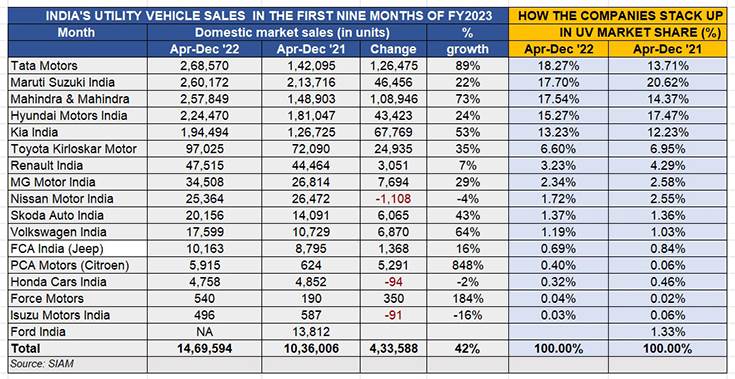

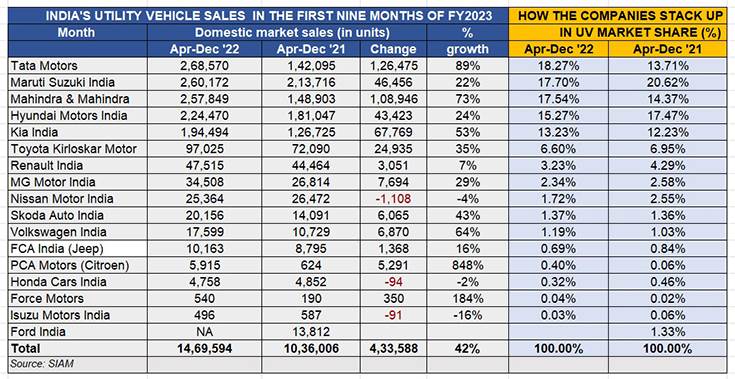

There is an exciting tussle underway for leadership in India’s booming utility vehicle (UV) market, which has seen sales of 14,69,594 UVs in the first nine months of the ongoing fiscal year, up a solid 42% year on year (April-December 2021: 10,36,006 units).

Of the 15 OEMs in the fray, four – Tata Motors, Maruti Suzuki, Mahindra & Mahindra, and Hyundai Motor India – have each sold in excess of 200,000 units in April-December 2022. But the first three are in a neck-and-neck battle for supremacy. Tata Motors is ahead of Maruti Suzuki by 8,398 units, and Maruti is ahead of Mahindra by just 2,323 units. Fourth-placed Hyundai is 33,379 units behind M&M at the end of December 2022.

As per the wholesales numbers released by apex industry body SIAM a few days ago, the the top five UV OEMs with six-figure sales – Tata Motors, Maruti Suzuki, M&M, Hyundai and Kia India – account for 12,05,555 units or 82% of total UV sales (see sales data table below), maintaining the ratio as seen in H1 FY2023. Riding on new products and increased market availability, Tata Motors and M&M are the ones which have made the maximum gains in April-December 2022.

Tata Motors: 268,570 units / up 89%

UV market share: 18.27%, up from 13.71% a year ago

Of these top five OEMS, Tata Motors, with 268,570 units has recorded the maximum YoY growth (89%), which has resulted in the company increasing its UV market share to 18.27% from 13.71% a year ago. The company has four UVs on offer of which the Nexon, India’s best-selling UV, has sold 127,888 units. It is followed by the Punch (99,750 units), Harrier (24,446 units) and Safari (16,486 units).

Maruti Suzuki India: 260,172 units / up 22%

UV market share: 17.70%, down from 20.62% a year ago

Maruti Suzuki, the overall PV market leader, which had the No. 2 UV position in Q1 FY2023 behind Tata Motors, is now in second place albeit by a small margin of 8,398 units.

In the ongoing fiscal which has seen the company impacted by semiconductor supply chain issues, Maruti has done well to sell 260,172 UVs in April-December 2022 (up 22%). However, its pace of growth is slower than both Tata and M&M, both of whom also have plenty more UV models. This means its UV share is down to 17.70% from 20.62% a year ago.

However, the company can be expected to claw back UV market share with its recently launched new Grand Vitara along with sustained demand for the new Brezza (the best-selling UV in September 2022) and the Ertiga, both of which are regulars in the Top 10 UVs list.

Mahindra & Mahindra: 257,849 units / up 73%

UV market share: 17.54%, up from 14.37% a year ago

Mahindra & Mahindra, with 257,849 units, is also an outperformer like Tata Motors in the ongoing fiscal. The period under review sees M&M increase its UV share – by three percentage points to 17.54% from 14.37% a year ago with robust 72% growth from 257,849 units.

M&M, which had a 260,000-units order back as of early November 2022, is ramping up manufacturing capacity to reduce the waiting period for popular models like the flagship XUV700, Scorpio N and Scorpio Classic, Thar, Bolero and Bolero Neo and the XUV300. With deliveries of the all-electric XUV400, the first proper rival to the Tata Nexon EV, slated to begin later this month, M&M should be making strong market gains.

Hyundai Motor India: 224,470 units / up 24%

UV market share: 15.27%, down from 17.47% a year ago

At No. 4 in the UV rankings is Hyundai Motor India with 224.470 units, up 24% YoY. The bulk of the company’s UV sales have come from the Creta, the No. 2 best-selling UV in India with 110,888 units, and the Venue compact SUV (89,894 units). These two SUVs together constitute 89% of Hyundai’s total UV sales.

Like Maruti Suzuki, Hyundai’s slower rate of growth compared to faster-growing rivals like Tata and Mahindra mean that its UV market share has reduced to 15.27% from 17.47% in April-December 2021.

Kia India: 194,494 units / up 53%

UV market share: 13.23%, up from 12.23% a year ago

Kia Motors, with 194,494 units and 53% YoY growth, is in fifth place and 29,976 units behind its Korean sibling. Like Hyundai, Kia too clocked its best-ever annual sales numbers in CY2022 but stiff market competition means its market share growth remains marginal.

Its first product, the Seltos midsize SUV remains its best-seller with 75,096 units, followed by the Sonet compact SUV with 66,322 units, the Carens MPV (50,064), Carnival MPV (2,582) and all-electric EV6 (430).

The two Korean carmakers’ combined UV market share is 28.5%, which is more than the combined 8.64% share of three Japanese players – Toyota, Nissan and Honda – in the Indian marketplace.

Toyota Kirloskar Motor: 97,025 units / up 35%

UV market share: 6.60%, down from 6.95% a year ago

Sixth-ranked Toyota Kirloskar Motor sold 97,025 UVs I April-December 2022, up 35% YoY. The bulk of the sales came from the popular MPV, the Innova Crysta (41,901), followed by the now-discontinued Urban Cruiser (April-September 2022: 22,158), Fortuner (20,456). The recently launched Hyryder sold 11,864 units in four months since launch. The company also retails the Hilux and the Vellfire.

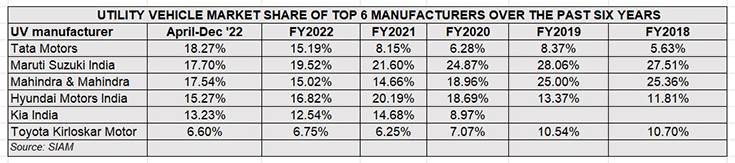

Strong shift in UV market share dynamics since FY2018

A close look at the UV industry’ sales over the past six years for the top six UV OEMs reveals interesting shifts – both in terms of the UV segment per se as well as company market share. From a share of 28% in overall passenger vehicle sales in FY2018, the UV segment now accounts for 51% of the PV market in April-December 2022. Every second car sold in India now is a UV compared to one in every four PVs sold barely four years ago.

UV sales, which hovered in the 925,000 units to 950,000 units range between FY2018 and FY2020, finally crossed the one-million milestone in FY2021 (10,65,750), improved that by 40% in FY2022 (14,89,178) and is set to hit a new high in FY2023, having already registered sales of 14,69,594 units (up 42%) units in the first nine months of the ongoing fiscal.

The past three years have also seen a resurgent Tata Motors make inroads into the market, eating into the share of established players – from the 6.28% UV share it had in FY2020, Tata has seen a three-fold increase to 18.27% in April-December 2022.

Mahindra & Mahindra has regained lost market share in the past couple of years. The UV major, which commanded 25% market share in FY2018, has seen its share fall to 14.66% in FY2021 but its strong showing over the past two years, on the back of new products, has seen it claw back its share to 17.54 in end-December 2022.

From the 28% UV share it enjoyed in FY2019, former UV market leader Maruti Suzuki has seen a sharp decline to 17.70% at present, particularly in the face of the stiff new competition from existing players and also entry from Kia India which has gone on to accumulate a 13% share in an expanding market.

Will FY2023 see sale of 2 million UVs?

Entering into the new year and the 10th month of FY2023, the UV industry’s sales are 530,406 units away from the 2-million milestone in FY2023. UV sales in CY2022 fell short of this big number by 77,234 units with total sales of 19,22,766 units. Hitting the 2-million mark will call for average monthly sales of 176,802 units which, while looking a tad difficult, just might come through.

Given that prices are slated to rise from April 2023 when RDE (Real Driving Emission) norms kick in, it is likely that SUV buyers might advance their purchase decisions. Also, the Union Budget, to be announced on February 1, could act as a catalyst for sales.

Meanwhile, with an estimated backlog of around 450,000 to half-a-million UVs (most of them with these top five players), vehicle manufacturers are putting their shoulder to the production wheel to keep their assembly lines busy and cater to demand. All in all, an exciting time for India UV Inc.