On the backdrop of growth in commercial vehicle (CV) sales, CV financing is also expected to bounce back. Interestingly, the used CV segment, largely dominated by Non-Banking Finance Companies (NBFCs), can clock a stable growth rate despite headwinds in the last few years.

It may be noted, the growth of CV sector remains primarily dependent on the sales volumes in the CV industry which in turn is directly correlated to economic growth.

CareEdge data shows, the CV finance industry in India has Assets Under Management (AUM) amounting to approximately Rs.3.6 lakh crore as of March 31, 2022, with banks, NBFCs and Anchor Financiers of Original Equipment Manufacturers (Anchor) accounting for 38.5%, 42.3% and 19.2% of the market share respectively. Banks and Anchors largely dominate the lending in the new CV segment while NBFCs have a lion’s share of the used CV financing pie.

CareEdge data shows, the CV finance industry in India has Assets Under Management (AUM) amounting to approximately Rs.3.6 lakh crore as of March 31, 2022, with banks, NBFCs and Anchor Financiers of Original Equipment Manufacturers (Anchor) accounting for 38.5%, 42.3% and 19.2% of the market share respectively. Banks and Anchors largely dominate the lending in the new CV segment while NBFCs have a lion’s share of the used CV financing pie.

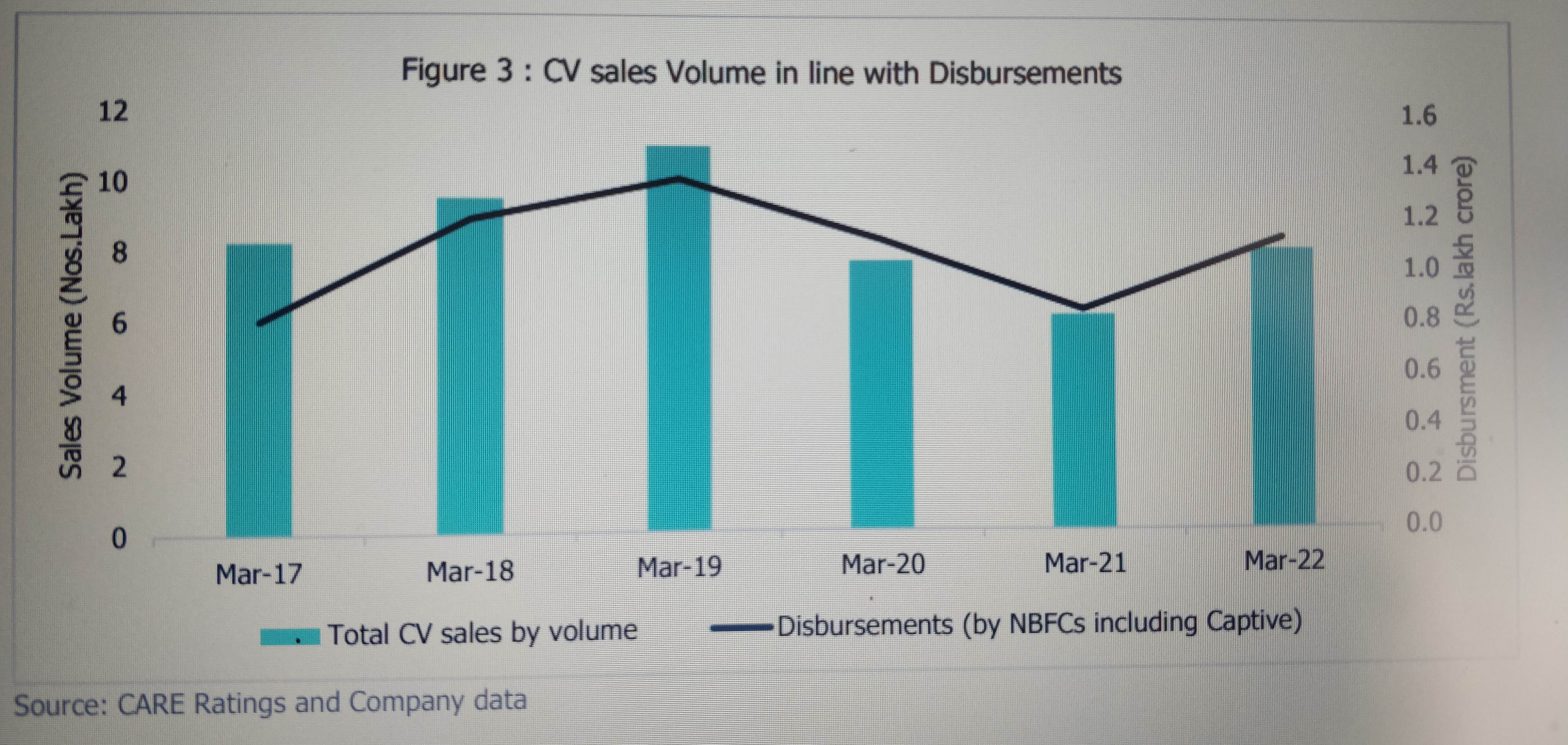

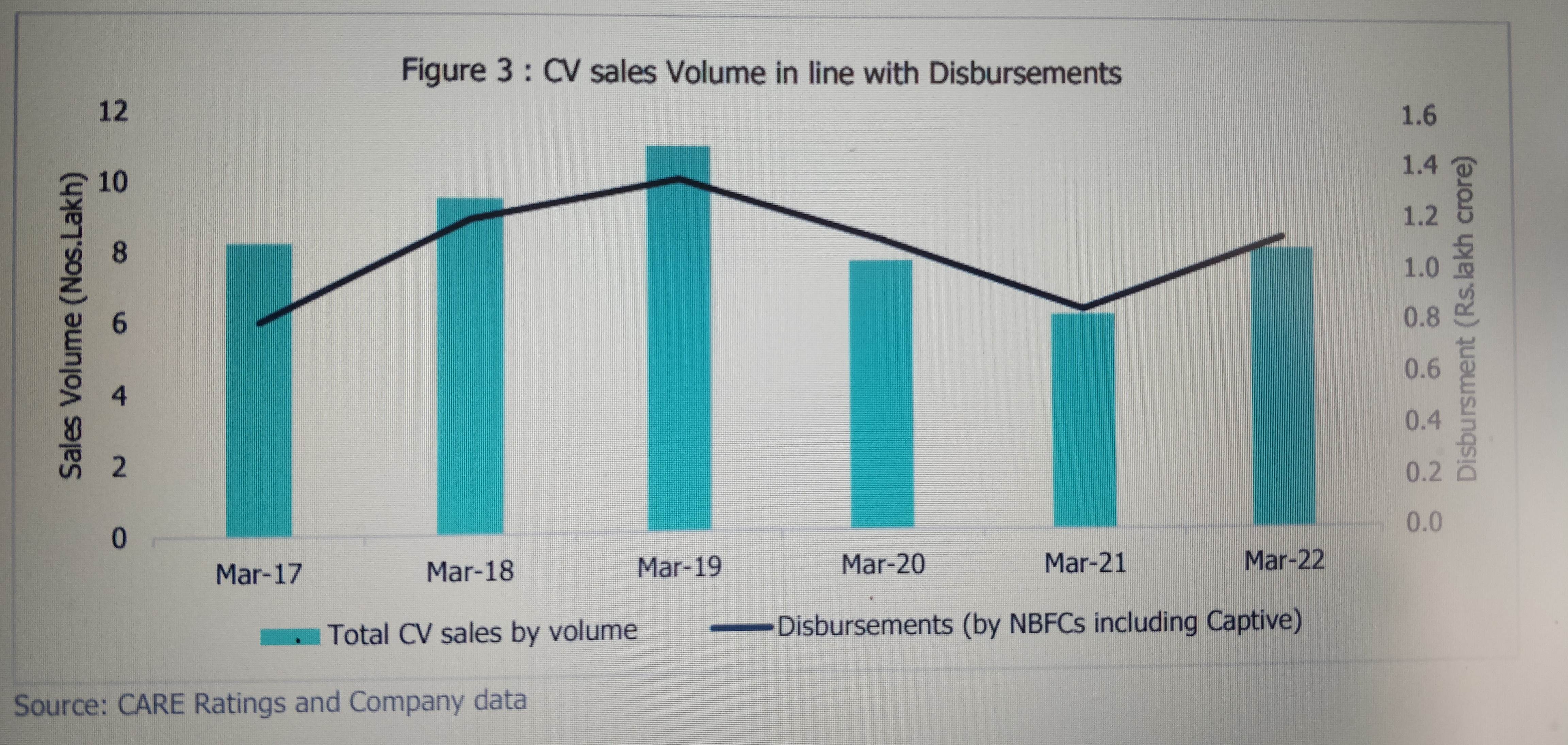

It further stated, the CV financing industry continues to clock lower growth rates as the AUM growth rate which dipped to 6.3% in FY20 from its high levels of 24.4% in FY19 and 18.3% in FY18, continued to remain low at 5.7% in FY21 and 7.9% in FY22. The low rate of growth in the last two years can be attributed to the Covid-19 pandemic which affected the CV industry since March 2020.

Even in FY20, CV sales took a major hit due to implementation of revised axle load norms, the improved vehicle availability on account of improved turnaround time post-GST and overall slowdown in the economy. The transition from BS IV to BS VI pushed the cost by nearly 10-15 per cent further impacted new CV sales in FY 21. The impact of the aforesaid factors was compounded even more by the Covid-19-led lockdown in FY21 and FY22.

It is interesting to note, the used CV segment, which is largely dominated by NBFCs, was able to clock a stable growth rate. The key reasons are increased in new vehicle prices, demand also remains supported on account of the used CV’s multi-purpose usability such as pick up of sand, cement, grains etc. as against the new CV which is generally used for only specific applications

Now, with the revival in CV sales volumes and expectations of 22% volume growth in FY23, the CV financing growth is also expected to bounce back. AUM growth of CV Financing NBFCs is expected to be above 14.1% for FY23, according to CareEdge estimate. While overall AUM growth is expected to be in double digits, the performance of players within a segment is likely to witness a divergent trend as few players would be constrained to focus on containing NPAs than on AUM growth.

“While growth has kickstarted in line with the improving macroeconomic fundamentals, growth numbers are yet below historical levels. Profitability is likely to improve going forward with a significant reduction in credit cost from FY24. Most CV financing entities have also strengthened their balance sheet and have shored up capital which provides comfort against adverse scenarios,” said the rating agency.

Sundaram Finance’s Managing Director Rajiv Lochan said, CV financing is enabling growth in CV sales as the economic activity recovers from the pandemic to the new normal. Post axle load norms relaxation and BS VI transition, commercial vehicle tonnage has moved up which has meant the traditional small road transport operator has shifted to used CVs.

“This is classic NBFC terrain and consequently financing of used CVs has clocked stable growth. As scrappage norms set in and economic expansion picks up, the new CV upcycle will gain momentum. We should see sustained new and used CV growth for the next few years,” he said.

During the recent investors call, Vellayan Subbiah, Chairman and Non-Executive Director, Cholamandalam Investment and Finance Company Limited (Chola), said that sale of commercial vehicles are expected to come close to the pre-pandemic peak of over one million units in FY ’23 due to improved fleet utilisations, strong replacement demand and pickup in the road construction projects across the country.

Despite high inflation and interest rates, strong festive season sales and workforce returning to the Metro cities have helped drive growth.

Company’s investors presentation stated, Light Commercial Vehicle (LCV) segment had a growth of 14% in Q3 FY23 & 47% in YTD Dec22. The segment is witnessing healthy demand from e-commerce, agriculture and its allied sectors coupled with replacement demand. The Small Commercial Vehicle segment had a de-growth of 8% in Q3 FY23 but has grown at 26% as of YTD Dec22. This segment is expected to grow in the coming quarters due to its nature of deployment in last mile connectivity. The Heavy Commercial Vehicle segment had a growth of 42% in Q3 FY23 & 68% in YTD Dec22. The recovery in macroeconomic environment and improved freight availability will aid growth in this segment during the year.

Increased demand for Light Commercial Vehicle will help us garner higher volumes. However, we will be cautious in this segment based on rural sentiments and upcoming Rabi harvest. Uptick in demand for Small commercial vehicles will help us improve our disbursements combined with our vigilant approach to financing, based on vehicle viability and earning capacity, said Chola Financial Holdings, part of Murugappa Group and one of the largest CV lenders.