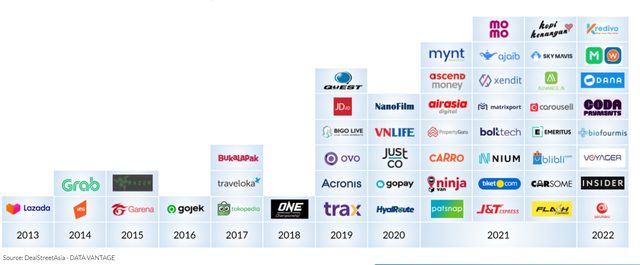

Only eight privately-held Southeast Asian startups earned the much sought-after unicorn tag in 2022 — a year marked by down rounds and a slowdown in private market funding, especially in the late stages.

In comparison, in 2021 there were a record 23 startups from the region that crossed the $1 billion valuation mark “amid a liquidity glut that drove a funding frenzy”, according to the SE Asia Deal Review: Q4 2022 report by DealStreetAsia DATA VANTAGE.

Akulaku, Insider, Voyager, Biofourmis, Coda Payments, DANA, LINE MAN Wong Nai, and Kredivo were the new unicorns minted last year.

Unicorns minted in Southeast Asia by year

Unicorns by country

Singapore and Indonesia produced the most unicorns — three each — in 2022. Thailand, which christened its first unicorns — Flash Express and Ascend Money — in 2021, saw the emergence of one unicorn (LINE MAN Wongnai) in 2022.

The Philippines, too, minted one unicorn (Voyager Innovations) in 2022. The country’s first unicorn emerged in 2021 after payments app Mynt raised over $300 million in a funding round that valued the company at over $2 billion. Mynt’s unicorn funding round, in November 2021, was co-anchored by Warburg Pincus and Insight Partners.

At 25, Singapore is now home to the most unicorns in the region, followed by Indonesia (16), Vietnam (4), Thailand (3), the Philippines (2), and Malaysia (2).

The distribution of 2022’s new unicorns by headquarters was also reflective of the countrywise fundraising pattern. At $9.79 billion, Singapore’s startups raised the most funds last year, followed by Indonesian startups that amassed $3.77 billion. The two countries accounted for around 86% of the overall equity fundraising of $15.8 billion in the year.

Unicorns by sector

Five of the eight new unicorns were from the fintech sector (see first table above). This again is reflective of overall fundraising activity in the region. Fintech was the top sector by funding value and funding volume last year. Startups in the sector amassed $5.01 billion from 233 deals.

Top fundraisers

Among the new unicorns, Singapore-based Coda Payments was the top fundraiser (see first table above). In April last year, Insight Partners, Smash Capital and Singapore sovereign wealth fund GIC invested $690 million to acquire a minority stake in the online payment solutions provider.

Perched in second place were Indonesia’s Akulaku and Singapore’s Biofourmis, which raised $300 million each last year.

Six of the unicorns were also among the top 20 Southeast Asian startup fundraisers of 2022.

The fall in the number of new unicorns was part of an overall decline in fundraising activity in 2022. Total private funding in Southeast Asian startups declined 32% to $15.8 billion from 2021’s record high of $23.2 billion, showed the DATA VANTAGE report.