/

Manchin introduced a bill that would temporarily block the government from handing out the $7,500 tax credit for new EV purchases while also clawing back the credit from some people who have already received it.

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24385735/1246485565.jpg)

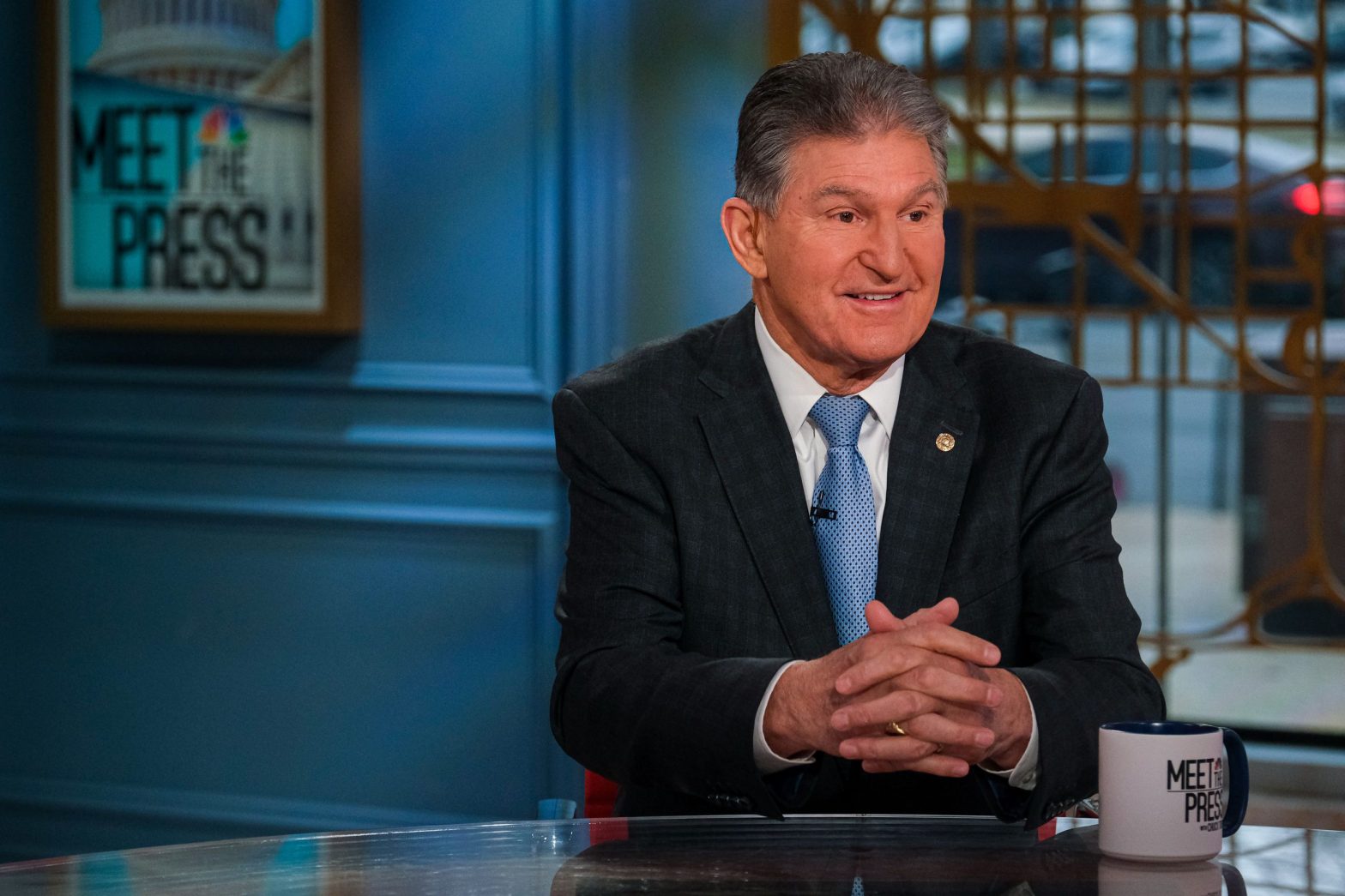

West Virginia Senator Joe Manchin (D) introduced a new bill that would halt the current electric vehicle tax credit until strict new battery requirements are put in place. It’s the latest move by the conservative Democrat to limit the government’s ability to incentivize car buyers to shift to less polluting vehicles.

Manchin, who had a hand last year in crafting the EV tax credit that was included in the Inflation Reduction Act (IRA), placed the blame on the Internal Revenue Service for blowing past its December 31st, 2022 deadline to release guidance on the battery requirements.

Under the IRA, only electric vehicles with battery materials sourced from the US and its approved trading partners would qualify for the $7,500 credit. The IRS said it needed a little extra time figuring out how to enforce those rules, but Manchin is having none of it.

“It is unacceptable that the U.S. Treasury has failed to issue updated guidance for the 30D electric vehicle tax credits and continues to make the full $7,500 credits available without meeting all of the clear requirements included in the Inflation Reduction Act,” the senator said in a statement.

Under the IRA, the full $7,500 EV tax credit that was due to take effect on January 1st is only available to cars assembled in North America. But it’s also contingent on the batteries meeting two factors that are each good for $3,750.

One half is based on the EV battery having at least 40 percent of its critical minerals sourced in the US or one of its free trade partners; the other half is based on the EV battery having at least 50 percent of its components manufactured or assembled in North America. Those percentages are meant to scale up in the coming years as well. This is because the IRA seeks to make certain that batteries are sourced and built in North America, not just the cars themselves.

But because the IRS has delayed putting those specific rules into effect, Manchin has clapped back. He introduced a bill that would immediately implement the new battery requirements. It would also claw back the credit from any consumer that received it after purchasing an EV that didn’t satisfy the domestic sourcing requirements. The tax credit was already a confusing morass of eligibility requirements and sourcing provisions, as well as income caps, sticker price requirements, and battery and supply chain limitations. Automakers were worried the law would ultimately stymie EV sales, but Manchin appears unfazed by these concerns.

If you’ll recall, the West Virginia Democrat is largely opposed to the EV tax credit and couldn’t give a toot whether people buy more Tesla Model 3s because of it. He sees the IRA as an “energy security bill” that’s meant to incentivize automakers to invest in EV manufacturing in the US rather than rely on a supply chain that snakes through all sorts of countries, but mostly China.

“The United States is the birthplace of Henry Ford who revolutionized the automotive industry with the Model T,” Manchin said. “Being an automotive powerhouse is in our blood which is why it is shameful that we rely so heavily on foreign suppliers, particularly China, for the batteries that power our electric vehicles.”

It’s unclear how the auto industry will react, though it’s unlikely to be positive. (The Auto Innovation Alliance and the Zero Emissions Transportation Association both declined to comment.)