salary freezes for senior management, and cuts in travel and expense budgets, with the aim of getting leaner and fitter in its move towards sustainable and profitable growth.

GoTo has also adopted a series of cost-cutting measures, with the most extreme being the retrenchment of 12% of its workforce or around 1,300 people. In terms of non-people costs, the largest savings came from technology work streams, including renegotiating contracts on the cloud, software, and apps. It also consolidated its marketing spend on TV and digital media, as influencer spending across the platform.

Grab, which has been tapering down incentive spending, introduced a subscription service for GrabFood that offers a number of free deliveries and other non-monetary benefits. This has proved to be a successful strategy as it has already signed up 17% of users, by tying promotions to membership. The underlying aim is to reduce the number of freebies on offer.

Grab has also streamlined certain businesses including a pullback from its dark store strategy in favour of a more asset-light approach through retail partnerships. The focus of the online groceries business will be on the marketplace and catering to customers’ urgent needs similar to convenience stores but adding other services such as florists and chocolatiers but not as many big box-type groceries.

In Indonesia, Trans Retail gives Grab free real estate within Transmart stores, with a 5,000 sq ft area where it stores its inventory, which is mainly fast-moving SKUs. One area of potential conflict is the reduction of incentives and specifically in increasing delivery fees, which in some cases have gone through the roof, increasing by multiples, even for very short distances. This is almost certainly going to reduce demand, potentially leading to consumers switching back to offline habits and collecting food themselves.

Extreme moves by one player to increase delivery charges aggressively could easily lead to customers switching to other providers of the same service at a lower cost. This process of adjustment will be a fine balance for the players involved.

So far, the improved rationality has been greeted with optimism by market players but, at some point, those players with sufficient cash on hand may start to turn on promotions again in a limited fashion.