The global private equity (PE) world felt the brunt of persistent macroeconomic headwinds in 2022 as investments, exits and fundraising took a hit, according to Bain & Company’s Global Private Equity Report 2023.

The slowdown has continued into 2023 and will likely plough on until the macroeconomic factors steady, the report added.

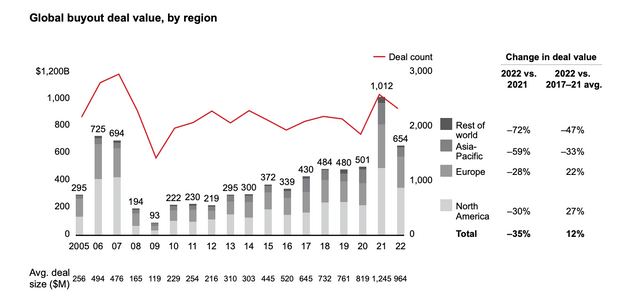

Global buyout value dropped by more than a third in 2022 as larger transactions became scarce over the second half of the year. Asia-Pacific suffered the steepest drop last year compared to 2021 as buyout value fell by almost 60%, whereas in Europe and North America it fell by 28% and 30% respectively.

“The especially sharp drop-off in Asia-Pacific dealmaking reflects repeated market shutdowns due to COVID-19 restrictions.”

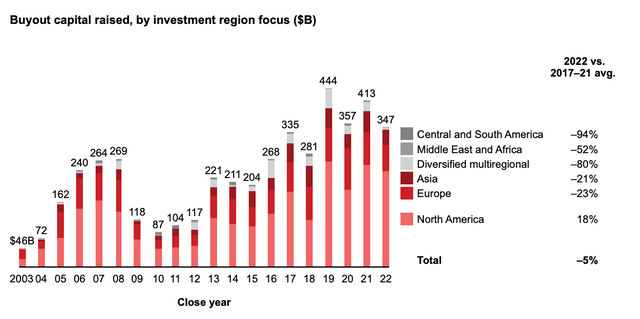

However, in terms of buyout capital raised, Asia-Pacific performed comparatively better than some of its peers.

Buyout fundraising declined across all major regions last year, with the smallest fall recorded in North America. APAC came in second with a 21% decline last year compared to its average over the last five years. Europe fell by 23%, while Central & South America suffered the biggest fall of 94%.

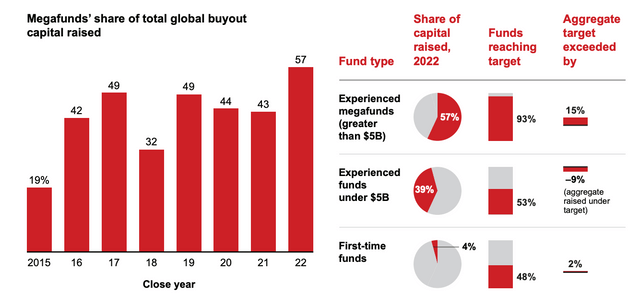

Macroeconomic conditions also swayed limited partners (LPs) further into investing with the largest, most experienced funds, which raised record-breaking amounts of capital. Meanwhile, first-time funds became less and less appealing, with a huge chunk finding it increasingly difficult to meet targets.

The environment for attracting new capital will substantially shrink in the coming year and a shortage of funding will make it difficult for LPs to ramp up commitments in the coming months, the report added.