Maruti Suzuki to retain top exporter title, leads Hyundai by 77,885 units in ongoing fiscal

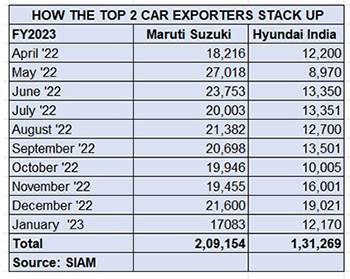

Maruti Suzuki India is set to retain the title of India’s top passenger vehicle exporter in FY2023. The domestic market leader has shipped a total of 209,154 units in the April 2022 to January 2023 period, which is 89% of its FY2022’s total exports (235,670 units) which have been its best-ever exports in a fiscal year.

In CY2022, the carmaker achieved its best-ever overseas shipments in a calendar year: 263,068 units, up 28% (CY2021: 205,450 units), surpassing the 200,000-units mark for the second consecutive year.

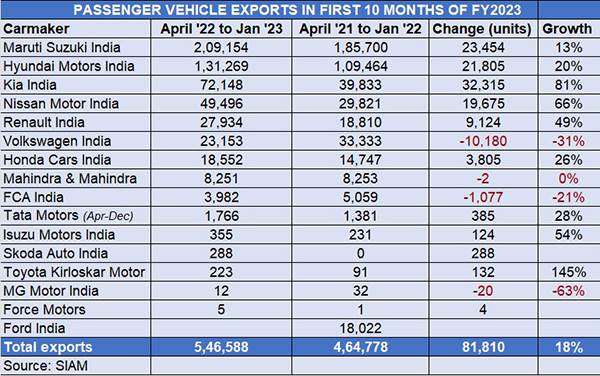

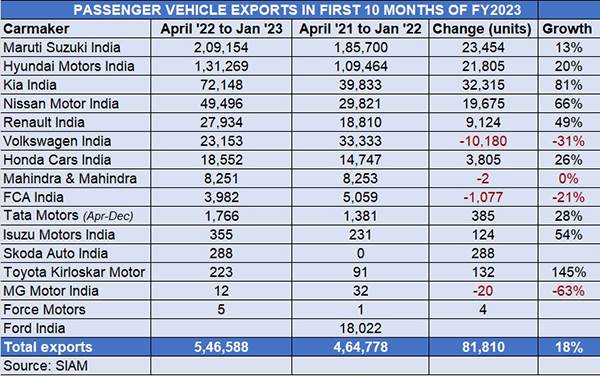

As per the latest industry export numbers released by apex body SIAM, at the end of January 2023, Maruti Suzuki has a strong lead of 77,885 units over second-ranked Hyundai Motor India, which has shipped 131,269 units in the first 10 months of FY2023. Given the sizeable volume lead between the two carmakers, this effectively means Maruti Suzuki will be the PV export leader for the second year in a row, having wrested the crown from Hyundai Motor India in FY2022.

Maruti Suzuki’s total shipments comprise 170,613 cars (up 17%), 72,148 utility vehicles (up 81%) and 213 vans (down 78%). Maruti Suzuki currently exports 17 PVs, some of which see strong demand in regions like Africa, Middle East, Latin America and ASEAN. The models with the highest export demand are the Dzire sedan, the Swift, S-Presso and Baleno hatchbacks and the Brezza SUV.

The new Grand Vitara has become the 17th export model with the first batch being despatched last month to Latin America from Kamarajar Port. The company plans to export the Grand Vitara to over 60 countries across Latin America, Africa, Middle East, ASEAN and neighbouring regions.

Hyundai exports up 20%, Verna top export model

With total shipments of 131,269 units comprising 93,789 cars (up 25%) and 37,480 UVs (up 8%), which is a YoY growth of 20%, Hyundai Motor India has done well but not enough to beat Maruti Suzuki this fiscal.

The Chennai-based OEM, which was the No. 1 exporter in FY2020 when it took the crown from Ford India, and also in FY2021, when it pipped a hard-charging Maruti Suzuki by just 9,404 units, will have to take a shot at the top exporter title at a later date.

While the trio of the Aura, i10 and the i20 saw exports of 58,335 units (up 18%), the Verna was the strong growth driver with 35,454 units (up 40%) and accounts for 27% of total Hyundai exports. Overseas shipments of the Creta remain under pressure – 21,756 units, down 17.5%, while the Venue with 6,471 units is up 5% YoY. The premium Alcazar SUV has 9,253 units to its tally.

Kia exports soar 81%

At No. 3 position is Kia India with 72,148 units, up 81% (April 2021-January 2022: 39,833). The midsized Seltos SUV, Kia’s longstanding best-seller in India, is also its most popular export model with 41,771 units (up 66%), followed by the Sonet compact SUV with 23,571 units (up 60%). Kia also exported 6,665 Carens and 141 Carnival MPVs.

Fourth-ranked Nissan Motor India has shipped 49,496 units, which constitutes 66% YoY growth. The export-only Sunny sedan remains its best-selling model with 36,468 units (up 64%) or 74% of total exports.

The company also shipped 9,709 Magnite SUVs. Nissan India’s overall export performance remains better than its domestic market sales: 28,167 units in April 2022-January 2023. In end-July, the company recorded a key export milestone: shipment of its millionth vehicle manufactured at the Renault-Nissan Automotive India plant in Chennai. The export journey to the million-units milestone has taken a little less than 12 years.

Renault Motor India, with 27,934 units and 49% growth, takes fifth spot in the export rankings. The carmaker has seen demand for its Kiger/Triber SUVs nearly double to 19,597units from 9,882 units a year ago. The Kwid hatchback, however, with 8,337 units saw sales decline 6% YoY.

The No. 6 export OEM is Volkswagen India with 25,153 units, down 31% YoY (April 2021-January 2022: 33,333). The company exported 15,558 units of the Vento/Virtus sedans (down 36%), 6,500 Taigun SUVs (up 426%) 4,193 Taigun SUVs and 1,095 Polo hatchbacks, down 86% YoY.

The only other carmaker with five-figure export sales is Honda Cars India with 18,552 units, up 26%. Demand for its City sedan is up 30% to 17,116 units.

Growth outlook

Of the three segments for which SIAM has provided data – PVs, two- and three-wheelers – PVs is the only one which has secured YoY growth on the export front. Total PV exports from India for the first 10 months of FY2023 are 546,588 units, up 18% YoY. In comparison, two-wheeler exports are down 12% and those of three-wheelers down by 23 percent.

With the domestic market firing on all cylinders and recording robust growth, PV manufacturers, who are now benefiting from improved supplies of semiconductors, are keeping their production lines humming. With global economies gradually improving, a sustained uptick in export demand for made-in-India cars, SUVs and MPVs in the coming months will only further accelerate good times.

ALSO READ:

India’s Top 6 carmakers start 2023 with strong sales in January

Tata Motors, Maruti Suzuki and Mahindra battle for UV leadership in FY2023