/

A judge allowed a lawsuit accusing Dapper Labs of selling unregistered securities to proceed, despite arguments that the NFT Moments are just like baseball cards.

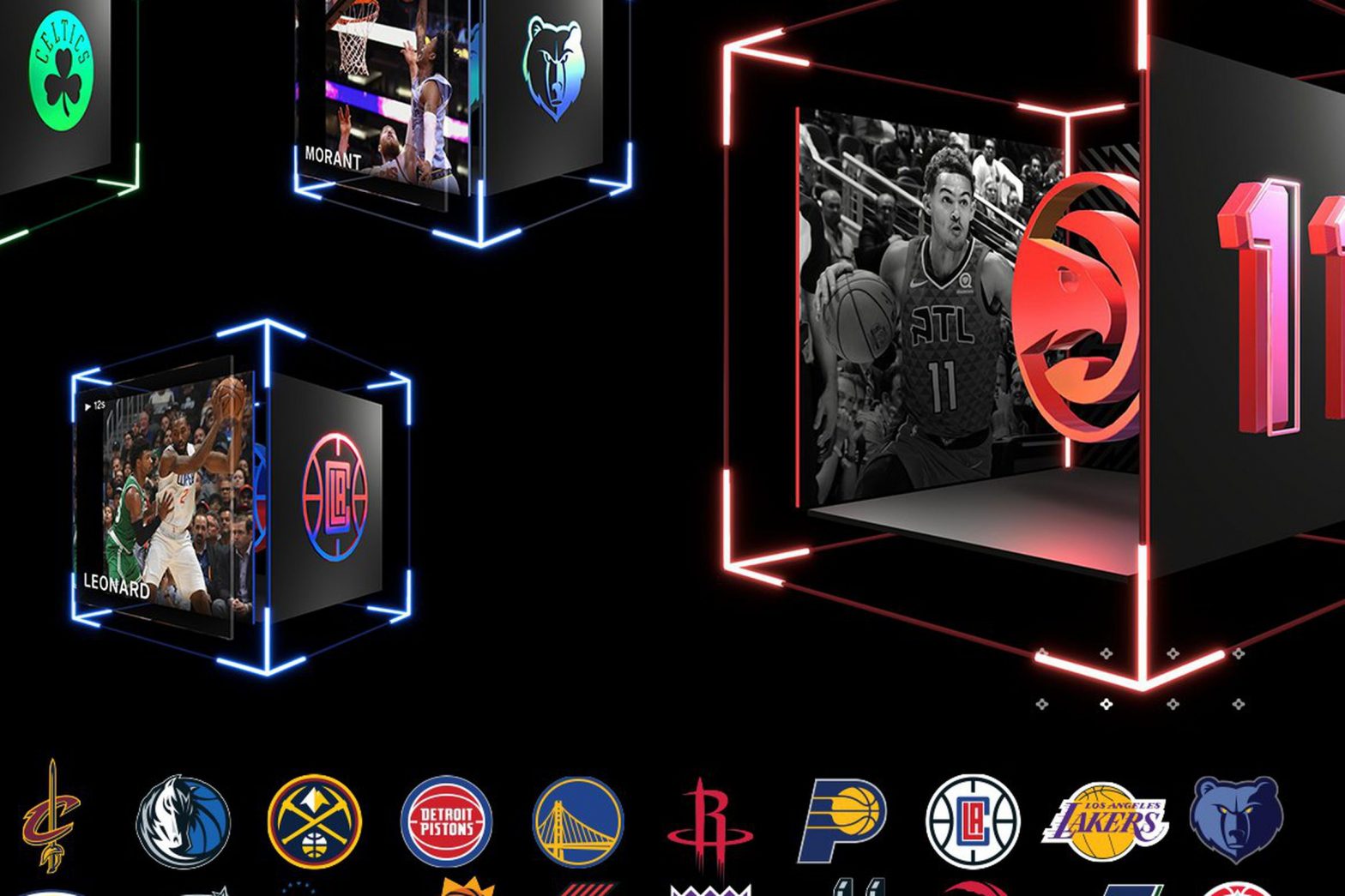

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24452678/nba_topshot_crop.jpg)

NBA Top Shot developer Dapper Labs and its CEO, Roham Gharegozlou, will face a lawsuit accusing the company of selling unregistered securities in the form of its “Moments,” which are non-fungible tokens for sports fans.

Despite Dappers’ lawyer’s claims that “Basketball cards are not securities. Pokémon cards are not securities. Baseball cards are not securities. Common sense says so. The law says so. And, courts say so,” Judge Victor Marrero decided to let the case go forward.

As he wrote in his decision (Friel v. Dapper Labs, Inc. et al., 1:21-cv-05837-VM):

In totality, the economic realities of this case support the Court’s conclusion that the AC’s allegations pass muster at this stage. In sum, Plaintiffs adequately allege that Dapper Labs’s offer of the NFT, Moments, was an offer of an “investment contract” and therefore a “security,” required to be registered with the SEC.

The plaintiffs, Gary Leuis, Jeeun Friel, and John Austin, accuse Dapper Labs of not only making hundreds of millions of dollars in profit through the sale of unregistered securities but also “propping up the market for Moments as well as the overall valuation of NBA Top Shot” by preventing users from withdrawing their money for months on end. While Top Shot users couldn’t withdraw, Dapper highlighted Moments sales to draw interest and increase value for its Flow Blockchain and Flow token.

When we covered NBA Top Shot near the peak of its activity in March 2021, many users still couldn’t get their money out of the platform. According to CryptoSlam, the number of active buyers peaked that month at 184,000 before sharply declining, while a post on the company’s blog from March 26th, 2021, said about 28,000 users were approved for withdrawals, with 5,000 more due to be added in the next week.

The plaintiffs cited marketing for NBA Top Shot that highlighted high-priced sales of Moments and increased trading on the platform, like this tweet about a $208,000 transaction for a LeBron James Moment. The plaintiffs referenced our 2021 article in their lawsuit as part of their argument that Dapper Labs didn’t stop Top Shot users from viewing and referring to their purchases of Moments as investments.

In their counterarguments, lawyers for Dapper Labs and Gharegozlou wrote, “When Dapper sold its Moments, it was selling formed products not as part of capital fundraising but as products. This was not a capital investment drive, not an appeal to passive investors, but the sale of cards to collectors.”

In an emailed statement to The Verge today, Dapper Labs SVP, head of communications Stephanie Martin said, “Importantly, today’s order – which the court described as a “close call” – only denied the defendants’ motion to dismiss the complaint at the pleading stage of the case. It did not conclude the plaintiffs were right, and it is not a final ruling on the merits of the case. Courts have repeatedly found that consumer goods – including art and collectibles like basketball cards – are not securities under federal law. We are confident the same holds true for Moments and other collectibles, digital or otherwise, and look forward to vigorously defending our position in Court as the case continues.”

However you view them or whatever the courts ultimately decide, interest in NBA Top Shot Moments as either investments or “formed products” dropped quickly from a peak two years ago, when market tracker CryptoSlam noted $45 million in sales in just one day on February 22nd, 2021, as part of a $224 million month.

Today, CryptoSlam shows $71,645 in sales and just over 12,000 unique buyers this month… so far.

Update 2:41PM ET: Added comment from Dapper Labs.