Dealmaking in the crypto sector fell in the fourth quarter of 2022 as startups sealed 182 deals, down 46.2% from the previous quarter, according to Cointelegraph’s latest report on venture capital investments in the space.

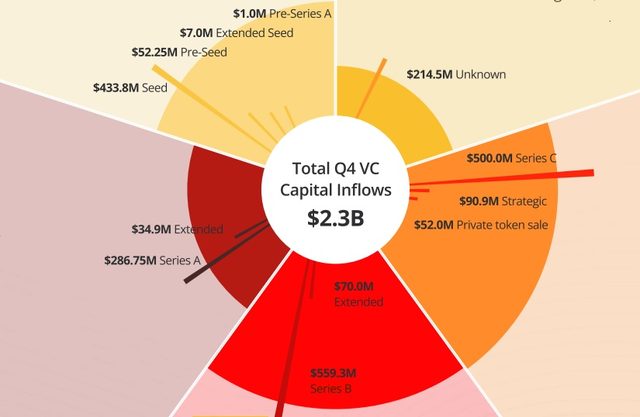

The total capital inflows into global crypto startups in the December quarter stood at $2.3 billion, down 53.8% sequentially and hitting a two-year low, the Venture Capital Report: 2022 stated.

The significant drop in venture capital investment wraps up a year that witnessed a series of meltdowns — from crypto lender Celsius Network, hedge fund Three Arrows Capital, crypto broker Voyager Digital, crypto exchange FTX, and crypto lenders BlockFi, Hodlnaut and more.

VC investments in the crypto sector for the entire 2022 stood at $36.6 billion, up 20% from $30.5 billion in the previous year thanks to strong fundraising in the first half of the year.

“Headwinds started to slow the progress [of the crypto sector] at the start of Q2 with the Terra collapse and the contagion that followed. The positive news story is that despite the drawdown in investment, it is still above levels seen in the past few years,” the report said.

Web3 recorded the most deal activity with 68 deals worth $632 million in Q4; while centralised finance (CeFi) was the least active vertical, logging only 15 deals worth $27.4 million, per the report.

Despite the low deal volume, CeFi startups amassed as much as Web3 startups in 2022 — $9.2 billion each — as the average deal size in CeFi stood at $46.6 million vs $15.4 million for Web3.

Singapore-based crypto trading and lending platform Amber Group bagged the biggest deal of Q4, snapping $300 million in Series C funding, in a bid to protect clients affected due to the collapse of FTX. The round was led by Shanghai-based Fenbushi Capital US and joined by other blockchain-focused venture capital investors and family offices.

Only four other deals in Q4 crossed the $100 million mark, per the report.

The fewer number of $100 million+ deals, compared with the previous quarters, led to a sharp fall in the average deal value in the fourth quarter.

Average crypto deal value per quarter (2022)

Series B funding rounds garnered the most interest in Q4 in terms of fundraising — $629.9 million. The Series C stage followed at $500 million but only comprises two deals: Amber Group at $300 million and Matter Labs at $200 million (see table above).

Crypto fundraising by stage in Q4 2022

The data coincides with a series of job cuts at major crypto exchanges in a bid to cut costs, including the likes of Crypto.com, Coinbase, OSL, Amber Group, Luno, and Gemini, signifying a further market slowdown.

Coinbase Ventures, Polygon, and Polychain Capital were among the top three most active crypto investors in 2022, per the report.