Goodyear Tire GT reported fourth-quarter 2022 adjusted earnings per share (EPS) of 7 cents, missing the Zacks Consensus Estimate of 17 cents. Lower-than-anticipated operating income in the Americas, EMEA segments and Asia Pacific, and lesser-than-expected sales in the Asia Pacific segment weighed on the results.

The company generated net revenues of $5,374 million, rising 6.3% on a year-over-year basis, riding on pricing actions. The top line also surpassed the Zacks Consensus Estimate of $5,287 million.

In the reported quarter, tire volume was 47.2 million units, down 3% from the year-ago period.

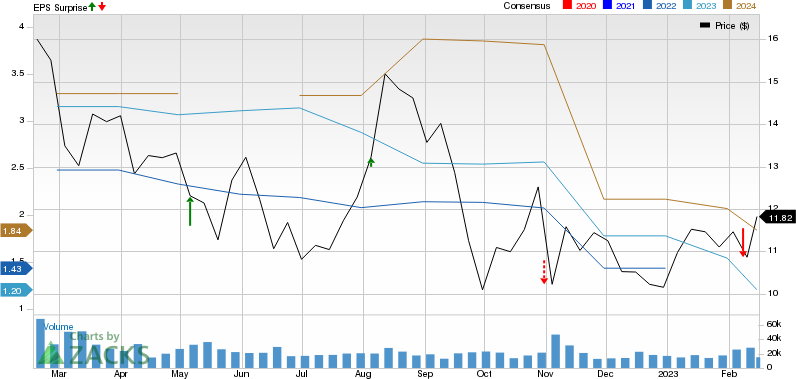

The Goodyear Tire & Rubber Company Price, Consensus and EPS Surprise

The Goodyear Tire & Rubber Company price-consensus-eps-surprise-chart | The Goodyear Tire & Rubber Company Quote

Segmental Performance

In the reported quarter, the Americas segment generated revenues of $3.4 billion, around 11.8% higher than the prior-year period, topping the consensus metric of $3.38 billion. The segment registered an operating income of $279 million, which decreased 9.4% from the year-ago period. Rise in raw material cost offset the improvements in price/mix and resulted downswing in operating margins. Also, the figure missed the consensus mark of $294 million.

Revenues in the Europe, Middle East and Africa (EMEA) segment were $1.4 billion, shrinking 1.4% from the year-ago period. However, the figure outperformed the consensus mark of $1.3 billion. The segment suffered an operating loss of $80 million in the quarter, contracting 295% on raw material cost increases and lower volumes. The figure also trailed the consensus mark of $13.3 million.

Revenues in the Asia Pacific segment decreased 2.9% year over year to $610 million and also lagged the consensus mark of $739 million. The segment’s operating profit income was $37 million, down 11.9% from the year-ago figure, owing to raw material cost that offset the price/mix benefits. The figure, however, crossed the consensus metric of $20.16 million.

Financial Position

Selling, general & administrative expenses fell to $697 million from $750 million in the year-ago period.

Goodyear had cash and cash equivalents of $1,227 million as of Dec 31, 2022, up from $1,088 million on Dec 31, 2021. In the fourth quarter of 2022, long-term debt and finance leases amounted to $7,267 million, up from $6,648 million on Dec 31, 2021. Capital expenditure in the quarter was $296 million, down from $315 million in the year-ago quarter.

Outlook

For the first quarter of 2023, the company anticipates continued volume softness in the EMEA unit. Raw material costs are expected to be up about $300 million. Price/mix may exceed the rise in raw material cost to provide a net benefit of $100 million. Capital expenditure is expected to be $1 billion in 2023.

Zacks Rank & Key Picks

Goodyear currently has a Zacks Rank #5 (Strong Sell).

A few top-ranked players in the auto space include Mercedes-Benz Group AG MBGAF, Wabash National WNC and Modine Manufacturing MOD, all sporting a Zacks Rank #1 (Strong Buy).

Mercedes-Benz develops, manufactures and sells passenger cars, including premium and luxury vehicles. The Zacks Consensus Estimate for MBGAF’s 2023 sales implies year-over-year growth of 3.57%.

Wabash is one of the leading manufacturers of semi-trailers in North America. The Zacks Consensus Estimate for WNC’s 2023 sales and earnings implies year-over-year growth of 13.06% and 24%, respectively.

Modine designs and manufactures world-class thermal dynamic equipment for today’s agricultural, mining & construction equipment. The Zacks Consensus Estimate for MOD’s 2023 sales and earnings implies year-over-year growth of 11.43% and 43.09%, respectively.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goodyear Tire & Rubber Company (GT) : Free Stock Analysis Report

Wabash National Corporation (WNC) : Free Stock Analysis Report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report

Mercedes-Benz Group AG (MBGAF) : Free Stock Analysis Report