Thailand’s online fashion platform Pomelo issued Series D preference shares worth $13.9 million to investors early this month, according to its filing with Singapore’s Accounting and Corporate Regulatory Authority.

The shares were allotted to investors that had participated in a convertible loan issue in July 2021. They include Thailand’s Central Group, Hong Kong-based Provident Growth and L’OCCITANE Group vice-chairman Andre Hoffman.

We had earlier reported that Pomelo had upsized the fundraising target of its Series D round from $20 million to $50 million. However, its share price is down 43.5% from its Series C financing.

In addition, Pomelo is seeking to raise $3 million in venture debt from Malaysia-domiciled Iris Fund LP, which is co-managed by Paris-based Iris Capital Partners and South Korea’s Hanwha Asset Management.

The Thai company in December amended the liquidation preference for Series D investors from 150% of the original subscription price per share earlier to 300%. Liquidation preference specifies which investors get paid first and how much they get paid in case of a liquidation event, which could be an acquisition or an initial public offering (IPO).

Pomelo is currently valued at over $400 million.

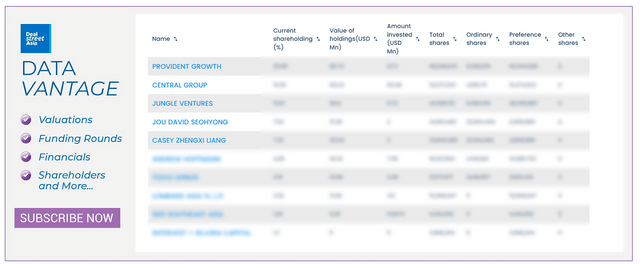

Top shareholders in Pomelo

Indonesian fintech lending firm Komunal issued shares worth $7 million last week to investors that backed its latest funding round, which was announced in January.

The $8.5 million round comprised $6.5 million in fresh equity funding and additional shares issued to East Ventures (Growth Fund) for a $2 million loan provided to Komunal earlier.

The Indonesian venture capital firm led the round with a $4 million equity investment through its growth fund. Other investors include AlphaTrio Sustainable Technology Fund, Skystar Capital, Sovereign’s Capital, Ozora and Gobi Partners.

Komunal is a digital platform that aggregates the services of multiple rural banks in Indonesia, locally known as Bank Perkreditan Rakyat (BPR), where customers can both deposit as well as borrow funds.

Other updates from DATA VANTAGE

VFlowTech, a Singapore-based provider of vanadium-based redox flow batteries, on Tuesday announced a $10 million Series A round. Its regulatory filings show that lead investor Real Tech Holdings contributed $2.25 million to the financing, as did SEEDS Capital.

Other Series A backers include Wavemaker Partners, VFlowTech chairman Michael Gryseels and İnci Holding. VFlowTech has appointed Real Tech Holdings’s Louis Christian Murayama to its board of directors.

Singapore-based waste management company Blue Planet Environmental Solutions received nearly $9 million last week from Kaizenvest and a joint vehicle of Sing Lun Industrial and Mizuho Asia Partners.

Ampotech, a Singapore-based company that develops carbon data analytics to help companies improve energy efficiency, issued fresh shares last week to KSL Maritime Ventures, the venture arm of Malaysia’s Kuok Group, and existing backer Earth Venture Capital.

Indonesian aquaculture startup Delos issued shares worth $6.2 million last week to investors that took part in its seed round extension last year. The $8 million financing comprised $5.7 million in fresh equity funding and conversion shares for noteholders.

Investors that received the shares last week include Centauri, a joint fund of MDI Ventures and South Korea’s KB Investment; Alpha JWC Ventures; Mandiri Capital; and Telkomsel Mitra Innovasi (TMI).

Singapore-based equity and debt crowdfunding platform FundedHere received over $581k from Starland Axis, a subsidiary of publicly listed financing firm Luminor Financial Holdings, last week. In February last year, Luminor had announced its intention to acquire a 71.55% stake in FundedHere. It disclosed in August that the companies had extended the long-stop date for the deal to February 11, 2023.

VIZZIO Technologies, a company that publishes 3D digital models of buildings and cities, received $1 million in fresh funding last week.

Singapore-based regtech startup Lexagle has secured more capital from a number of individual investors, bringing its total funding to date to over $5 million.