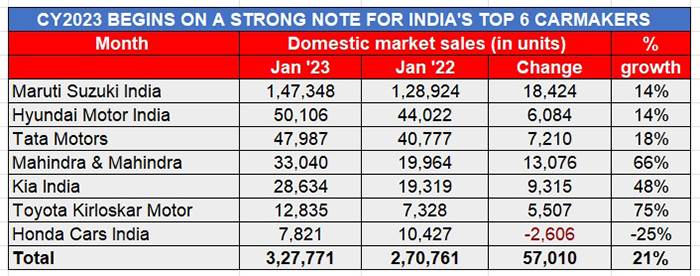

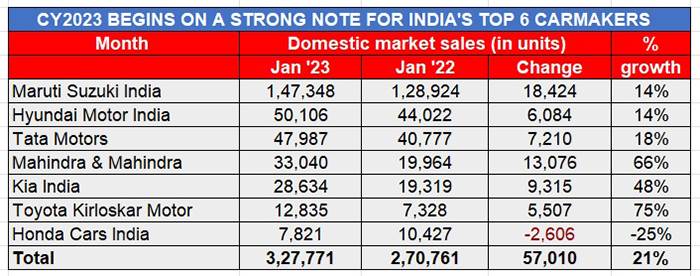

India’s passenger vehicle industry exited CY2022 on a very strong note – over 3.8 million units and 24% year-on-year growth. Now, the top six players, some of whom recorded their best-ever annual sales last year, are maintaining their ‘run rate’ in CY2023.

The top six players – Maruti Suzuki, Hyundai Motor India, Tata Motors, Mahindra & Mahindra, Kia India and Toyota Kirloskar Motor – together account for 90% of the total PV market.

What’s common to this six-pack is that their product range includes popular SUVs and, given the sustained and surging demand for this vehicle category, it is imperative they do well in the marketplace. Let’s look at how each of them fared in January 2023.

Maruti Suzuki India – 147,348 units, up 14%

Having closed CY2022 with its lowest monthly sales last year – 112,010 units in December 2022 – Maruti Suzuki India saw its sales recover smartly to 147,348 units in January 2023. This constitutes 14% year-on-year growth (January 2022) and is the second-best monthly performance in the ongoing fiscal year after the 148,380 units in festive September 2022.

What has helped the passenger vehicle market leader is the return of demand for its entry-level cars – the Alto and S-Presso – 25,446 units, up 37%. Following the company’s launch of the CNG variant of the S-Presso in October 2022 and the third-generation Alto K10 in November, both models are seeing increased customer interest.

Maruti Suzuki’s six-pack comprising the Baleno, Celerio, Dzire (and Tour S), Ignis, Swift and Wagon R sold a total of 73,840 units, up 3% (January 2022: 71,472) while the premium Ciaz sedan continued to fall – 1,000 units, down 40% (January 2022: 1,666)

The UVs – new Brezza, Ertiga, XL6 and the new Grand Vitara – contributed 35,353 units, up 33% on year-ago 26,624 units. Maruti Suzuki is witnessing strong demand for the new Grand Vitara (which now also has a CNG variant) and the new Brezza. The Eeco van with 11,709 units cl growth: 10,581 units, up 15% on year-ago wholesales of 9,165 units.

It is understood that the company currently has an order backlog of around 350,000 PVs. Over the past couple of months, production was constrained intermittently by inadequate chip supplies. Given the stiff competition, particularly in the UV market, it will have to speedy rollout of vehicles if it is to capitalise on market demand.

Hyundai Motor India – 50,106 units, 14%

Recording a similar growth rate as the PV market leader, Hyundai Motor India reported domestic market sales of 50,106 units (January 2022: 44,022 units). This is the second instance of the company surpassing the 50,000-unit sales mark in the ongoing fiscal year, having previously done so in July 2022 (50,500 units).

Tarun Garg, Chief Operating Officer, Hyundai Motor India said, “We have begun CY2023 on a high note recording double-digit growth in January. The recent launch of the Hyundai Ioniq 5 has generated high customer excitement and registered excellent booking numbers, fortifying our commitment towards bringing benchmark EVs for the Indian market.”

According to the company, its SUVs – Creta, Venue, Tucson, Alcazar and Kona Electric – continue to maintain strong sales momentum in their segments. This lot of five SUVs together sold 27,532 units in January, which accounts for 55% of total PV sales

Tata Motors – 47,987 units, up 18%

Tata Motors, which achieved its highest-ever sales for a calendar year in 2022 with 526,798 units and 50% year-on-year growth, is continuing its accelerated run in 2023. The carmaker has announced sales of 47,987 units in January 2023, up 18% (January 2022: 40,777 units) including an estimated 3,831 EVs. This is its best-ever monthly market performance and betters the 47,654 units it recorded in the festive month of September 2022.

The company, which retails seven PVs – Altroz, Tigor, Tiago, Nexon, Punch, Harrier and the Safari – in the domestic market, has capitalised on surging demand for its SUVs, particularly the Nexon and the Punch which are currently the best-selling and the No. 4 SUVs in the Indian market.

What has also helped Tata Motors’ accelerated growth is its first-mover advantage in the fast-growing electric vehicle market, where it has an over 80% market share. The company currently retails the Nexon EV, Tigor EV and Xpres-T (for fleet buyers) and has also recently launched the sub-Rs 10 lakh Tiago EV. Tata Motors, which has an order book of 20,000 units for the electric hatchback, has commenced deliveries of the sub-Rs 10 lakh electric hatchback this month. Given the additional volumes from the new car, Tata Motors could well cross the 50,000-unit monthly sales mark for the first time in February. And it is on track to achieve 500,000 sales in FY2023.

Mahindra & Mahindra – 33,040 units, up 65%

Mahindra & Mahindra reported wholesales of 33,040 units in January 2023, up 65% over the year-ago 19,964 units. This, the company says, is “despite disruptions in supply chain of crash sensors and airbag ECUs due to availability of semiconductors.”

Veejay Nakra, President, Automotive Division, M&M, “The Thar RWD and our first all-electric SUV, XUV400, have received a very encouraging response from our customers in the first month of 2023. Our utility vehicles saw a growth of 66%. We continue to keep a close watch on the dynamic supply chain situation.”

Kia India – 28,634 units, up 48%

Kia India, which notched its best-ever annual sales of 254,556 units and 40% year-on-year growth in CY2022, is continuing its strong performance in CY2023. The Korean carmaker has recorded its highest-ever domestic monthly sales of 28,634 units in January 2023, which is a 48% YoY increase over January 2022 numbers. The company’s previous monthly best was 25,857 units in September 2022.

Kia India’s top two models – the Seltos and Sonet – led the company’s performance in January 2023 with sales of 10,470 and 9,261 units, respectively. Both SUVs are among India’s best-selling utility models and were ranked seventh and ninth, respectively, in the Top 25 UV List for 2022.

The Carens MPV, which was launched on February 15, 2022, recorded its best-ever monthly sales of 7,900 units and cumulative sales of 70,656 units in less than a year. The Carnival MPV sold 1,003 units last month.

Toyota Kirloskar Motor – 12,835 units, up 175%

At 12,835 units, Toyota Kirloskar Motor posted triple-digit growth of 175% over January 2022’s 7,328 units and 23% month-on-month growth over December 2022’s 10,421 units. Last month saw the company open bookings for the Hilux and the Toyota Innova Crysta, while also announcing the prices for the CNG variants of the Urban Cruiser Hyryder which is witnessing strong demand.