This weekly newsletter chronicles top digital themes and trends playing out in SE Asia, especially Indonesia. We will decode policy and regulatory changes affecting digital economy sectors, crunch earnings data of top players, track developments related to gig economy workers and attempt to piece together ecosystem buildouts in some of the fastest-growing, venture-backed plays. You can access the previous editions of the Vantage Point weekly posts here.

Executive Summary

- PropertyGuru: Macro factors remain an overhang on profitability

- Pertamina Hulu Energy listing is an important milestone

- GoPay Coins — Widening the ecosystem J&T Express revives Hong Kong IPO plan

- J&T Express revives Hong Kong IPO plan

PropertyGuru: Macro factors remain an overhang on profitability

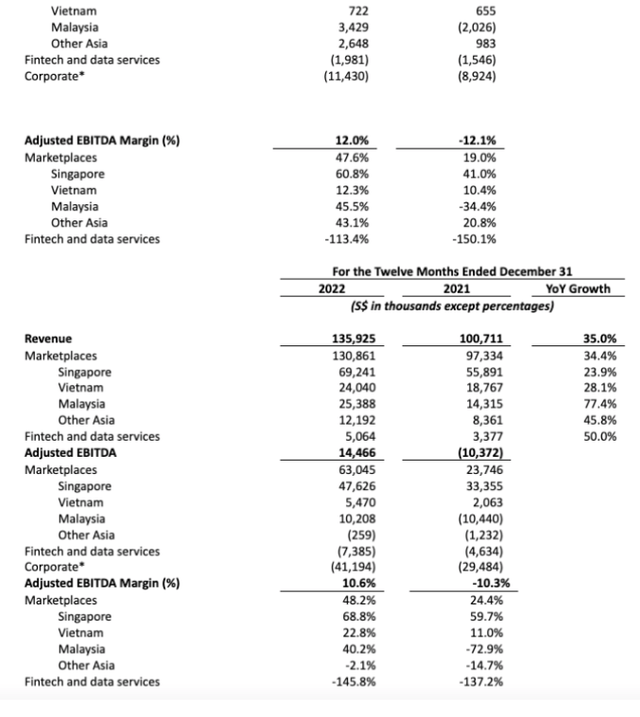

On the surface of it, SE Asian property listings platform PropertyGuru’s earnings for the fourth quarter of 2022, and full year 2022, seem to be promising. However, the proptech sector is extremely vulnerable to global uncertainties such as rising interest rates and tightening credit, which remains an overhang on its profitability.

The New York-listed platform said it narrowed its net loss to S$5 million in the fourth quarter from S$27 million in the corresponding period a year earlier. For the full year 2022, too, net loss narrowed to S$129.2 million from S$187.4 million in 2021. Adjusted EBITDA was positive S$5 million in Q4, versus a loss of S$4 million in Q4 2021, representing a significant turnaround.

PropertyGuru’s revenues grew 17% YoY to S$40 million in Q4, which was slower than the full year 2022’s growth of 36%, to S$136 million.

The deceleration in revenue growth in the December quarter is a sign of the tough environment that the property sector faces in Southeast Asia.

The company registered revenue growth of over 20% in all markets in FY2022. Yet, the one outlier of H2 2022 was Vietnam where the government implemented stringent cooling measures in the form of credit restrictions in the second half of last year. Vietnam is the only market for PropertyGuru that is driven by listing fees instead of agent fees, which translated to a 7% decline in revenues in Q4 to S$6 million versus an FY2022 growth number of 28% YoY to S$24 million.

The number of listings in Vietnam in Q4 2022 was down 22% YoY to 1.6 million. The average revenue per listing was up by 22% YoY in Q4 2022 to S$3.25.

Singapore and Malaysia marketplace revenues performed relatively well both in Q4 and FY2022. Singapore booked marketplace revenue growth of 15% YoY to S$19 million in Q4 2022 versus FY2022 growth of 24% YoY to S$29 million, representing a slight growth slowdown.

These numbers were driven by both an increase in the number of agents and the average revenue per agent. The latter increased by 20% YoY in Q4 2022 to S$1,076 and was up 24% YoY for the full year to S$4,076 per agent. In Q4 2022, there were 15,529 agents with a renewal rate of 79% in the quarter.

PropertyGuru’s Malaysia marketplace business saw revenues increase 28% YoY to S$8 million in Q4 2022 but increase 77% YoY to S$25m for FY2022. The company continues to benefit from its two market-leading brands in Malaysia plus from the acquisition of the iProperty business in August 2021.

PropertyGuru also highlighted its leading position in a number of markets including Singapore where it commands an 81% share, and is 5.2xX larger than its nearest competitor. In Malaysia, the platform dominates with a 93% market share, 15.2x its nearest rival.

In Vietnam, it controls 75% of the overall market, around 3.1x its nearest peer, while in Thailand, it has a 58% share, which is 2.5x its nearest competitor. In Indonesia, it has a 22% market share.

The company remains well-positioned to weather the current funding winter, given that it had cash and cash equivalents of S$309 million plus it is adjusted EBITDA positive already, which points toward more positive numbers going forward.

PropertyGuru (PGRU US) experienced a slowdown in sales growth in Q4 2022

PropertyGuru remains upbeat for 2023, with expectations that revenues will reach S$160-170 million, and Adjusted EBITDA of S$11m-$15 million. The company sees some potentially negative impacts from the scaling of Sendhelper.

Even with relatively bullish guidance, management highlights potential upsets to its expectations, which include further action by the Vietnam government to rein in consumer credit, some residual political uncertainty in Malaysia, and tightening residential policy in Singapore.

But other than these issues, the company remains bullish on growth and improving profitability, and it sees fundamental opportunities in its core markets.

Pertamina Hulu Energy listing is an important milestone

The IPO of state-owned oil company Pertamina’s upstream oil & gas business, Pertamina Hulu Energy, has been delayed slightly as the firm seeks to include the latest financial data to present a more up-to-date picture of its operations.

The firm has decided to use its numbers up to the end of FY2022 versus figures until the end of June 2022.

The company is due to sell 10%-15% of its shares through the IPO on the Indonesia Stock Exchange (IDX) to raise a total of around $2 billion. CitiGroup, Credit Suisse, and JP Morgan, along with local players BRI Danareksa and Bank Mandiri are reportedly acting as the joint book-runners for the issue.

Floating the upstream business of Pertamina should enable the firm to not only increase its production but also expedite exploration. The offering comes at a time when the Indonesian government is stepping up its focus on reducing reliance on imported oil to improve its fiscal position.

The issue also follows years of underinvestment in the industry, which led to a significant deficit.

Indonesia has a number of older wells that can still be exploited using modern technology to ramp up production relatively quickly.

On the downstream side, the growing car ownership in the country has led to a surge in demand for oil products. The country continues to bear a hefty subsidysubsidies burden despite having increased fuel costs by 30% last year.

The listing of more state-owned assets on the IDX will further deepen the capital market given that it will reflect the underlying Indonesian economy. Currently, there is very little representation from the oil & gas sector on the IDX, with private operator Medco Energi being the only significant listed player.

Pertamina Hulu Energi has around $4.5 billion in debt, making the IPO route all the more important for the company that has laid out capex plans of $4-6 billion per annum, SOE Deputy Minister Pahala Nugraha Mansury was cited as saying in media reports.

Besides providing an additional channel for investing in a growth area of the economy, the size of the Pertamina Hulu Energy IPO will also be a significant test of appetite for oil & gas stocks in the SE Asian market, Its successful listing is an important milestone for Indonesia, an erstwhile member of the Organization of the Petroleum Exporting Countries (OPEC).

GoPay Coins — Widening the ecosystem

GoPay has announced that GoPay Coins, its unified rewards programme for GoTo users, have been expanded beyond its ecosystem.

Starting last week, its users in Indonesia can collect and redeem GoPay Coins when transacting even with external online and offline merchants that offer GoPay as a payment method, including Cinema XXI, Hypermart, Blue Bird (BIRD IJ), and several others.

GoPay Coins were launched in October 2021 and are awarded to users when they transact via GoPay. The coins can then be exchanged to obtain discounts on future transactions.

The value of one GoPay Coin is equivalent to one rupiah, with each GoPay Coin having a one-year validity for redemption.

The move will offer GoPay customers more opportunities to collect GoPay Coins, which is effectively a cashback product.

GoPay Coins provide consumers with more flexibility to choose how and when to utilise their cashback benefits and are eligible for use in all types of transactions across Gojek and Tokopedia, as well as external merchants now.

The strategy behind GoPay Coins as rewards is to switch away from cash incentives to an instrument that will encourage greater cross-pollination across the GoTo ecosystem, with GoPay Coins generated through Gojek being used on Tokopedia and vice versa.

The issue of GoPay Coins to customers also encourages existing customers to stay on the platform, thereby improving retention plus getting new customers to use multiple services. Customers using multiple services spend significantly more than those only using one service.

GoPay Coins were fully rolled out across the GoTo ecosystem in June 2022 and have already helped strengthen customer engagement. In Q3 2022, the increased use of GoPay Coins led to a 2.3x higher conversion for cross-platform user acquisition from Gojek to Tokopedia or vice versa compared with other incentives.

GoPay Coins also lowered customer acquisition costs by 20% versus standalone platform incentives, according to the company.

This latest move will give customers new ways to use GoPay Coins and help increase the ubiquity of GoPay in Indonesia with multiple use cases. The wider usage should also help enhance user engagement across the GoTo platform.

J&T Express revives Hong Kong IPO plan

Indonesian e-commerce enabler J&T Express plans to launch an IPO in Hong Kong in the second half of this year with the aim of raising $1-2 billion at a valuation of $20 billion, according to market sources. This would be its second attempt to stage an IPO after volatile financial conditions stalled its earlier plan in 2022.

The company last raised $2.5 billion at a valuation of $20 billion in November 2021, in a funding round backed by Hillhouse Capital, Boyu Capital, and Sequoia Capital China plus some other Chinese investors. The company will likely be keen to avoid a down round when it conducts its IPO.

Given its Indonesian roots, it is quite surprising that the company should choose Hong Kong as a listing venue, but it may have something to do with its founders, both of whom have previously worked with Chinese smartphone manufacturer OPPO.

The issue with a Hong Kong listing of a firm that does not have the majority of its business in Hong Kong or China is that there is a danger that it could potentially become what is termed an orphan stock. This means it may not attract significant investor attention given investors there tend to look for Chinese exposure rather than Southeast Asian.

J&T Express was founded in Indonesia in 2015 by Robin Lee and Jet Lee and now operates in 13 countries, including Indonesia, Vietnam, Malaysia, the Philippines, Thailand, Cambodia, Singapore, China, Saudi Arabia, the UAE, Mexico, Brazil, and Egypt, with the last five joining the list last year as the company has sought to become more global.

J&T Express increased its exposure to China through its acquisition of Best Inc’s express business in late 2021, which propelled it to the number three slot in terms of express parcel deliveries at the time of the acquisition.

Its main competitor a-Commerce, despite having the majority of its business in Indonesia, has chosen Thailand as a listing venue but also delayed its listing plans until 2023 due to inclement market conditions.

Angus Mackintosh, a consulting editor with DealStreetAsia, is responsible for the publication’s Southeast Asia digital economy weekly newsletter and its monthly research reports. Angus is also the founder of CrossASEAN Research and publishes on Smartkarma.