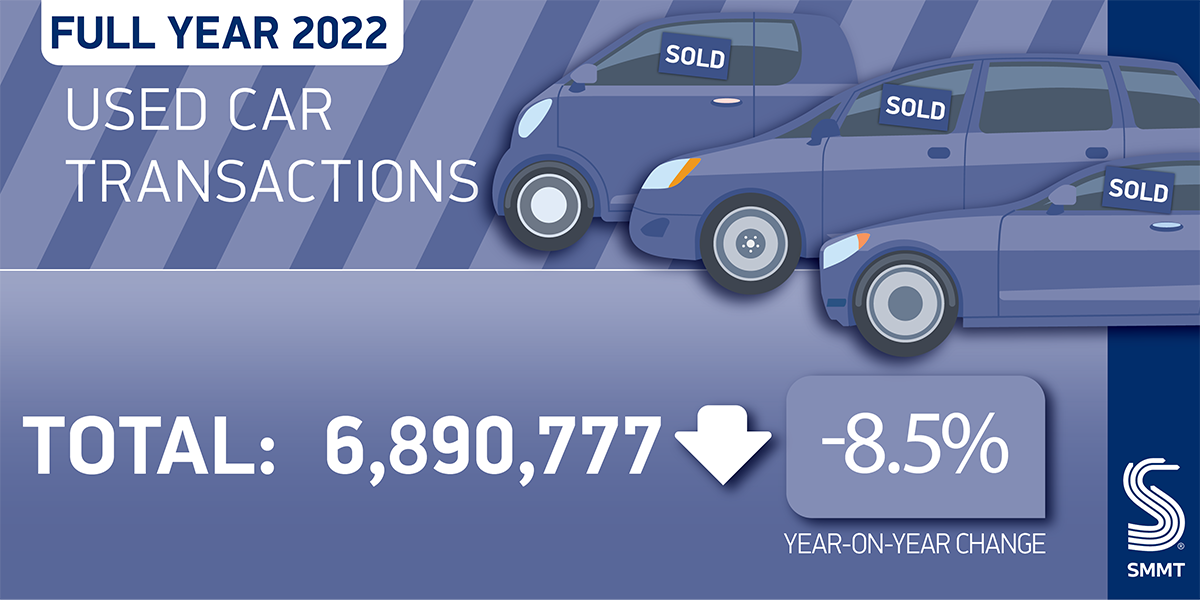

- Used car transactions fall -8.5% in 2022 with 6,890,777 units changing hands as supply chain restraints curtail market.

- Record demand for used electrified vehicles, as transactions of BEVs soar by 37.5%, HEVs rise 8.6% and PHEVs grow 3.6% against 2021 performance.

- Q4 decline moderates to -4.3%, with 0.8% growth in December, signposting recovery in 2023 as improving new car market adds stock

Download the used car sales report for Q4 2022

The UK’s used car market declined in 2022, down -8.5% to 6,890,777 transactions, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The performance saw 640,179 fewer vehicles changing hands than in 2021, and remains -13.2% off 2019’s pre-pandemic total, as the squeeze on new car supply – primarily due to the global shortage of semiconductors – restricted stock entering the second-hand market.1

Transactions increased by 0.8% in December in the first monthly rise since February, and while Q4 was down -4.3%, the third successive quarterly decline, it was not as steep as in quarters two (-18.8%) and three (-12.2%).2 This reflects the renewed growth seen in the new car market, helping more vehicles enter used car stock.

Fuel Types

Used battery electric vehicle (BEV) transactions bucked the overall trend, recording their best-ever annual performance with a record 71,071 units finding new owners in 2022, a rise of 37.5%, and boosting their overall market share to 1.0%, from 0.7% in 2021. Robust demand for other alternatively fuelled vehicles continued, too, with sales of hybrid electric vehicles (HEVs) rising 8.6% and plug-in hybrid electric vehicle (PHEVs) transactions up 3.6%.3

Combined, however, electrified vehicles represented just 4.1% of the market (up from 3.3% in 2021) and while transactions of used diesel and petrol cars fell by -11.8% and -7.7% respectively, they remained the dominant powertrains with a combined 6,594,880 units changing hands.4

Mike Hawes, SMMT Chief Executive, said,

While the market headlines are negative, and reflective of the squeeze on new car supply last year, record electrified vehicle uptake is a bright spot and demonstrates a growing appetite for these models. With new car registrations growth expected this year, more of the latest low and zero emission models should become available to second owners. Accelerating uptake is key and will be dependent on drivers being assured of a positive ownership experience. This means ensuring charging infrastructure keeps pace with demand as more new and used car buyers make the switch to zero emission motoring than ever before.

Used car buyers went back to black as it proved to be the most popular colour for the year, accounting for a fifth (21.6%) of the market. Blue ranked second, with 16.4% share, and, despite grey topping the new car market, it ranked third for used cars at 16.3% market share. Some buyers opted to add a splash of colour to their journeys, with 4,461 pink, 6,708 turquoise and 18,658 bronze used vehicle transactions during the year.

Market Segments

In terms of market segments, all sectors saw transactions decline aside from dual purpose, which was the third most popular body type, recording a small growth of 0.8% as just over a million changed hands. Superminis once again took the title for most popular segment, taking a third of the market (32.3%) despite recording a -9.0% fall in volumes. Following behind, lower mediums were the second most popular and were responsible for 26.3% of the market, but also noted a -9.6% decline. The smallest volume segment type was luxury saloons with a 0.6% market share.

Notes to editors

1 2019 FY performance – 7,935,105 transactions

2 December used car transactions: 415,036 units

3 HEV performance: 155,055 units; PHEV performance: 55,053 units

4 2022 combined electrified vehicle performance: 281,179 transactions