Southeast Asia-based venture capital firms closed 31 funds and raised $4.14 billion in total proceeds in 2022 to top their pre-pandemic performance, finds the latest report from DealStreetAsia- DATA VANTAGE.

The impressive performance may suggest that the region is insulated from the effects of a global liquidity tightening, but that is not the case.

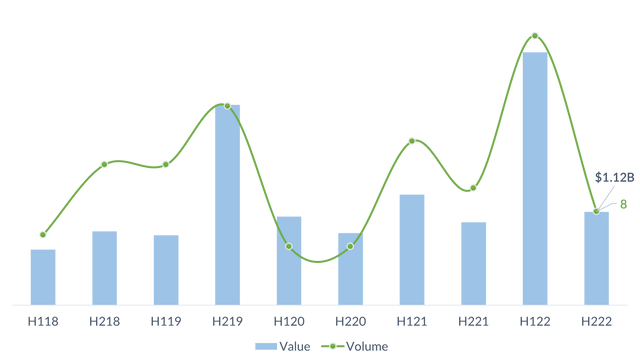

A closer look at the fundraising data reveals that most funds were closed in the first half of the year, benefitting from carry-over deals and lingering effects from 2021’s liquidity glut. The second half of the year showed visible signs of a slowdown as the number of final closes took a plunge, according to SE Asia’s VC Funds: H2 2022 Review.

Final fund closes per semester

From this perspective, Southeast Asian VC firms reported fewer fund updates relative to the previous year. An examination of the 2022 milestones also reveals that fundraising momentum slackened in the second half, as milestone updates and total proceeds dropped by 45% and 58% relative to the first half.

An investor’s market

Acknowledging a tougher VC fundraising environment, AC Ventures founder and managing partner Adrian Li said the Ukraine war and rising inflation contributed to the economic uncertainty while rising interest rates increased opportunity costs for investors.

“As a result, LPs were rebalancing their appetite for risk, particularly in the later stages of venture investment. Overall, venture funds were focused primarily on their portfolios, ensuring companies have sufficient runways and improving business fundamentals,” he said.

Li added that despite the challenging environment, a record amount of venture capital was raised in prior years, and much of it is still waiting to be deployed.

Kejora Capital managing partner Andy Zain said he is expecting a more selective approach from LPs in 2023.

“While [LPs] are excited that Southeast Asia’s macro factors are going against global trends, they are also aware that finding liquidity for the investments is tougher,” he said.

For the time being, Southeast Asia’s tech ecosystem finds itself in a period of transition as companies streamline their operations and trim the fat.

Better times for debut funds

While AC Ventures and other major early-stage venture players such as Jungle Ventures and East Ventures managed to raise large funds, first-time funds also benefitted to an extent last year.

In 2022, ten debut funds held their final close, on par with 2019. The median and average size of these funds, however, have remained below pre-pandemic levels, as LPs favoured existing relationships over new ones.

Median and average size of debut funds that held a final close in 2022

To gain a foothold in an increasingly competitive environment, new funds must distinguish themselves by focusing on specific sectors. Indeed, six of 10 debut funds that reached a final close last year were specialists.

Sector specialist funds have a competitive edge as investors seek more allocation to fast-growing segments such as fintech or B2B SaaS that are expected to deliver outsized growth, said Herston Powers, co-founder of fintech-focused 1982 Ventures, which closed its first fund last year.

More funds in the market

Looking at the latest indicators, there is some indication that the flow of foreign funds may taper in 2023.

In 2022, we witnessed 13 Asian/global funds with SE Asia allocations hold a final close, four of which were fully dedicated to the region. This compares to a total of 20 funds in the previous year.

“I think the jury is still out on whether global funds can invest in earlier [stages] than Series A without a high-quality investment team on the ground. I expect many of these ‘tourist’ investors will retreat after licking their wounds,” said Dave Richards, co-founder and managing partner at Capria Ventures.

According to the DATA VANTAGE report, there are 97 funds managed by regional VC firms in the market currently, higher than 79 funds a year ago. The total corpus these funds are seeking to raise has also increased by 26% year on year.

Among foreign funds with allocations for Southeast Asian assets, the report shows 29 are currently seeking to raise capital.

SE Asia’s VC Funds: H2 2022 Review has extensive data on:

- Fundraising by Southeast Asian VCs, including first-time GPs

- Performance by VCs in different markets of SE Asia

- Fundraising by global VCs with SE Asia allocations

- Funds currently in the market

- Perspectives from leading SE Asian VCs