Maruti Suzuki ships 192,071 cars in first 9 months of FY2023, set to retain top exporter title

Maruti Suzuki India, which has seen its share in the domestic passenger vehicle market share decline to 42% in CY2022 from 45% in CY2021, and to 41% from 43.50% in the first nine months on the ongoing fiscal (April-December 2022), is seeing its market share increase substantially on the export front.

In fact, the company, which became the export market leader in FY2022 with shipments of 235,670 units, wresting the crown from Hyundai Motor India (FY2022: 129,260 units), is well placed to retain the PV export crown in FY2023.

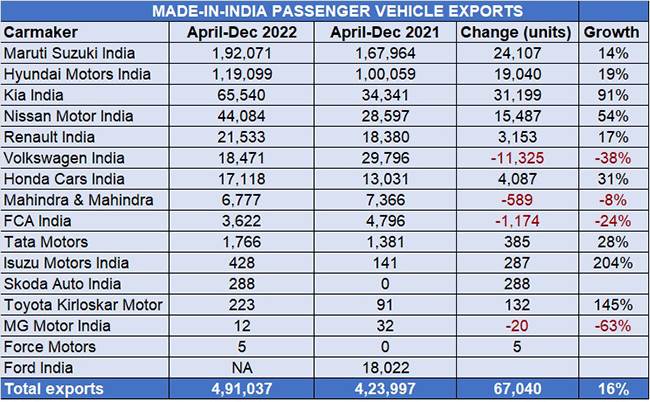

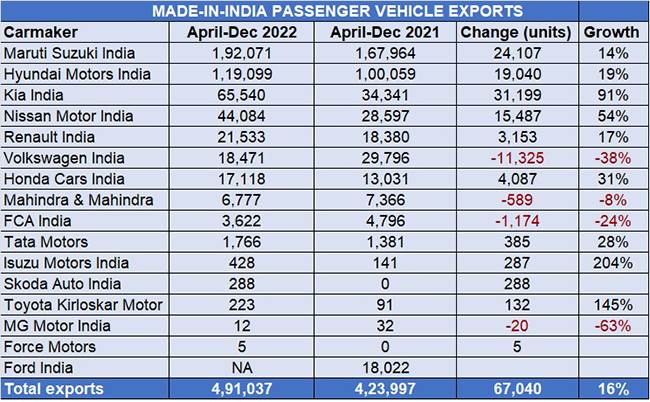

As per the latest industry export numbers released by apex body SIAM, Maruti Suzuki has shipped a total of 192,071 units between April and December 2022, up 14% YoY (April-December 2021: 167,964 units). These comprise 154,947 cars, 36,911 utility vehicles and 213 vans.

Maruti Suzuki currently exports 16 PVs, some of which see strong demand in regions like Africa, Middle East, Latin America and ASEAN. The models with the highest export demand are the Dzire sedan, the Swift, S-Presso and Baleno hatchbacks and the Brezza SUV.

With three months left for FY2023 to end, Maruti Suzuki is 72,972 units ahead Hyundai Motor India which has exported 119,099 units in the first nine months of FY2023. Given that FY2022’s 235,670 units were a record high and given that it has already achieved 81.50% of that, Maruti Suzuki is set to scale a new high in FY2023. In CY2022, the carmaker achieved its best-ever overseas shipments in a calendar year: 263,068 units, up 28% (CY2021: 205,450 units), surpassing the 200,000-units mark for the second consecutive year.

The carmaker is looking to accelerate its export numbers. Last month, it signed a five-year contract with Kamarajar Port Ltd (erstwhile Ennore Port), located on the Coromandel coast, about 24km north of Chennai Port, Chennai, for export shipments to Africa, Middle East, Latin America, ASEAN, Oceania and SAARC regions. Kamarajar Port will be used to export around 20,000 cars annually and becomes the fourth port, after Mumbai Port, Mundra Port and Pipavav Port, to be used by Maruti Suzuki for its overseas vehicle shipments.

Verna remains Hyundai’s top export model

In the April-December 2022 period, Hyundai Motor India has despatched a total of 119,099 units overseas, up 19%, comprising 86,337 cars (up 27%) and 32,762 UVs (up 2.70%). The Chennai-based OEM, which was the No. 1 exporter in FY2020 when it took the crown from Ford India, and also in FY2021, when it pipped a hard-charging Maruti Suzuki by just 9,404 units, will have to do a fair bit of catching up if it is to beat Maruti in the export game this fiscal.

While the trio of the Aura, i10 and the i20 saw exports of 54,392 units (up 21%), the Verna was the strong growth driver with 31,945 units (up 37%) and accounts for 27% of total Hyundai exports. However, the Creta and Venue numbers have seen a decline: the Creta with 19,520 units is down 20% YoY, and the Venue with 5,222 units is down 8%. The premium Alcazar SUV has 8,020 units to its export tally, up 360% YoY albeit on a lower base.

Kia exports 65,540 units, up 91%

At No. 3 position is Kia India with 65,540 units, up 91% (April-December 2021: 34,341). The midsized Seltos SUV, Kia’s longstanding best-seller in India, is also its most popular export model with 38,259 units (up 73%), followed by the Sonet compact SUV with 21,239 units (up 73%). Kia also exported 5,901 Carens and 141 Carnival MPVs.

Nissan Motor India exported a total of 44,084 units in the period under review, up 54% (April-December 2021: 28,597 units). The export-only Sunny sedan remains its best-selling model with 36,468 units (up 71%) or 83% of total exports.

The company also shipped 7,596 Magnite SUVs, up 29%. Nissan India’s overall export performance remains better than its domestic market sales: 25,364 units in April-December 2022. In end-July, the company recorded a key export milestone: shipment of its millionth vehicle manufactured at the Renault-Nissan Automotive India plant in Chennai. The export journey to the million-units milestone has taken a little less than 12 years.

At fifth place in the PV export rankings is Renault Motor India with 21,533 units and 17% YoY growth. It has seen demand for its Kiger/Triber SUVs grow 43% YoY to 14,119 units while the Kwid hatchback with 7,414 units saw sales decline 13% YoY.

Volkswagen India with 18,471 units, down 38% YoY (April-December 2021: 29,796), is at sixth place among the exporting carmakers. The company exported 13,183 units of the Vento/Virtus sedans, 4,193 Taigun SUVs and 1,095 Polo hatchbacks.

The only other carmaker with five-figure export sales is Honda Cars India with 17,118 units, up 31% (April-December 2021: 13,031). Demand for its City sedan is up 39% to 15,946 units, albeit that for the WR-V SUV fell 41% to 423 units from 714 units a year ago.

Growth outlook

Exports across vehicle segments will continue to be under pressure with the US dollar continuing to gain strength compared to local currencies. As per the World Economic Forum, the US dollar has risen by nearly 15% against some of the world’s most traded currencies which has prompted more interest rate hikes. Emerging economies with dollar-denominated debt balances have been particularly hit hard. This has meant that a number of countries in Asia and Latin America, which are key markets for Indian-made vehicles, have been compelled to introduce restrictions to reduce outflow of foreign exchange, which has impacted exports from India.

Total PV exports from India for the first nine months of FY2023 are 491,037 units, up 16% YoY. With the domestic market firing on all cylinders and recording robust growth, OEMs, which are now benefiting from improved supplies of semiconductors, are keeping their production lines humming. An uptick in export demand in the coming months will only further accelerate good times.