Scooter sales rise by 29% to 4.36 million units in first 10 months of FY2023, TVS gains market share

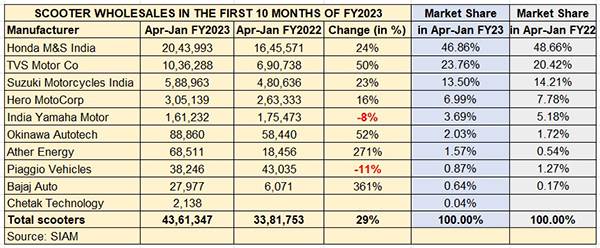

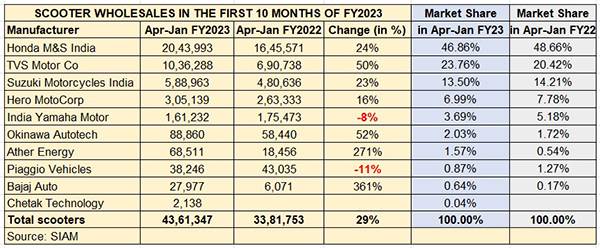

After seeing a sustained slowdown for over two years, India’s scooter market is finally seeing some green shoots of recovery. As per the scooter segment’s wholesale numbers, released by industry body SIAM, a total of 43,61,347 units were despatched in the April 2022 to January 2023 period. This is an increase of 979,594 units or a 29% year-on-year increase (April 2021-January 2022: 33,81,753).

The top five OEMs among SIAM 10 scooter members account for 41,35,615 units or 95% of the total but pare this further and the top three players – Honda Motorcycle & Scooter India, TVS Motor Co and Suzuki – cumulatively have 36,69,244 units or 84% of the industry numbers. While these three have each recorded over-20% growth, the fastest growth (at 50%) comes from TVS, which is reflected in its 24% market share, up from 20.42% a year ago (see wholesales data table below).

Scooter market leader HMSI with 20,43,993 units has recorded 24% growth, selling 398,422 units more in the 10-month period. This gives it a market share of 46.86%, down by two percentage basis points from 48.66% Honda had a year ago.

In comparison, TVS Motor Co, with 10,36,288 units in the April 2022 to January 2023 period, has registered 50% growth – selling 345,550 units more YoY and 87% of HMSI’s YoY increased sales of 398,422 units. Look at it another way – TVS scooter numbers are now 50% of the market leader’s total.

Suzuki Motorcycles India, with 588,963 units, sold 108,327 units more in the first 10 months of FY2023 but despite that sees its market share reduce marginally to 13.50% from 14.21% a year ago.

SIAM’s EV members – Okinawa Autotech, Ather Energy and Bajaj Auto – have all delivered strong performances due to the growing demand for electric two-wheelers. Okinawa, with 88,860 units sees 52% YoY growth and increases its market share to 2.03%, while Ather Energy with 68,511 units has a 1.57% share of the overall scooter market. Bajaj Auto with 27,977 units has a 0.64% share at present.

Ola Electric has sold over 110,000 units in the first 10 months of FY2023. However, with the company not being a member of SIAM, it is not represented in this listing of scooter manufacturers, which is specific to SIAM members only.

Scooter sales still below pre-Covid FY2020 levels

Given the current pace of growth in the scooter industry, total numbers for FY2023, with February and March sales still to be added, can be expected to be in the region of 5 million units. However, this will be below the pre-Covid FY2020 total of 5.5 million units (55,66,036) and way below the record 6.71 million units (67,19,811) of FY2018 and 6.70 million units of FY2019.

While there is no doubt that the domestic market scenario is much improved since a year ago, the scooter market in tandem with motorcycles is yet to see fulsome demand come its way. The cost of two-wheeler ownership has increased over the past year and the demand in the critical entry-level segment has been impacted. Furthermore, sales from rural India are yet to deliver sustained growth.

Nonetheless, the promise of enhanced growth is there given the recent Budget 2023 proposals, which should put additional income in the hands of buyers, as well as the month-on-month improving performance of the electric two-wheeler industry.

ALSO READ: Electric two-wheeler sales in India soar 305% in CY2022 to race past 600,000 units