Sales of passenger cars and SUVs reach 64,147 units, 26% less than in January 2020 before the first confinements.

Registrations of light commercial vehicles achieved in the first month an increase of 34.8% more in the month, with 9,357 sales

Sales of industrial vehicles, buses, coaches and minibuses rose 20.9% in January with 2,764 units

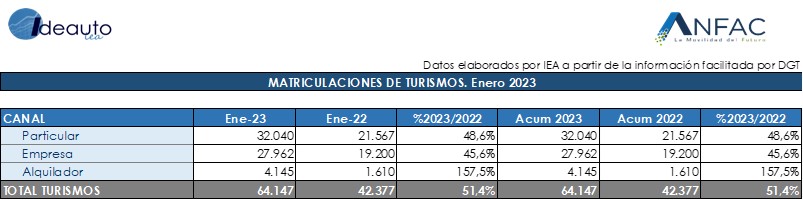

Madrid, February 1, 2023. The passenger car and SUV market starts the year with a 51.4% increase in sales and a total of 64,147 units sold. This strong increase is partly due to the units sold in December and that were registered in the first month, but mainly because the market volume of the previous year was at very low levels due to the microchip crisis and of transport bottlenecks. Compared to the pre-pandemic figures, the month of January 2020 recorded 86,443 units sold, which is 25.8% lower than the first month of this year.

The average CO2 emissions of passenger cars sold in January remain at 118.3 grams of CO2 per kilometer traveled, 0.13% lower than the average emissions of new passenger cars sold in the same month of 2022.

Regarding registrations by channels, all registered a notable increase compared to the previous year but less compared to January 2020. Sales to individuals stood at 32,040 registered units, with an increase of 48.6%, but with a 21% drop compared to January pre-pandemic. Similarly, the market to companies with 27,962 sales stands at an increase of 45.6% compared to the previous year, but with a decline of 14.7% compared to 2019. For its part, sales to rent-a- Due to the sharp drop last year, cars managed to grow 157.5% with 4,145 registrations, but with a decrease of 68.4% against the data from January 2019.

LIGHT COMMERCIAL VEHICLES

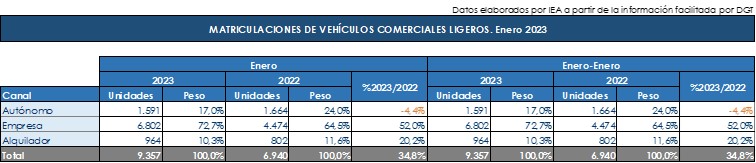

Registrations of light commercial vehicles totaled 9,357 units in the first month of the year, which represents an increase of 34.8% compared to last year. Regarding sales by channel, only those aimed at the self-employed suffered a decrease of -4.4%, while registrations for companies and renters grew by 52% and 20.2%, respectively.

INDUSTRIAL AND BUSES

For the first month of 2023, the registrations of industrial vehicles, buses, coaches and minibuses achieved an increase of 20.9%, with a total of 2,764 units, maintaining the positive rhythm with which it closed the previous year. By type of vehicle, industrial vehicles registered 2,473 new registrations (+16.2%), and in the same way, sales of buses, coaches and microbuses managed to rebound by 83%, with 291 sales.

Félix García, ANFAC’s director of communication and marketing, explained that “we started the year with an increase in sales of over 50%. It is a good fact, but you have to see it in perspective. The effects of the pandemic and Filomena in the months of January of previous years distort the reality of the vehicle market in Spain. The relevant fact is that we are still 26% below the figures for January 2020 when we were not yet aware of the Covid-19. This 2023 is a key year for the recovery of the automotive sector. Sales directed to the private channel are still very low and it is necessary to see how much of the increase produced in January is due to vehicles that were not distributed in the last months of 2022. It is true that the increase in inflation is an important determinant for the purchase decision of families, but it is necessary to establish measures that serve as an incentive, both from the economic and fiscal spheres, to alleviate this inflationary pressure. We are facing a complex year, but a year where the political decisions that are made will be key to the future of our industry and its employees.”

Raúl Morales, communication director of FACONAUTO, indicated that “The strong increase in sales at the start of the year actually reflects how unstable the automotive market is, since it is mainly due to the fact that, in January, there have been The units that were no longer registered in December due to problems with the transport of vehicles from the factories and logistics centers to the dealers have been counted. Therefore, we cannot speak of a change in trend because the context that weighed down the market remains the same and what is foreseeable is that, in the coming months, we will once again see a very low level of registrations”.

According to GANVAM’s communication director, Tania Puche, highlighted that “the turn of the year has brought with it a change in the trend in registrations, which has allowed us to face the dreaded January slope, growing in double digits, after a 2022 to forget. We cannot launch the bells on the fly because we are still well below the pre-pandemic levels and the 100,000 monthly units that, in theory, would correspond to our market by level of motorization, population and per capita income. In addition, it must be taken into account that January 2022, with which we are making the comparison, was the second worst January in more than two decades due to the chip crisis. Therefore, we have to receive this improvement with caution because the tensions in the supply chain and in the logistics chain are still present. The improvement in these bottlenecks is what will alleviate a market that faces the year 2023 with a lot of uncertainty”.