Tesla has just started what could become a major EV price war, and it could change the landscape as the automaker is in a great position to win that war.

The number one thing I hear from people that are interested in buying an electric car is that the price is high.

I always counter it by asking them how much they spend on gas and with those savings, the cost of ownership is often cheaper than a gasoline vehicle. However, a higher sticker price remains an important psychological barrier for many buyers even after considering the total cost of ownership.

On top of that, the average price of electric vehicles has been steadily increasing over the last two years thanks to high demand, supply chain issues, and general inflation.

But now things are starting to get interesting for the first time on the EV pricing front.

Tesla has implemented some significant price cuts across its entire lineup and in all markets. It almost reversed the price increases over the last few years entirely.

As we recently reported, the price drop has been working in the US where it also arrives at the same time as the new $7,500 tax credit for electric vehicles.

Tesla’s sales are surging following the price drop and now we are seeing other automakers following in the price drop. For example, Xpeng saw its sales drop during the week following Tesla’s price drop, and the company has now implemented important price drops, too.

Many experts are seeing this as the first few steps into the first ever EV price war.

Tesla is in a perfect position to win the EV price war

In a price war, it’s all about your ability to absorb price reductions and on that front, you can’t deny Tesla’s lead.

For years now, the automaker has been enjoying industry-leading gross margins and net profits.

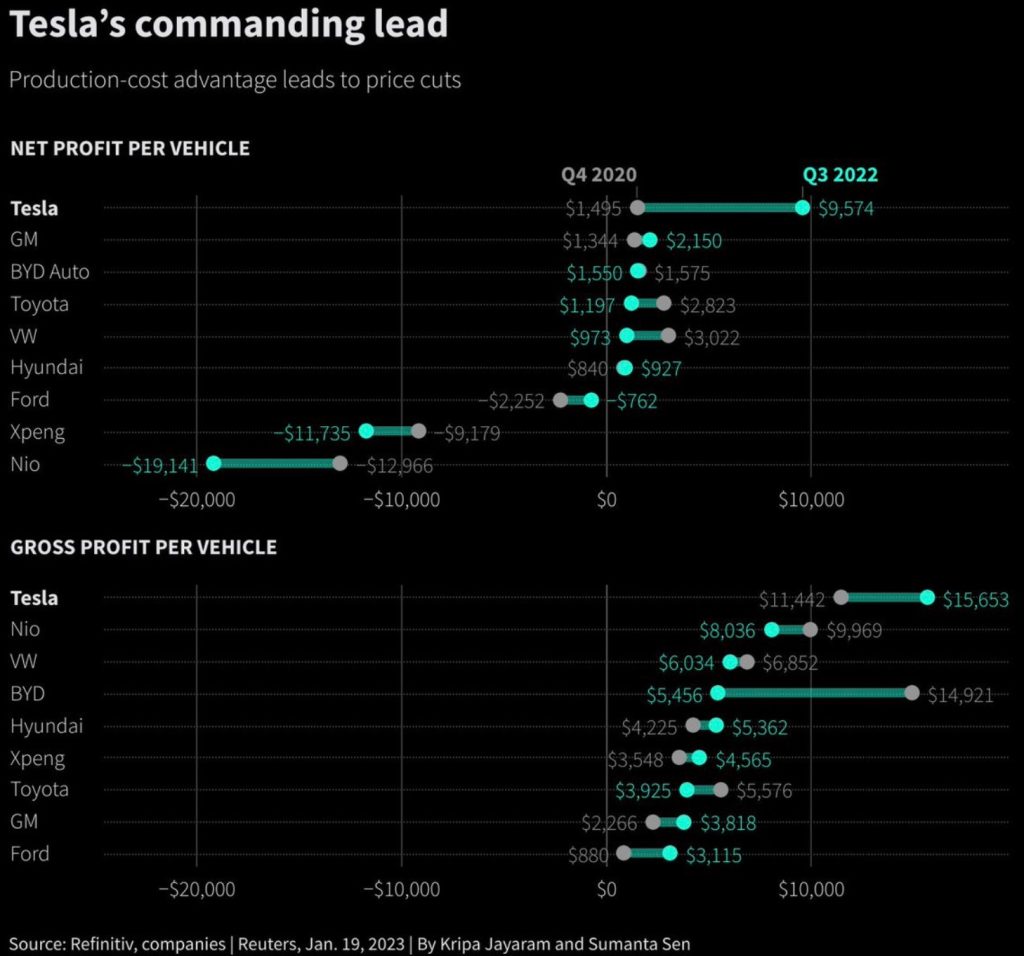

Here, Reuters put a chart together showing how Tesla’s gross margin and net profit compare to rivals in the auto industry:

That chart is impressive, but it doesn’t even tell the whole story.

Aside from companies like Nio and Xpeng, all the gross margins and net profits from the other companies also come from non-all-electric vehicles – meaning hybrids, PHEVs and gas-powered cars.

For companies like GM, which comes in second to Tesla in net profits, it is believed that its gasoline-powered vehicles have much higher margins than its electric vehicles.

Electrek’s Take

I’ve always said that I believe some big companies will fall during the electric revolution. I’m not saying that’s happening now, but if an EV price war heats up, I think we could see it happen.

I think Tesla still has a few wild cards that are questionable – Elon Musk is at the top of that list – but it is definitely Tesla’s war to lose.

FTC: We use income earning auto affiliate links. More.