Indian EV industry opens CY2023 with retail sales of over 100,000 units

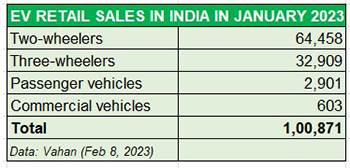

Having surpassed retail sales of a million or 10 lakh units for the first time in CY2022, the Indian electric vehicle industry has opened CY2023 with a better monthly average. In January 2023, as per published data on the Vahan portal, the EV industry clocked cumulative sales of 100,871 units, which works out to a daily sale of 3,253 units across four segments – two- and three-wheelers, passenger vehicles and commercial vehicles.

While electric two-wheelers accounted for 63.90% of total retails last month, three-wheelers contributed 32.62%, with the balance being split between passenger vehicles (2.87%) and commercial vehicles (0.59%).

Let’s take a quick look at the numbers and company performance, segment-wise.

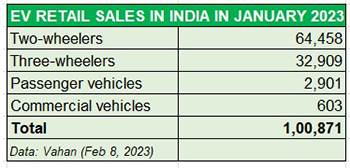

Electric 2-wheelers: 64,458 units – Ola tops, TVS jumps to No. 2 position

At 64,458 units sold in January 2023, last month’s retail sales of electric two-wheelers were 633 units down on December 2022’s 65,091 units. There are around 91 EV OEMs listed in this EV category in which the Top 10 really dominate the market. In January, they accounted for 58,666 units or 91% of total sales, leaving the balance 9 percent to 81 other players.

Ola Electric, with 18,282 units, has opened CY2023 on a strong note – it clocked its best-ever monthly sales in January, bettering the previous best of 16,359 units in November 2022. Last month’s performance gives it a 28% market share.

In second place is a hard-riding TVS Motor Co with 10,423 units – this is also the company’s best-ever monthly retails, improving on December 2022’s 8,720 units. This robust performance has helped TVS jump four ranks from its sixth position in CY2022 to No. 2 in January 2023. Its wholesales at 12,169 units last month were also its highest monthly numbers, which means it is maintaining good inventory levels of its iQube e-scooter at its dealerships.

Ather Energy, with 9,169 units, is ranked third with its best-ever monthly retail sales. The Bangalore-based EV OEM continues to witness strong month-on-month growth. Since October 2022, it has consistently surpassed 7,000-unit sales each month and has reported strong consumer demand in markets like Kerala, Maharashtra and Karnataka.

Hero Electric (6,395 units) and Okinawa Autotech (4,405 units) take fourth and fifth ranks respectively. Both OEMs have seen much higher monthly numbers in CY2022 and were among the Top 3 not very long ago. The slowed-down sales are an impact of the FAME-II subsidy being revoked for these two companies.

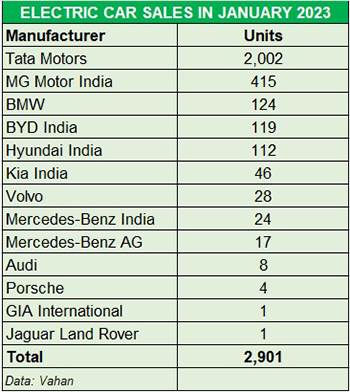

Electric 3-wheelers: 32,909 units – Mahindra leads, YC Electric a strong performer

The three-wheeler category, which has seen the biggest shift to e-mobility as a result of the lower-cost-of-ownership mantra, sold a total of 32,909 units in January. Proof of their growing demand is that EVs accounted for 46.18% share of total three-wheeler sales (including ICE variants) in January, up from 42% (17,779 units) a year ago.

In comparison, IC engine three-wheeler market share (35,405 units in January 2023) stands reduced to 53.81% in January 2023 from 57.14% a year ago. The FAME 2 subsidy along with demand for last-mile operations is fuelling healthy growth. And, interestingly, there are as many as 334 companies selling electric three-wheelers in India.

With 2,824 units, Mahindra & Mahindra (combined M&M and Mahindra Electric) leads the three-wheeler table, indicating the growing demand for its passenger and cargo-carrying EVs. Other players which recorded four-figure sales included Saera Electric Auto (1,663 units), Dilli Electric Auto (1,336 units), Champion Polyplast (1,121 units) and Mini Metro EV (1,171 units).

Ten companies sold over 500 units each last month (see data table below), while there are plenty more with sales below that number.

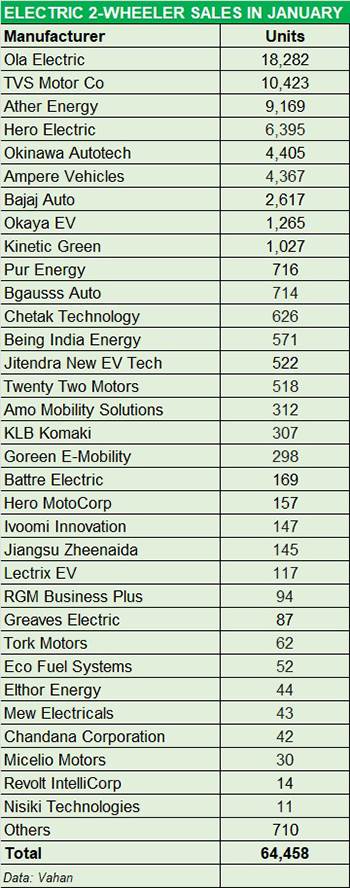

Electric PVs: 2,901 units – Tata Motors leads, MG takes 14% share, BYD checks in

In CY2022, the electric passenger vehicle segment accounted for retails of nearly 38,000 units, averaging 3,166 units and a near-4% share of the overall EV market. Tata

Tata Motors, the market leader and the OEM with the biggest EV portfolio in India in the form of the Nexon EV, Tigor EV, Tiago EV and the Xpres-T (for fleet buyers), retailed 2,002 units. MG Motor India with 415 units is the firm No. 2 in the segment and had a 14% share of the sales last month. Meanwhile, BYD India, which launched the Atto 3 SUV in November, has begun deliveries and chalked sales of 119 units.

Growth outlook

The shift from IC engine vehicles to EVs is underway in India, which has outlined EVs to account for 30% of its mobility requirements by 2030. This industry momentum is being driven by the FAME scheme, state subsidies and a growing portfolio of products across vehicle segments.

The domestic EV industry’s sales growth can be attributed to an increase in the availability of products, high petrol, diesel and CNG prices, state subsidies and sops offered under FAME II. Growing consumer awareness about the need to use eco-friendly transport and the wallet-friendly nature of EV cost of ownership over the long run is a big catalyst to adoption of electric mobility.

Given the Union Budget 2023’s focus on this segment of the automobile industry, the increased allocation of the FAME II subsidy should help accelerate sales of EVs across sub-segments.

The Auto Expo 2023, held last month, was a veritable showcase of EVs to come in the near future, which augurs well for the industry. Meanwhile, recognising the huge business potential, component manufacturers are fast upping the ante on localising EV parts, either through full ground-up development or through technology licences. This will led to enhanced optimisation of costs and in turn EV affordability.