The Shanghai Science and Technology Innovation Board, popularly called STAR Market, was the world’s top stock exchange in terms of IPO proceeds in 2022.

The 116 companies that listed on the STAR Market last year cumulatively raised almost $34 billion in IPO proceeds, besting global peers such as the Nasdaq ($16.3 billion) and NYSE ($5 billion) by a wide margin, according to DealStreetAsia DATA VANTAGE‘s Greater China Deal Review: Q4 2022 report, which was based on global IPO data from Dealogic.

This was followed by Shenzhen’s startup board ChiNext, where IPO proceeds stood at $26 billion last year.

However, in terms of the number of IPOs the Nasdaq topped its Chinese peers at 152.

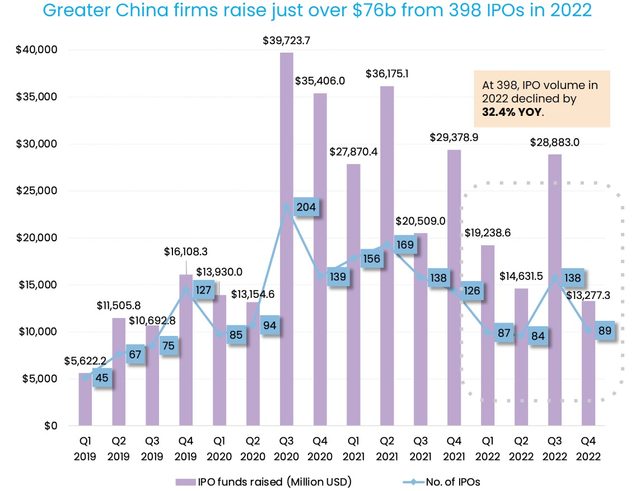

The STAR market accounted for 44.6% of the $76 billion raised by 398 Chinese companies last year via IPOs across stock exchanges in mainland China, Hong Kong, Taiwan, and the US. The total IPO funds raised was down 33.3% from 2021, while the number of IPOs also decreased by 32.4%.

“China’s A-share market, which includes stocks of mainland China companies trading on the mainland stock exchanges, contributed almost half of the world’s IPO proceeds in 2022,” according to the DATA VANTAGE report.

Shanghai United Imaging Healthcare Co., a producer of CT Scan and X-Ray devices, in August 2022 raised 10.99 billion yuan ($1.62 billion) in a STAR Market IPO — the biggest public listing by a Chinese company in 2022.

The top three Greater China IPOs by proceeds in 2022 were all hosted on the STAR Market.

The STAR market was mooted by the Chinese government in the middle of the trade war with the US in 2018 to give local startups an alternative to listing abroad. It is modelled on the lines of the Nasdaq.

“The equity market in the US has better liquidity and more listed comparable companies. But the issue is that the Chinese firms will be categorised as Chinese American depositary receipts (ADRs), and when Chinese ADRs can resume IPO in the US remains a question mark,” said Henry Zhang, president & managing director of Hermitage Capital.

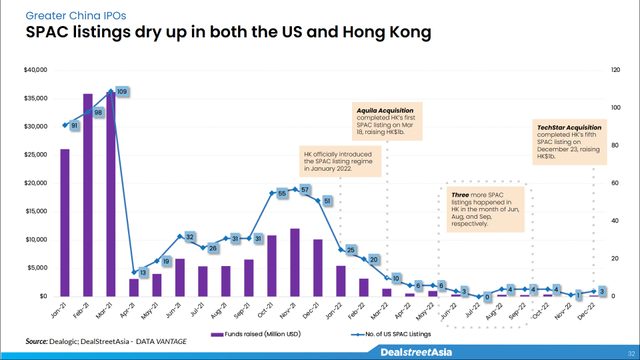

The IPO market last year was also characterised by the weak response to SPAC listings on the Hong Kong Stock Exchange. The HKEX opened up to SPAC listings on Jan. 1, 2022, but hosted only five SPAC listings since the introduction of the scheme.

“After a slowdown in 2022, initial public offerings (IPOs) by Greater China companies are expected to grow steadily this year as the domestic economy regains its robustness with the government’s various economic stimulus measures and the long-awaited removal of its zero-COVID policy,” according to the report.

The Greater China Deal Review: Q4 2022 report is available exclusively to DealStreetAsia–Professional subscribers. Subscribe/upgrade your subscription now to access our entire set of reports. Still not sure? Opt for a one-month trial for only $208.