Singapore-based cross-border payments startup Tazapay allotted shares worth $16.9 million to various investors last week as part of a Series A round.

Lead investor Sequoia Southeast Asia contributed $7 million to the round, while RTP Global invested $3.6 million.

Founded by former Stripe, Grab and Standard Chartered executives in 2020, Tazapay provides a digital platform for businesses engaging in cross-border transactions in over 170 markets.

The company recently received in-principle approval for a major payment institution (MPI) licence from the Monetary Authority of Singapore. The approval covers five payment services – account issuance, merchant acquisition, cross-border money transfer, domestic money transfer and e-money issuance.

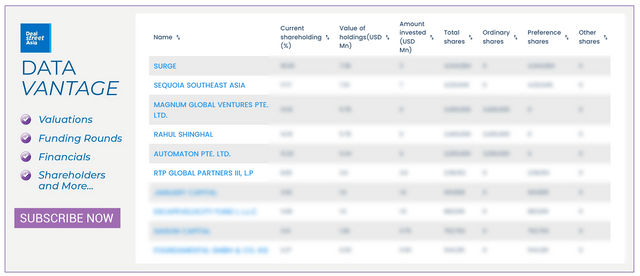

Top shareholders in Tazapay

Indonesia-based used car marketplace Moladin received nearly $8 million from Singapore-based Ascend Capital last week.

The company had last secured $95 million in a Series B round led by DST Global in May 2022, a development first reported by DealStreetAsia. The lead investor chipped in $50 million, while East Ventures contributed nearly $20 million to the financing.

Earlier this month, Moladin laid off 360 employees, or 11% of its total workforce, to improve its long-term operational sustainability.

Other updates from DATA VANTAGE

Southeast Asia-focused market intelligence company Cube Asia received $80k from individual investors this month as part of a recently announced $1.5 million seed funding round. According to its regulatory filings, lead investor Wavemaker Partners contributed $1 million to the round, while M Venture Partners invested $250k.

Singapore-based smart access control solutions provider Willowmore secured $800k last week from SEEDS Capital in fresh funding.

Singapore-headquartered wireless communications provider Transcelestial announced raising $10 million in a new funding round led by Airbus Ventures last week. The company raised $7 million in equity funding – we wrote about it in January – and another $3 million from venture debt providers in the Series A2 round.

Food tech company TiffinLabs posted revenue of $2.6 million for the financial year ended Dec 31, 2021. Its net loss for the period stood at $2.76 million.

Singapore-based e-commerce platform Qoo10 reported a nearly 80% growth in revenue for the financial year ended Dec 31, 2020, according to its latest regulatory filing. Its net loss went up by 52% during the period.

Loyalty solutions provider Giift earned $20.75 million in revenue and accrued a net loss of $5.24 million in the financial year ended Dec 31, 2020.